Researchers at RWTH Aachen University have launched detailed analysis of the battery storage system (BSS) market in Germany, which they believe is the first to cover their country alone.

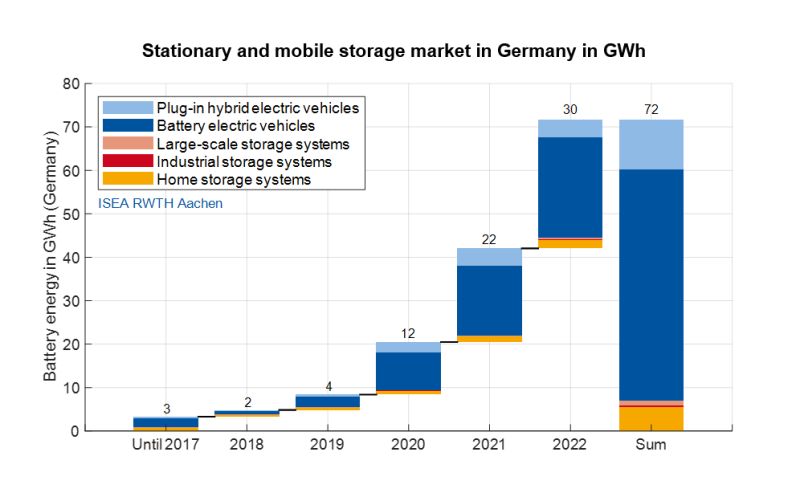

In comparison to 2021, the market for home storage systems (HSS) grew by 52% in terms of battery energy in 2022, the survey said.

It is by far the largest stationary storage market in Germany. The survey estimates that about 220,000 HSS (1.9 GWh/1.2 GW) were installed solely in 2022.

The study estimates that over 650,000 stationary BSS with a battery energy of 7.0 GWh with an inverter power of 4.3 GW, and 1,878,000 EVs with a battery energy of 65 GWh and a DC charging power of 91 GW (12 GW AC), were operated in Germany by the end of 2022.

“The cumulative battery energy of about 72 GWh is therefore nearly twice the 39 GWh of nationally installed pumped hydro storage, demonstrating the enormous flexibility potential of battery storage for the energy system,” it said.

Jan Figgener, one of the researchers and Head of Grid Integration and Storage System Analysis at RWTH Aachen University, told BEST: “It is good to see that the market for large-scale storage systems gained traction after rather weak years. Besides the saturated market for frequency containment reserve, new use cases emerge.

“Especially the integration of renewable energies is on the rise and grid boosters will soon be used for the optimisation of grid operation. Thus, storage begins to unlock more and more of its potential of being a key technology for the energy transition.”

Other highlights:

- the emerging market for industrial storage systems (ISS) grew by 24% in 2022, with a total of 1,200 ISS (0.08 GWh/0.04 GW) installed

- the market for large-scale storage systems (LSS) increased by a huge 910%, with 47 LSS (0.47 GWh/0.43 GW) commissioned

- the electric vehicle (EV) market grew, with 693,000 new EVs (27 GWh/43 GW (DC)/4.5 GW (AC)), up by 34% in terms of battery energy. The number of EVs per charging point grew from nine in 2017 to 23 in 2022

- LSS prices ranged on average from €310/kWh to €465/kWh. In comparison, if the 2022 BEV prices for the whole vehicle are simply divided by their battery energy, the mean specific BEV system prices range from €800/kWh for medium to €1,240/kWh for luxury cars.

In December 2022 alone, 250 MWh of LSS were registered. One reason for this end-of-year rally could be the last chance to register the LSS for the avoidance of grid tariffs, according to the study.

System BSS prices increased significantly in 2022, the study found. They were estimated at €1,200/kWh for HSS, an increase of some 30%. The reason for the increase is extremely high demand, which has continued to grow due to high energy prices and the war in Ukraine.

“Installers are at the limits of their installation capacities and many people have to wait more than half a year for an installation date of PV and HSS.” It said prices vary widely, with prices ranging from €700/kWh to €2,300/kWh in single offers analysed in 2022.

Cumulative capacity of EVs places battery storage at the forefront of national energy storage

Figgener said the large cumulative capacity of EVs places battery storage at the forefront of national energy storage, with nearly twice the capacity of pumped hydro storage. “However, this potential must be realised through smart vehicle-to-grid technologies and the appropriate regulatory framework.”

While the global market prices for battery packs increased rather moderately last year, the researchers quantified significant price increases for turnkey stationary battery storage systems. “This shows the clearly different purchasing conditions between large automotive groups and the manufacturers of stationary storage systems,” he said.

The researchers evaluated and combined all major public databases on national stationary and mobile storage, as well as own databases from subsidy programmes. They extended insight by literature and media research, and bilateral industry exchange.