The energy storage industry is more than lead-acid and lithium-ion. The newly launched Flow Batteries Europe organisation aims to shape a long-term strategy that will not only ensure flow batteries are well known by European decision-makers but show the technology can break the battery storage mould.

On 28 April, 16 stakeholders met to confirm the formation of a new industry association that aims to shape the long-term strategy for the flow battery sector.

Flow Batteries Europe (FBE)— launched by research centres, industry, and an association— is an international not-for-profit group with a clear goal of increasing the number of flow batteries deployed to help governments decarbonise their power supplies.

The organisation’s goals include creating and reinforcing networks between key stakeholders in the flow battery industry to promote the advantages of the technology and accelerate the development and deployment of the flow battery value chain via European Union (EU) legislation, funding and projects.

During the first Statutory General Assembly, the founding members elected Kees van de Kerk as its president. The association’s three vice presidents are Tobias Janoschka, Alexander Schönfeldt and Paul Vollant. Guillaume Chazalet (Kemiwatt) was made its treasurer, and Anthony Price was named its secretary general.

By joining forces, the FBE members aim to unify flow-battery industry voices so they have a stronger influence in Brussels while harmonising discussions regarding the legal and R&D funding framework for energy storage at the EU level.

The organisation’s key performance indicators in the next 5-10 years are simple. “We will be able to say that we have succeeded in our role, when either an existing or a start-up company builds, commissions, and operates a flow battery manufacturing facility in Europe with an output of more than 1,000MW of flow battery stacks/year, and these new batteries reach the market,” says Price, the director and consultant at Swanbarton.

To make this possible, the organisation expects similar levels of EU and national governmental financial support for the flow battery industry that is given to other battery types. For example, the European Commission has approved $3.5 billion in state aid to fund lithium-ion R&D in 12 European countries as part of the bloc’s European Battery Innovation program.

The FBE is also calling for R&D projects in flow batteries to be categorised as a separate technology class, similar to those witnessed for other battery technologies, following the recognition in the proposed EU Battery Regulation of that status.

Janoschka, a co-founder of Jena Batteries, believes flow batteries can be a central building block in Europe’s future energy system.

“We want to exchange ideas with other manufacturers along the supply chain, identify common strategies and synergies as well as make flow batteries widely known to all relevant stakeholders,” he says.

Founding members

Flow Batteries Europe’s 16 founding members are:

- Industry: CellCube; InEnergy; Largo Clean Energy; Voith; W.L. Gore & Associates

- Start-up: JenaBatteries; Kemiwatt; Pinflow energy storage; Vanevo; Volterion

- Research: CIC energiGUNE; Cenelest; Tekniker; University of Padua; ZHAW

- Association Member: Vanitec

FBE invites all European industrial and institutional organisations interested in actively promoting flow battery technologies to join.

Alternative technology

Batteries have entered main-stream discussion— whether it’s electric vehicles, or energy storage systems (ESS) used to harness renewables and ensure grid stability— as countries clamber to meet climate change targets, such as those set out in the Paris Agreement.

Each European country has its own regulations when it comes to energy storage, which makes it a complex issue when trying to nail down the role storage can play in power markets.

Lithium-ion is reaching the same heritage status as lead-acid; the former is very much the battery-du-jour for an increasing number of applications, including SLI where lead batteries have remained dominant for decades.

So why launch a flow battery organisation now? Haven’t the above technologies got all bases covered when it comes to energy storage? Well, not quite.

“Batteries are important not only for electromobility but also in stationary applications; for supporting the deployment of renewable generation technologies and reinforcing the power networks as we switch use from fossil fuels to cleaner decentralised electricity,” says Price.

“But energy storage is more than just batteries, and there are more types of batteries than the well-known lead-acid and lithium-ion types. It’s important that any strategy developed either nationally or at the EU level for developing battery energy storage includes recognition of the role that flow batteries have in the energy mix.

“We have launched our Association now because decisions on funding of research programmes, investment in manufacturing capacity and decisions on the use of energy storage in the electricity sector are being taken now, and we want to make sure that the decision-makers have the correct information available in good time.”

With many of the world’s battery manufacturing plants owned by American and Asian companies, investment now in flow battery R&D, manufacturing and production within Europe would open up export markets and reduce the need for imports.

Strong, well-backed flow battery companies would then be able to compete in the world’s energy storage markets, says Price.

Place in the mix

Over the course of the past decade, more and more companies, organisations and governments have committed additional time and money to tackle the global issues of decarbonisation and sustainability.

It’s becoming clear that if the world needs renewables, it will also need energy storage to deliver grid services— such as frequency control and peak shifting— at all levels within the power network. Lead-acid and lithium-ion have traditionally covered these areas, with the latter claiming an increasingly larger percentage of the ESS market. Both technologies have useful characteristics for dealing with short-term grid services, but relatively high lifetime costs, degradation profiles and expensive end-of-life and recycling issues (especially lithium-ion) compared to some technologies, such as flow batteries.

It’s amid the white noise of decarbonisation and sustainability that the flow battery industry’s voice continues to call for more recognition of the role long-duration storage has in allowing for higher renewable generation, such as solar and wind, in the energy mix.

However, despite the technology’s many advantages, flow batteries are still perceived as a niche product.

But they can be a cornerstone in the central building block of Europe’s future energy demands because the technology bridges the need between demand for fast-response and seasonal storage, and is technically the most optimal technology to address this need, says Cellcube CEO Schoenfeldt.

With a focus on a long storage duration of four hours and up, stationary flow batteries are ideally co-located alongside renewables like PV and wind. “In the midterm, we will see factories increasing their PV self-consumption and lowering their high demand charges as well as buffer batteries for e-mobility charging stations,” says Janoschka.

“Later on, gas-peaker plants and other grid-related infrastructure will be replaced by flow batteries/renewables. First examples have already been demonstrated in the US.”

Flow batteries are also safe, and environmentally friendly and offer an ethical alternative to conventional lithium-ion batteries as they do not require critical raw materials, and the at times debatable nature of mining those materials.

Last year, the EU’s list of critical raw materials— elements vital to the economy and structure of Europe—saw lithium added for the first time; cobalt was already on the list.

There are real concerns in Europe— and wider afield— that the battery industry could be compromised because of the lack of critical materials, especially as it waits for a commercially-ready lithium-ion recycling industry to be formed.

It means there are major market opportunities for alternative battery configurations.

Step forward flow batteries, which are less dependent on critical raw materials than other battery types, with new types of flow batteries— using non-metallic electrolytes— potentially further reducing dependency on critical material supply chains.

“As the push increases towards electro-mobility, there will be increased demand for batteries,” says Price. “Although we recognise that at present, most flow battery types are not ideally suited for transport and hence electro-mobility will depend heavily on the lithium-ion family of batteries.

“Using other battery types for stationary storage will ensure the electro-mobility market can be served adequately, without compromising the supply of energy storage into the stationary ESS markets, and without increasing non-European imports.”

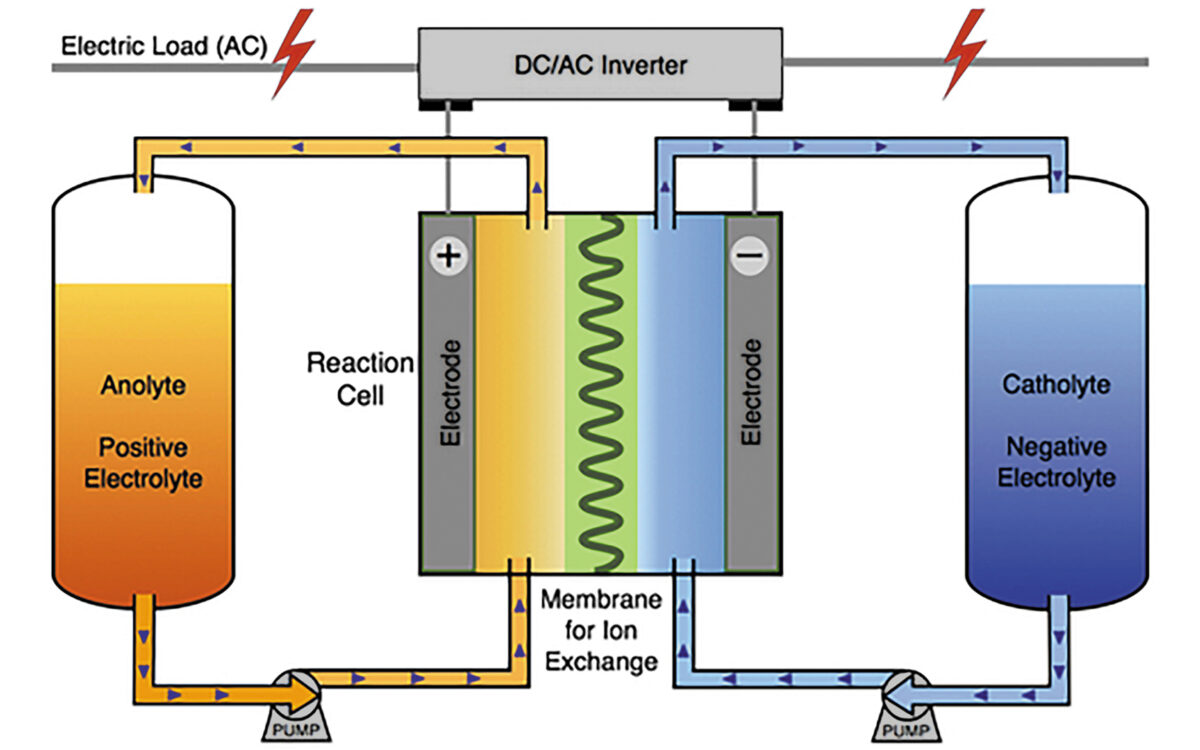

Redox flow batteries are a highly flexible, enabling technology that allows industrial customers, grid operators and project developers to build their future energy business models in a carbon-neutral society.

Jumping hurdles

But there are still hurdles to overcome before flow batteries are to be seen in the same way as lithium-ion and lead-acid by project developers.

Multiple barriers remain while coal and other fossil fuels are still the dominant fuel source in most countries because of their abundance, which makes them cheap and accessible. In that sense a (far higher) tax on CO2 emissions in combination with the scrapping of all fossil fuel subsidies would be helpful, says Van de Kerk, managing director of Volterion.

“There are vested interests limiting the speed of integrating energy storage both behind and after the meter, hence slowing down the so-wanted energy transition.

“There is a general lack of knowledge regarding the different storage solutions and opportunities amongst some policymakers. As can be expected with emerging technologies, regulatory policy is lagging while energy storage technology has made tremendous steps forward. Both wholesale market rules and retail rules will need to be updated, especially as residential, commercial and industrial interest grows. Politicians still struggle with the definition of energy storage and how to treat the fast-acting battery storage.”

Moreover, there are still some specific barriers like the relatively small size of most flow battery companies, the limited number of batteries in the field, and a lack of standards and certifications that will help navigate the hurdles facing storage projects.

Those issues are because flow battery technology is at the beginning of mass production, and, as such, the cost degression has not yet fully started, says Schoenfeldt. In addition, he says the standardisation of components, materials and equipment needs to improve in order for the supply industry to perceive this technology to be attractive.

“Finally it seems that even though the technology is not new, the flow battery is still a hidden champion in the economy and, as such, not visible when developing energy storage projects or procurements,” he concludes.

Those concerns are echoed by Janoschka. “Flow batteries are still perceived as a risky investment,” he says. “The flow battery industry needs to prove that this is not the case by offering competitive warranty conditions, insurance models and, in consequence, make flow batteries bankable.”

He also believes that production capability needs to be scaled up by several orders of magnitude— along the whole supply chain— in order to further reduce cost and provide market opportunities within the storage system markets.

“As much as lithium-ion is perfect in the mobility sector, any requirement for stationary storage can be covered by flow batteries as the flow battery helps far better to reduce greenhouse gas emissions, is not flammable or explosive and can be recycled more than 99%,” says Schoenfeldt.

Meeting demand

As with all new technologies, there has to be a reason project developers move away from legacy technologies to embrace new ones.

Flow batteries will need to match lithium/lead batteries in many areas including levelised cost of energy, cycle life, services provided, initial costs, footprint, safety and reliability.

Van de Kerk, managing director at Volterion, says flow batteries offer significant benefits in long-duration usage applications and situations that require regular cycling throughout the day, and may provide unrivalled cost certainty versus other emerging storage technologies on the market.

Moreover, current energy storage technologies do not satisfy the complex technological, environmental and economic requirements set by the renewable industries for stationary storage.

“We recognise that the foundation of our technology needs to be more cost-competitive to be sustainable,” says Van de Kerk. “Cutting costs across the board will be achieved through a mix of business model solutions, higher levels of standardisation, and scaling.”

Flow batteries represent a higher upfront capital investment than a similar-sized lithium-ion configuration. However, they become more competitive when evaluated on a total cost of ownership over a 20-30-year lifecycle.

Moreover, costs are dropping for flow batteries as technology advances and manufacturing efficiencies are implemented.

Typical flow battery advantages are:

- 20,000-25,000+ battery cycles

- Little or no loss of storage capacity

- Ramp rates range from milliseconds for discharge if pumps are running, to a few seconds if pumps are not

- Wide temperature ranges for operation and standby modes

- Safe— no explosion or fire hazard

- Chemistries that pose a limited human-health risk due to exposure

- Easy and independent scale-up of capacity and power by adding electrolyte volume (that may involve more tanks and piping) and/or stacks

But, as seen earlier, the flow battery value chain is yet to reach the maturity of other technologies.

In terms of sustainably and system lifetime, flow batteries already offer a ‘best-in-class’ solution, but some questions still need to be answered.

Those questions include: how to improve and scale flow battery production to lower system costs? and, how can the deployment of flow batteries be accelerated?

Innovation along the value chain is clearly needed to improve value creation.

“To scale and accelerate deployment, more investment needs to be attracted along the entire value chain as well as into application of flow battery systems,” says Van de Kerk.

“Governmental support for innovative projects through preferred public procurement and access to finance is needed at this stage for flow batteries to become more affordable through lower production costs, higher utilisation and improved business cases for end users.”

Growing demand

Global battery demand is expected to grow by 25% annually to reach 2,600GWh in 2030, according to industry analysts Statista.

The main drivers of demand growth are the deployment of batteries in power grids, with grid-connected batteries expected to be the dominant solution in the next decade.

Reducing greenhouse gas emissions by incorporating renewables will drive strong growth in demand for systems that offer balancing services that enable the intermittent power supply from renewables to be available when needed.

Therefore, flow batteries are well poised to claim a share of the global battery market by playing an increasingly important role in enabling the shift from fossil fuel to renewable power generation. The FBE will no doubt be instrumental in the change.