Analyst company Rho Motion reported on 10 February that 2024 was the first year where lithium-ion battery demand across all end-use markets surpassed 1TWh.

Iola Hughes, head of research at Rho Motion said lithium-ion battery demand increased 27% compared to 2023. This takes in both electric vehicles (EVs) and battery energy storage systems (BESS).

It added global battery production capacity surpassed 1TWh in 2023, with China accounting for over 80% of this production capacity.

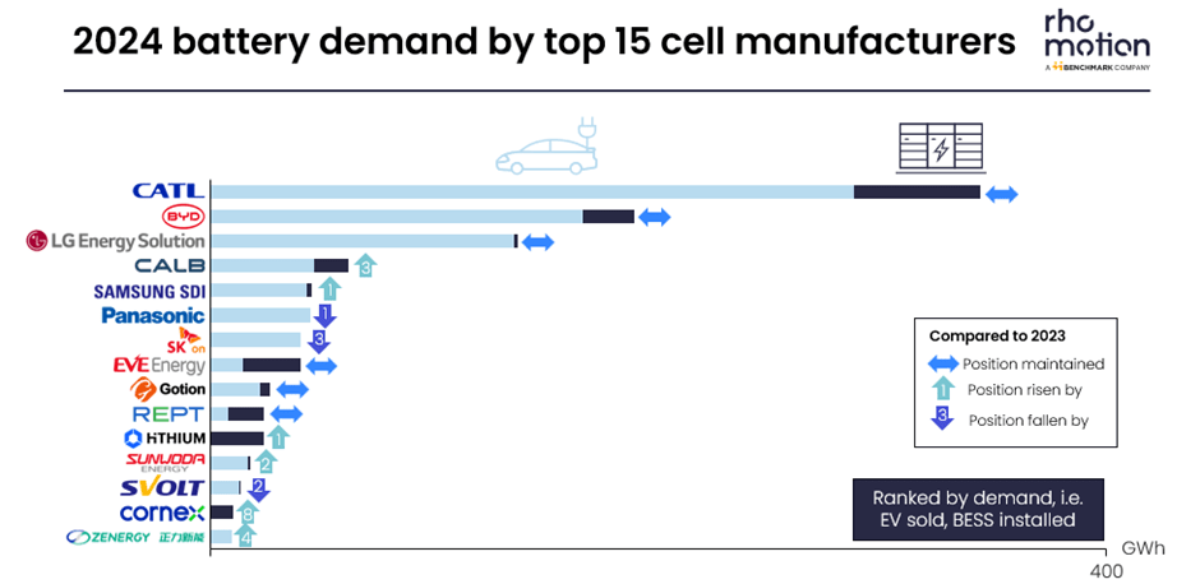

The global battery industry remains dominated by a handful of key players, it said.

The EV sector continues to make up the majority of lithium-ion battery demand, but the BESS market has seen its market share jump from 7% in 2020 to 15% in 2024, it added. CATL, BYD and LG Energy Solution remained the top three suppliers in 2024 with just over 60% of the total market, it said.

Two standout performers were CALB and Cornex, now the world’s seventh and eighth largest BESS cell suppliers, it said.

South Korea’s SNE Research reported in its 2025 Jan Global Monthly EV and Battery Monthly Tracker on 11 February that EV battery installation registered worldwide was approximately 894GWh in January to December 2024, a 27.2% year-on-year growth. This followed 23.4% year-on-year growth for the first nine months of 2024.

It said CATL remained number one in the global ranking with a 31.7% (339.3GWh) year-on-year growth. Its market share increased to 37.9% from 36.7% in September. Major Chinese OEMs, such as Zeekr, Aito and Li Auto in the Chinese domestic market use CATL batteries. Global OEMs such as Tesla, BMW, Mercedes-Benz and VW also choose CATL batteries.

BYD ranked second on the list with a 37.5% (153.7GWh) year-on-year growth. Its market share edged up to 17.2% from 16.4% in September. In 2024, the sales volume of BYD’s EVs reached some 4.14 million units, according to SNE. BYD plans to sell approximately six million new cars in 2025 – rapidly expanding its market share beyond the Chinese domestic market and into the Asian and European markets.

Among the market share losers were Panasonic (growth rate down 18.0%) and Samsung SDI, whose growth fell 10.6%.

In the lead battery segment, Battery Council International reported on 24 January a 3.6% year-on-year rise in shipments of original equipment and replacement automotive batteries for December – November 2024 by its members, to total 158,397,542.

Image source: Rho Motion