This year’s International Flow Battery Forum (IFBF) in Glasgow, Scotland, kept a focus on costs, standardisation and supply chains. Andrew Draper reports.

In his keynote speech to the forum in June, Invinity Energy Systems CEO Larry Zulch said the challenge for the flow battery industry was not about increasing demand, but rather about bringing costs down and meeting demand at scale.

“We’ve been bringing the costs down 30% a year for the last two years, but the willingness to pay is getting less,” he said. This was due to price drops of lithium and unfamiliarity with flow batteries. Big price cuts could not carry on indefinitely and innovation was required, he said.

The main competition is lithium, he said: “We might see ourselves as competitors with Cellcube and Sumitomo, but we are competing with lithium, not each other. But we have to get costs down.

He described Invinity’s new battery, Mistral, which comes in a 20-foot shipping container and contains two tanks and two stacks.

Modularisation is underway in energy storage and will facilitate the same growth that was seen in computing and solar energy when they adopted a modular approach, he said. Data centres represent a major opportunity for the industry, he said.

At its exhibition stand, chemicals company Oxkem said it would be able to reduce costs when it gets more volume and battery manufacturers relax their requirements. Its chemical products include vanadium sulphate, which is used as electrolyte.

‘Alternative membranes needed’

The University of Strathclyde’s Ed Brightman outlined the work on flow batteries and plans for a new innovation centre. Alternatives to the existing membranes are needed as “forever chemicals” come under increasing scrutiny and regulation. He highlighted the properties of graphene oxide and nanocellulose as potential materials.

Separator manufacturers Daramic and Entek both attended the forum for first time. Major players in lead-acid and lithium battery sectors, their people said they were looking at flow batteries as a potential business area in addition to their existing battery separator business. “At this stage it is a matter of research and making contacts with battery manufacturers to understand their needs and specifications,” according to Entek materials scientist John Miller.

Thorsten Seipp, CEO of Germany’s flow battery stack developer Volterion, talked about testing and evaluating membranes. He said the most important requirements for membranes are that they must be weldable (with polyolefin backbone or reinforcement) and stable in the electrolyte. The most critical felt requirements are the thickness (3mm in its case) and density (75mg/cm3), he said.

Low capex, high energy density

Gavin Park of StorTera told his audience about the company’s SLiQ lithium sulphur eight-hour demonstrator flow battery. The lithium polysulphide single liquid means low capex with high energy density. At the end of life, the lithium can be recovered.

He claimed it has high energy density of 250Wh/L, 93% efficiency over 16,000 cycles, low levelised-cost-of-storage (£10 ($13)/MWh). The battery management system uses AI to improve performance and lifetime, he said, claiming a 30% improvement in performance and halved energy storage payback to under five years. It plans to scale up and start manufacturing in 2025, he said.

The chemistry is working, he said: “I would encourage you to keep pioneering. We now know we can do it and the market is there.”

Field reports

Day one included reports from the field of actual projects. Johannes Häntzschel, head of battery storage at German company Prolux Solutions, described how there was no real alternative flow battery technology in the home storage market.

The solution, he said, was the in-house development of a redox flow home storage system as either a 2kW/6kWh unit or 4kW/10 kWh battery.

The product comes in two parts: the storage equipment and the electrolyte. The company has set up a new business unit for home energy storage and focuses on the German, Austrian and Swiss markets.

Thomas Lüth, CCO at flow battery manufacturer Cellcube, said the company had received over 4MW of orders in recent months and is moving towards long duration energy storage (mostly over eight hours). It has invested more than $100 million in 140+ systems deployed worldwide.

Cautious in Dalian

Philip Krause, SVP at Rongke Power, set out his company’s involvement in the Dalian Energy Storage Station, the world’s biggest flow battery project. It provided the battery equipment, adopting a cautious approach and working in phases. The Chinese power station is now in commission and switched on, with Phase II getting underway. Each phase is 100MW/400MWh.

Dalian connects Dalian Bay and Jinzhou Bay to the northeast mainland with three 500kV lines and four 220kV lines, designed to ensure regional power stability and distribution, he said. In 2020, the peaking deficit of the provincial power grid, not accounting for the addition of battery energy storage peaking stations, was over 2.45GW.

The energy storage plant comprises 716 electrolyte tanks, 358 battery modules (250kW/1MWh and 400kW/1.6MWh), 179 power conversion systems, four control units and one energy management system.

High cycle stability

In a technical session on vanadium, Adam Whitehead of Cellcube told how flow batteries have performed in practice. The company has had several batteries in the field for up to 13 years. They have very high cycle stability (claims ranging from 10,000 to infinite cycles).

He said the rate of discharge fade was very low with no dependence on temperature and it means the lifetime prediction of up to 25 years seems true.

The 20 systems in use for 7–13 years showed no correlation between equivalent full cycles per day. Three things cause discharge energy fade, he said:

- stack resistance increase

- increase in membrane permeability

- electrolyte imbalance (mainly through oxidation).

Electrolyte imbalance is the main cause of discharge fade. He said it can be corrected by partial replacement of positive electrolyte, for example.

Electrolyte had also leaked and caused corrosion of current collectors. Copper contamination can evolve hydrogen and cause problems with stack life if not corrected, he said. Copper collectors can be replaced with aluminium as a remedy.

The company now has several collecting measures in place. Better seals and sealing are also a remedy to prevent leakage, he added.

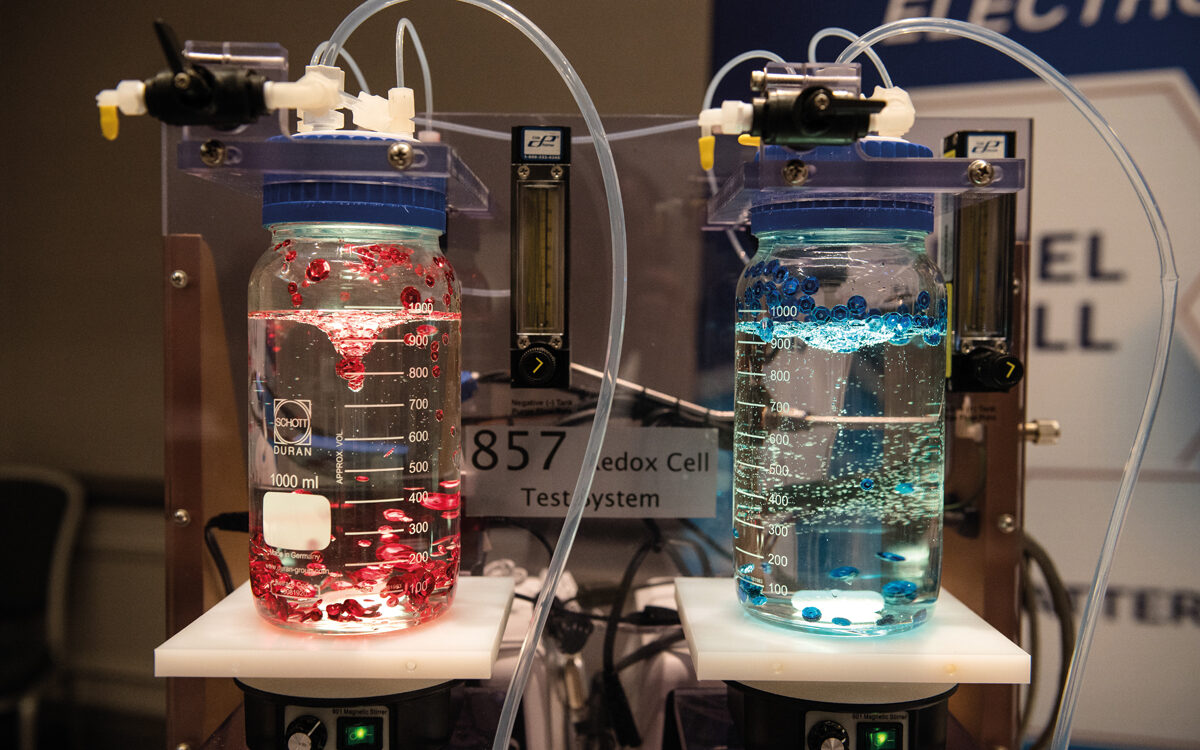

Electrosynthesis and cycling

The day two keynote speech was from Eugene Beh of Quino Energy on electrosynthesis and cycling of quinone negolytes and cycling performance. He said flow batteries are all about low degradation and easy scalability. This results in low cost of manufacture, he said. Its water-based quinone battery is 30–40% cheaper than LFP and has less than a tenth of the degradation, he said. The battery materials are made from low-cost dyes.

The electrochemical Marshalk reaction produces negolyte directly, he said. That creates greatly improved water solubility and lifetime compared to the raw material. Backed by the US Department of Energy, the company announced in March it was now ready for low-rate initial production of Quino Energy’s proprietary quinone battery active material

Beh said: “Long term, we’ve achieved really impressive cap degradation at 100% level of discharge cycling…we’ve scaled up now to commercial flow battery systems.”

Reliability testing

In the session on manufacturing, performance and reliability, Takashi Kanno of Sumitomo Electric Industries talked about reliability testing of their flow battery cell stacks. They have been conducting such tests for 35 years, he said. They cover large cell stack stress test, material life test and system test.

He said when a system is restarted after a long shutdown, the temperature difference between the cell and electrolyte causes a heat shock to the cell stack. Heat shock tests are conducted by alternately circulating hot and cold electrolyte through the cell stack.

After stress tests there is no performance degradation before or after the test, or abnormality of the material and structure, he said.

In 2015, Sumitomo was the first in the world to obtain UL1973 certification proving safety against explosion, fire and liquid leakage, he said. It has contracted a 20-year cell stack guarantee insurance with Munich Re and Tokio Marine & Nichido Fire Insurance Co.

Looking at capex

Uwe Bögershausen, CFO of battery stack manufacturer Vanevo, talked about cost reduction. He said typical sales conversations cover safety and operations, but clients always come back to costs. “We’ve got many advantages of our technology but most customers just look at the capex,” he said.

To cut costs, the German company is looking at automation such as dosing and process automation. Standardisation is something it is focusing on – stack and battery module, for example. What drives down capex are new electrolytes and leasing models, while standardisation and automation will also play their part.

The installed base is driving unit costs, and the PV sector is a showcase industry for how pricing has fallen, he said. Costs have gone from approximately €20 ($22)/Wp in 1980 to €0.30 ($0.32)/Wp in 2023.

Learning curve effects (i.e. each doubling of the accumulated amount of production reduces the production unit costs by a certain percentage) will happen, he said. It has already happened in the PV and lithium battery sectors. “We’ve gone through that learning curve already. There are many challenges.

“If you’d asked me in 2021, I would never have expected that costs for solar modules would be coming down that way…and come down significantly.” He has worked in the PV industry and experienced the steep and rapid decline in costs. “We’re now very close to the danger zone, which is material costs,” he said.

The anti-dumping discussion discloses cost-cutting potential, he said. “The interesting question now is what’s the limit for redox flow batteries. Is it a sharp decrease or a smooth decrease. You never know but you have to do calculations. Where is the limit?”

At scale they should reach a cost of €1.20 ($1.30) per bipolar plate (core cost is €0.22 per plate). That would mean a module cost of €22,000/$24,000 (€550/kWh) becoming an at-scale cost of €2,800/$3,019 per module (€70/kWh). “This is a journey, the mass market is ahead of us, but only if we bring down capex massively and fast,” he said.

Speed posters

The speed poster session allowed more than 20 up-and-coming industry people to take to the stage and talk about their research posters. Not only did they have to convey years of technical research in under a minute before the bell stopped them, for most of them they did so in a foreign language to an audience of experts. “It can be extremely terrifying standing up here in the bright lights with Jez annoying you with the bell,” said IFBF secretary Anthony Price.

They richly received multiple rounds of applause. Topics ranged from electrolyte imbalance to multiphysics modelling of a novel non-aqueous redox flow battery, electrolyte density and viscosity data, and multi-phase electrolytes. At least one had clearly rehearsed his lines and delivered a performance worthy of a stage actor.

IFBF will be hosted by Cellcube next year in Vienna.