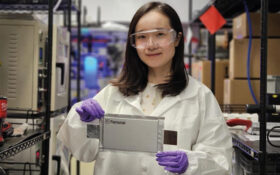

Dipak Sen Choudhury examines the market segments in India and finds lead-acid is losing some market share to lithium batteries, but holding its own in other sectors.

Former US President Joe Biden’s 25% import tariff on batteries for electric vehicles (EVs), sourced from China almost immediately caused an interesting ripple in the Indian battery market. Within a month of this tariff, the India material handling market received 500 trucks, fitted with lithium-ion batteries, at the cost of a lead-acid version.

With exports to US being thwarted and Europe’s anticipated anti-dumping duties on Chinese EV and EV battery imports, China may suddenly find itself sitting on a huge lithium truck capacity with no markets to go to. But the current Indian government cannot impose any anti-dumping measures on Chinese lithium battery imports, so India could be a soft target, as the country is in quite desperate need of multiple GWhs of Chinese lithium batteries to meet its own ambitious EV and energy storage system (ESS) plans.

White labelling

It is possible that the Chinese trucks could be brought to India for white labelling to re-export to the West, as India does not have any tariff barriers for exports to these countries. However, the arrival of cheap lithium battery electric trucks has become a big boost to the aspiring forklift truck manufacturers in the country, as every entrepreneur has a lithium plan in the name of upgrading their technology.

Even today, a relatively small percentage of forklifts sold domestically come from abroad, ranging from 10–15% of all electric trucks sold. These are most commonly from China. In 2024, the number of imports that came with lithium batteries more than doubled, to nearly 25%, from 12–13% of these imports in 2023. The lure of four times longer life (5,000 cycles at 80% depth of discharge (DoD) against lead-acid’s 1,200), the opportunity to charge at rates of 0.5C and above, and no maintenance features were enough to convince users to pay a premium. If now the trucks arrive at the same price, the demand would certainly go up.

Industry veterans predict that at this rate, by 2030 the amount of lithium-powered electric forklifts in the country will easily become as high as 20–25% of all forklifts. That the overall electric forklift business is growing at quite a staggering pace is a consolation to the lead-acid segment.

This growth is due to the conversion of erstwhile diesel forklifts, which is expected to go up from 40–45% market share to 60–65%, and the fact that the overall forklift business is slated to grow due to the rapid progress of India’s manufacturing and retail industries, anywhere from 9–13% compound annual growth rate (CAGR), between 2025 and 2030.

Booming UPS market

We turn next to the booming uninterruptible power supply (UPS) battery market, including those designated for data centres, a sub-segment on their own. The UPS segment overall has been growing at a value of CAGR of 12% over last three years. It is only expected to go up more in the next five years. Data centres are leading the pack in this fast-growing sector with an estimated CAGR of 15%. However, the big surprise here is the quiet entry and consolidation of lithium technology in this field, including within data centres. The lithium figures are impressive as over the last three years, the estimated CAGR has been close to 16% and total business value has reached ₹930 million ($110 million), which is roughly 15% of the overall UPS battery market.

In the last fiscal year, India reportedly spent a total of $3.5 billion on imports of lithium batteries, mostly from China. The majority of this went to the fitment of the two- and three-wheelers, as well as four-wheeler EVs and buses. In industrial applications, lithium has had major success in telecom and is now in pursuit of market share in the industrial motive power and UPS segments.

The UPS segment is looking at lithium-ion purely due to the falling prices and the promise of 10 years of life. Space saving is a consideration too but as not as much as the promised battery life is. The lead-acid market would find it difficult to counter the falling prices, as the average cost of a lithium pack has decreased to between $120–130/kWh.

Some Chinese sources have been offering even lower prices of around $95/kWh per pack. A well-made absorbent glass mat (AGM) with a proper battery management system also comes somewhere close to $75–85/kWh but suffers from the perception of being a good-to-go solution, at best, for five years, compared to lithium-ion’s declared 10.

Data centres

The notable exception though, are data centres, which have the architecture being imported mostly from the US, Europe, Japan, Singapore. These include servers, UPSs, HVACs and batteries that are exactly replicated here in India.

Many buyers have been very happy with the ‘front access’ battery form-factor, which fits into sleek cabinets and delivers quite a respectable floor space utilisation. Thin-plate is another buzzword, popularised in Europe, and heavily marketed in India. These TPPL front access lead-acids enjoy a perception of being a data centre battery. Indian manufacturers have quickly responded to this segment being entirely addressed by European and/or Chinese imports by competing with those products.

This segment of UPS battery looks to be safely lead-acid yet. Nevertheless, it would be important for regular upgrades to the lead-acid solutions, in terms of life, energy and volume density and footprint. An intelligent monitoring system that can communicate in real time with service technicians’ mobile phones, for example, can be important parameters to retain lead-acid in this segment.

Telecom

This brings us to telecom, which is largely moving towards lithium. Indian telecom tower operators have long suffered due to severe and very frequent power cuts across the country covering large cities to the rural hinterlands. Ensuring 24-hour power backup 24/7 was the biggest technical challenge all tower operators had to cope with. As if this was not enough, to ensure seamless connectivity across the country, a substantial percentage of the base transceiver station (BTS) towers were in places without grid power.

The strategy taken by the operators were to go with AGM valve-regulated lead-acid batteries (VRLA), backed up by a diesel generator set. Daily deep discharges of up to 80%, were the order of the day. This was compounded with an often incomplete recharge to save on diesel costs.

Not surprisingly the VRLA sets could deliver anywhere between two to three years of field life. It was in this environment the lithium storage solution entered Indian telecom. One of the largest, Jio Telecom, started their tower business with lithium battery packs only. This was more than 10 years ago when lithium was still substantially more expensive than lead-acid, yet was considered a serious alternative, only because of features like fast recharge and a promised cycle life of 3,000 or more at 80% DoD.

To manage the capex, lithium sales personnel suggested lower rating batteries to be fitted which would be fast charged between consecutive discharges, though in this case the charging modules costs would go up sharply. The lithium experience, overall, was not bad for the tower operators and fortunately have completed more than 10 years of regular deployment without any major adverse experience like a fire or explosion.

Lead-acid losing

With the above in mind and the recent slide in lithium-ion costs, this storage technology is now enjoying a green channel entry, in this one application of providing backup to telecom towers. In the last year itself, lithium-ion costs have come down from $175/kWh to the latest quoted figure of $95/kWh.

These are pack-level costs with cells being sourced from Tier 2 manufacturers in China and have a declared service life of five years or more. For comparison, the latest quotes for LA AGM VRLA are around $70/kWh and these batteries have a service life of three years and above.

The arithmetic is obviously in favour of lithium and that is exactly what is being seen in this market. The message is simple, telecom towers are going to lithium and lead-acid is losing market share.

Incidentally, the above situation is for 2G/3G/4G BTS towers only. Now that the country has already started to move towards 5G connection, towers are becoming numerous but smaller, fit only for the compactness of lithium. Some trials have been carried out with lead-acid but certainly it is concluded that lithium is a better-fit in the 5G towers. So, it is lithium all the way in telecom and likely to stay that way unless there are supply chain issues.