A joint venture project is aiming to ensure European vanadium supplies can keep up with demand from battery makers.

An EIT RawMaterials joint venture between Australian companies Critical Metals and Neometals will target 5% of global vanadium pentoxide production by the end of 2024.

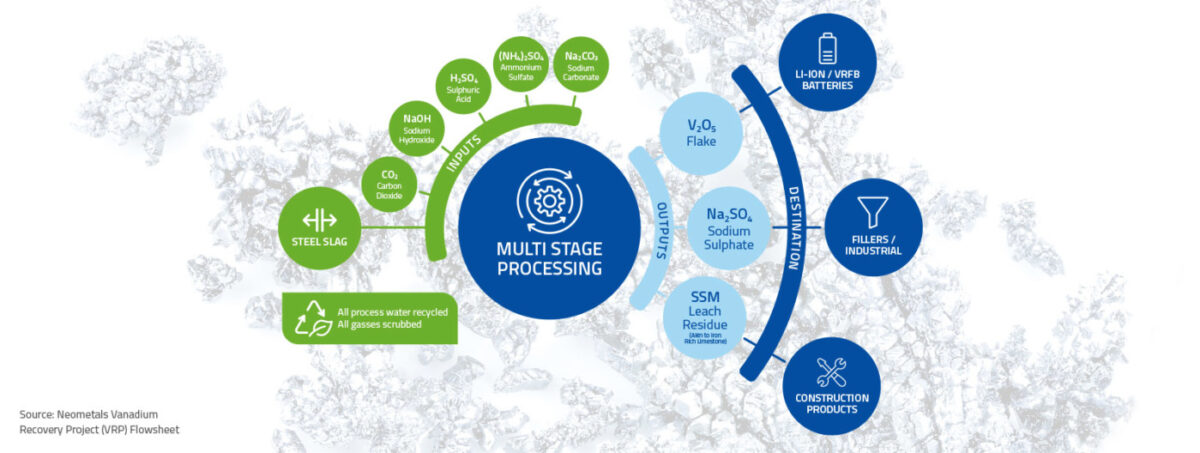

The Vanadium Recovery Project (VRP) in Pori, Finland will supply the material to vanadium redox flow batteries developers and next-generation lithium-vanadium cell makers.

The project will recover vanadium from ‘slag’ supplied from steel producers— China’s 2020 increase in production was driven by higher slag production.

The VRP relies on a novel proprietary hydrometallurgical process that results in no waste with by-products planned to be used in the production of CO2 free cement.

Darren Townsend, chief development officer at Neometals, said: “We believe that in the next 10 years vanadium will be the ‘new lithium’.

“We see a lot of parallels on where the vanadium industry is now versus where the lithium industry was 10 years ago.”

Critical battery material

Vanadium, placed on the critical raw material list by the European Commission, is beginning to be used in new lithium-ion electrode chemistries as well as in vanadium redox flow batteries.

In 2019, global vanadium supply was predominantly sourced from China (40,000MT), Russia (18,000MT), and South Africa (8,000MT).

In 2020, global vanadium production increased to 116,128 mtV from 109,643 mtV the previous year— with the above three countries controlling 84% of vanadium supplies (China 60%), according to South African vanadium producer Bushveld Minerals.

However, behind China and Russia, Australia holds the third-largest amount of vanadium in the world.

There are seven vanadium mines in pre-operation phases around Australia— four in Western Australia, two in Queensland, and one in the Northern Territory.

There are plans to plans to build a vanadium processing plant in Townsville, Queensland— the area where plans to build an 18GWh lithium-ion battery factory are being pushed by the Imperium3 consortium (iM3TSV).

The state-government will put at least AUS$10 million ($7.2 million) towards the facility, with the final amount depending on the outcome of the construction tender.

In the state’s North West, a mine owned by Multicom is set to process 10,000 tonnes per annum (tpa)— rising to potentially 20,000 tpa— of vanadium pentoxide and alternative vanadium-based products.

Also last November, Australian Vanadium, in conjunction with its 100% owned subsidiary VSUN Energy, signed a non-binding sales and materials memorandum of understanding with Spanish vanadium redox flow battery (VRFB) manufacturer E22.

AVL deals to deploy vanadium redox flow batteries and manufacturer materials in Australia