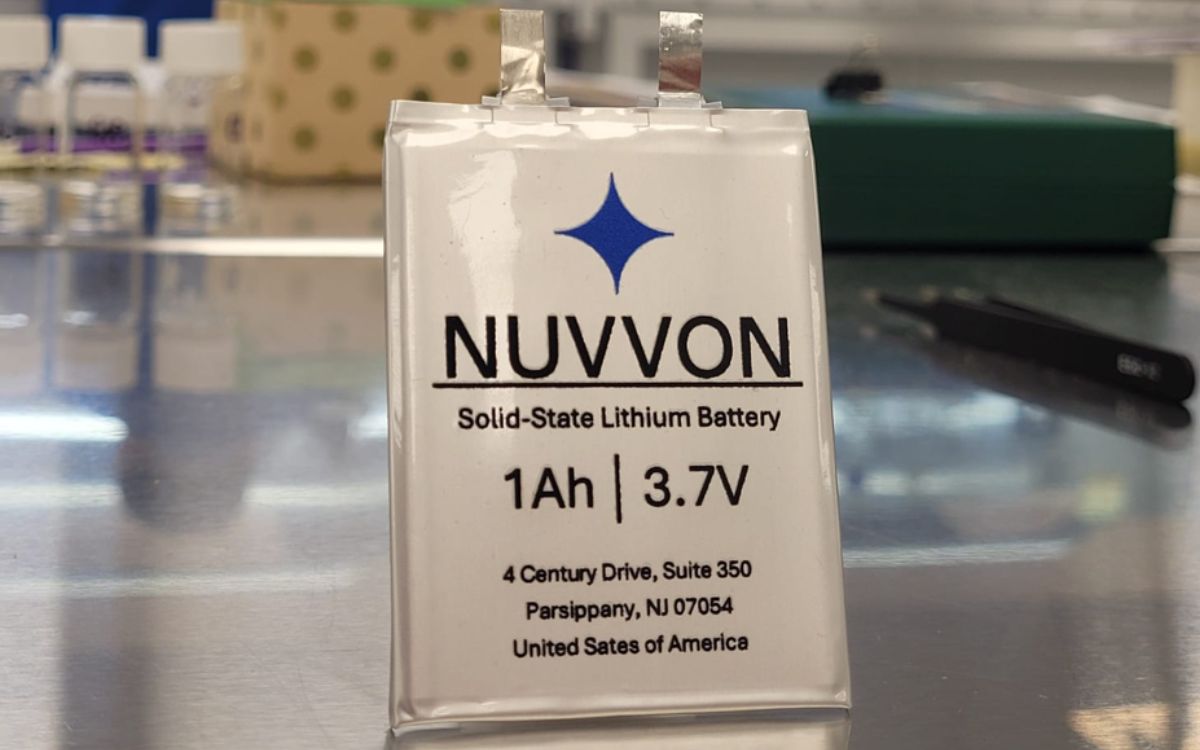

The Editor makes a repeat visit to Taiwan, where he learns how Government-funded research, disparate companies willing to enter into partnerships and an abundance of scientific talent can together compete with the might of the battery industries of both China and Japan.

A long time ago (well at least 25 years ago) in the land that I call my home, Government supported industry – really supported industry. There were state-funded laboratories, grants available and awards to help new businesses get off the ground. And there were occasional success stories, mainly in the biotechnology sector – the sector . . .

to continue reading this article...

Sign up to any Premium subscription to continue reading

To read this article, and get access to all the Premium content on bestmag.co.uk, sign up for a Premium subscription.

view subscription optionsAlready Subscribed? Log In