Battery cell materials maker BASF and South Korean battery maker SK On announced a tie-up to explore opportunities in the global lithium-ion battery market. They will focus on North America and Asia-Pacific. Analysts said it was a response to slowing growth in sales of electric vehicles (EVs).

Initially, Germany’s BASF and SK On will study collaboration options for producing cathode active materials (CAM), they said in a statement. Later, they will evaluate other areas, including battery recycling.

Peter Schuhmacher, BASF’s president of the catalyst division, said: “With the collaboration with SK On, we are further strengthening our market position to serve battery manufacturers and electric vehicle producers around the world. We want to address the need for more sustainable solutions for the electric vehicle industry.”

The Korea Economic Daily reported that LG Energy’s utilisation rates in its factories around the world in the first three quarters of the year averaged 72.9%. This is 2.5 percentage points lower than a year earlier and have been falling since a peak of 77.7% in the first quarter. This is on the back of slowing demand for EVs.

The news site said LG Energy and SK On have cut production and jobs at their US plants, although Samsung SDI is maintaining its operating rate.

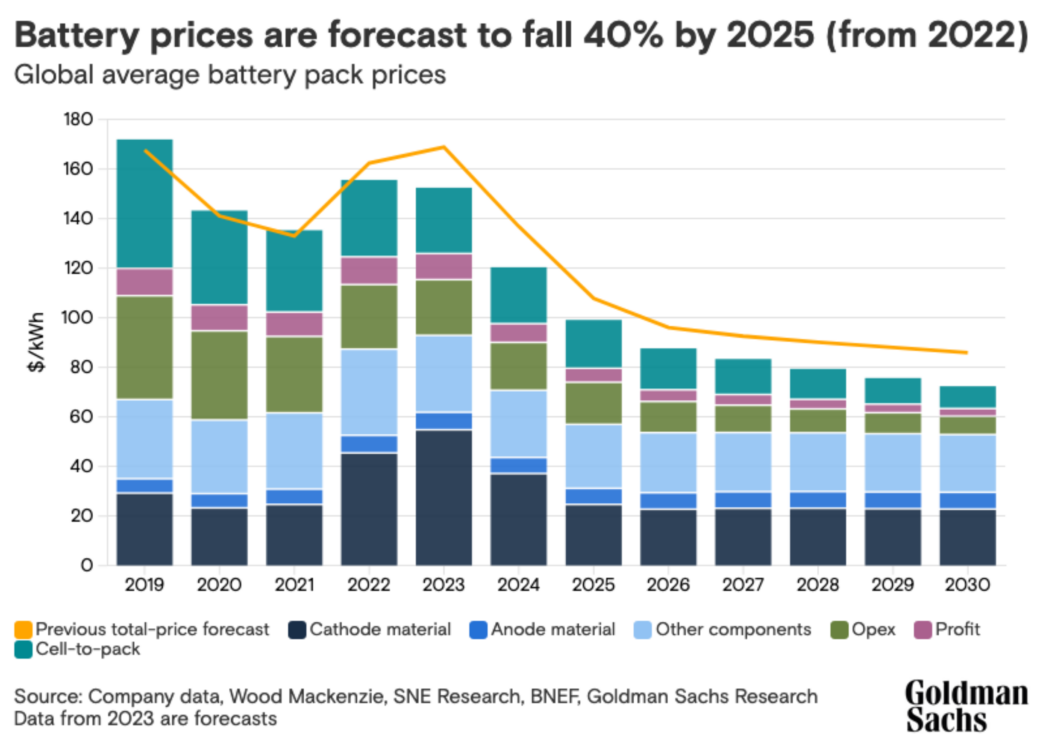

Vehicle makers are also holding off buying batteries due to falling battery prices. Finance house Goldman Sachs said in a research note on 1 November that EV battery prices are falling faster than expected. It said battery prices are expected to dip to $99 per kWh of storage capacity by 2025 – a 40% decrease from 2022. It had previously forecast a 33% slide.

Nikhil Bhandari, co-head of Goldman Sachs Research’s Asia-Pacific Natural Resources and Clean Energy Research, said: “Our analysts estimate that almost half of the decline will come from declining prices of EV raw materials such as lithium, nickel, and cobalt. Battery pack prices are now expected to fall by an average of 11% per year from 2023 to 2030.”