Predicting the future is said to be a fool’s game. But when it comes to intellectual property, filings can, at the very least, suggest the directions in which the industry is moving, especially when it comes to new technologies. Ben Lincoln and Alice Mortiboy, from European IP law firm Potter Clarkson, investigate patent filings around battery chemistries to determine where active research is occurring and, most importantly, suggest directions in which the industry’s future may be heading.

Compromises and limitations

Understanding and exploiting different battery chemistries allows for a variety of properties to be tailored, allowing each battery to be designed for a specific purpose. Properties tuneable by battery chemistry include everything from capacity to cost. With each new chemistry comes an associated technological compromise or limitation, which keeps innovation in battery technology an everchanging landscape.

Since the 1960s, when early research into rechargeable lithium-ion batteries (LIBs) began, a variety of different battery chemistries have been investigated. This article looks at those highlighted in ‘The 2021 Battery Technology Roadmap’ published in the Journal of Physics D: Applied Physics. Those chemistries are: lithium/sodium/aluminium/potassium-ion batteries, solid-state lithium-ion, lithium-oxygen, lithium-sulphur, zinc-air, aluminium-air, dual-ion, aqueous, flexible and flow batteries.

Using patent search software to carry out a search of key terms present in the abstract, title and the claims of patent families worldwide we were able to gather information from the last 10 years to establish which battery chemistries are in decline, as well as those new emerging technologies.

The search encompassed spelling variations such as “sulphur” and “sulfur” as well as plurals including “battery” and “batteries”.

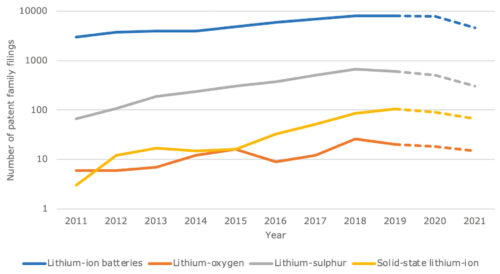

As the majority of patent applications publish 18 months after they have been filed, the data for 2020 and 2021 is incomplete and shown by a broken line in Graph 1.

General trends

Notably, LIBs still dominate the battery chemistry landscape. Specific types of LIBs include lithium iron phosphate (LFP), lithium nickel manganese cobalt oxide (NMC), lithium nickel cobalt AlOxide (NCA), lithium manganese oxide (LMO) and lithium cobalt oxide (LCO).

The dominance of LIBs is, perhaps, unsurprising due to their abundant use in everyday portable devices. Interestingly, a number of the other battery chemistries highlighted in the 2021 roadmap also included lithium metal.

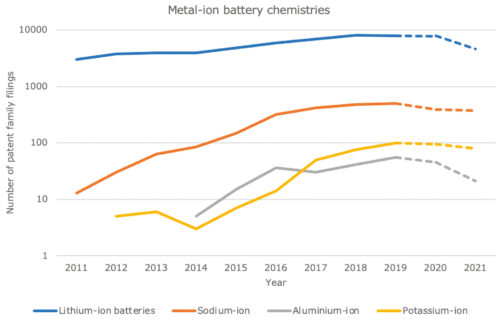

While the number of filings in LIB technology started to level out in 2018, in 2021 the number of LIB filings was still ten times that of filings related to sodium-ion batteries— the technology with the second greatest number of patent family filings.

The patent filing data shows there has been a general increase in all metal-ion technologies (Graph 2) over the last ten years, and this trend is replicated in alternative battery technologies such as metal-air, flow and flexible batteries. Taking both data sets together helps give an overall picture of a general growth in battery technologies, and this is replicated over a multitude of specific chemistries.

Emerging battery chemistries

LIBs may still represent the most dominant battery chemistry in terms of patent filings, however, the data gathered gives some interesting insight into potential emerging battery technologies.

For example, over the last decade, patent families relating to flow batteries— which have advantages such as being relatively safe, having a flexible layout (due to separation of the power and energy components) and a long-life cycle— represent the second largest number of filings out of all battery chemistries reviewed.

Flow batteries

The data collected includes filing relating to specific flow batteries, such as vanadium flow batteries (VFBs) and zinc-based flow batteries (ZFBs). But where are the filings?

When taking a closer look at the data, we see that the majority of the filings are in China, with Dalian Institute of Chemical Physics being the top applicant of patent family filings in this battery chemistry area during the last decade.

Notably, all of the top five applicants are based in South-East Asia, which represents this region’s dominance in flow batteries.

Examining Europe and US

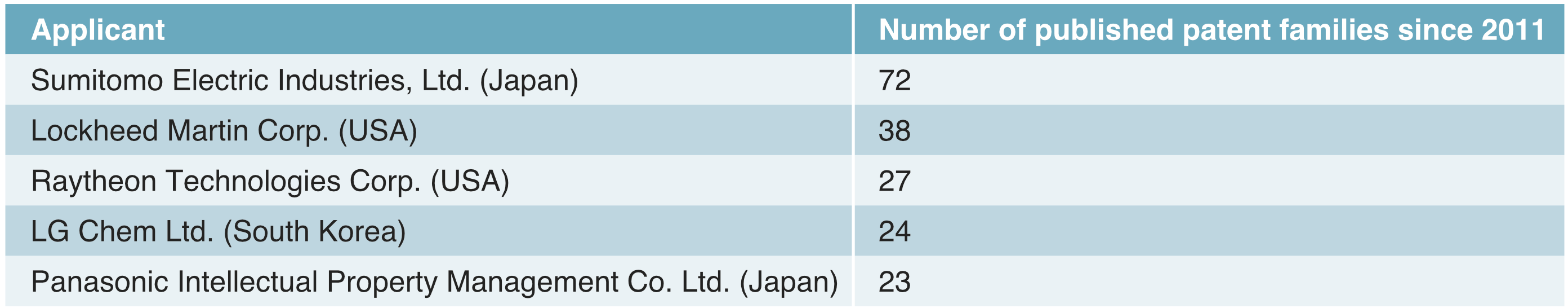

With South-East Asia (and specifically China) being so predominant in battery patent filings, it can be useful to take a look at patent families with applications that have been published in either Europe or the US (Table 1).

When taking into account patent families with either a US or European publication, Sumitomo Electric Industries moves into the pole position (previously fourth position in Table 1). Looking at the territories in which an applicant is filing their intellectual property can help to give an insight into (i) where the technology is being produced, (ii) where an applicant considers their commercial markets to be, and/or (iii) where an applicant’s competitors are located.

Dual-ion batteries

Since 2016, a small but notable number of applications have been filed relating to dual-ion batteries (DIBs).

This rise in filings may be due to DIBs being of interest beyond LIBs in high-efficiency energy storage owing to their high working voltage, material availability, as well as low cost and excellent safety. But, once again, it’s important to ask where are the filings?

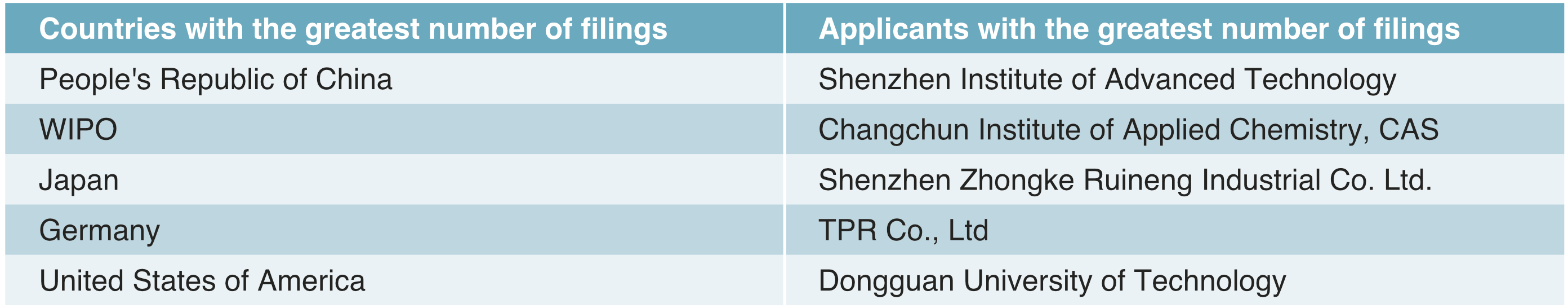

China once again leads the way as the territory with the most patent families relating to dual-ion battery technologies, with Shenzhen Institute of Advanced Technology being the biggest filer since 2011 (Table 2).

Interestingly, only five out of the top 25 applicants with filings relating to DIBs are non-academic institutions. This may be due to the technology still being relatively new, or perhaps due to the industrial application of this battery technology not yet being fully realised.

Non-academic applicants include:

- Shenzhen Zhongke Ruineng Industrial Co. Ltd. (China)

- TPR Co., Ltd (Japan)

- Toyota (Japan)

- Phillips 66 (USA)

- Microvast Power Systems Huzhou Co. Ltd. (USA)

- Finework Hunan New Energy Technology Co Ltd (China)

While the majority of the academic institutions are based in China, the remaining applicants are more widespread.

Sodium-ion batteries

With its natural abundance, low cost and physical and chemical similarities to lithium, sodium’s use in batteries has begun to rise in popularity, and this is reflected in the increase in the number of filings relating to sodium-ion batteries since 2011. Again, a look at the geographical region where the filings are taking place leads to obvious conclusions?

Unsurprisingly, China is the territory with the most patent families relating to sodium-ion battery technologies. The top five filers of sodium-ion battery applications are all Universities, with Shaanxi University of Science and Technology coming out top.

However, when the results are limited to those patent families with either a European or US application published, industry comes out as the top applicant of patent filings relating to sodium-ion batteries.

Top 10 applicants:

- Global Graphene Group Inc. (USA)

- Toyota (Japan)

- Nanotek Instruments Inc. (USA)

- Uchicago Argonne LLC (USA)

- Ningde Contemporary Amperex Tech Co. Ltd. (China)

- Faradion Ltd. (UK)

- William Marsh Rice University (USA)

- Petrochina Co. Ltd. (China)

- Battelle Memorial Institute (USA)

- 3M (USA)

The dominance of the US and Southeast Asia is once again demonstrated by the patent filing data. Faradion is the only European applicant to make the top ten. Notably, Faradion (a UK-based sodium-ion battery technology company) was bought by the Indian company, Reliance Industries in December of 2021.

While its number of patent filings puts Faradion among a number of international companies innovating in sodium-ion batteries, its acquisition by Reliance Industries may also be an indicator of India beginning to enter the sodium-ion battery space.

The way ahead

Batteries are fundamental within society, and as consumers and industry alike continue to move away from fossil fuels they will become an even more integral part of life in years to come. As our research indicates, innovation across the space continues at a pace and remains highly vibrant – pointing toward an exciting new era of battery chemistry developments and emerging technologies ahead.