Governments worldwide need to speed up the building of long duration energy storage infrastructure to take advantage of renewable energy power generation. To complete the energy transition away from fossil fuels, more renewable energy sources will be used for generating power. This in turn presents storage challenges for the reliability and stability of the power system. Storage technology solutions exist today, but they are far from meeting society’s energy needs. Andrew Draper reports.

A briefing note from the UK Parliament’s research service in December pointed out that low-carbon, long-duration energy storage (LDES) currently plays a relatively minor role in the UK energy system.

But, as the electricity system decarbonises, the amount of LDES needed is likely to increase significantly to replace the storage traditionally provided by fossil fuels, it said.

The research said that as the proportion of wind and solar generation grows, flexible types of generation such as LDES will become increasingly important. It can be scheduled to meet demand under low wind and dark conditions, for example. Storage can also contribute to security of supply during wind droughts, low annual wind speeds and power generator failures.

Storage will need to be deployed throughout the UK, it said, with certain technologies needing to be located in particular geographic areas that have suitable conditions, such as salt caverns and mountains. Many of these technologies are not well known to the public and positive or negative perceptions of their safety will start to emerge.

The UK government is supporting the demonstration and commercialisation of new LDES technologies. Examples include flow batteries, mechanical and thermal storage, and hydrogen. (For a detailed look at these and other energy storage solutions see Dr Mike McDonagh’s 2022 series How batteries can save the world. Topics include EV technologies, mechanical and electrochemical storage, grid-scale, and emerging electrochemical technologies.)

Poor reward for energy storage

Current market arrangements do not adequately reward energy storage over longer timeframes, particularly over seasons and years, the briefing said. In January 2023 the government announced reforms to the capacity market (CM), the government’s main mechanism for ensuring security of electricity supply. They include consulting on new contracts for low-carbon technologies to incentivise their participation in CM auctions.

Competitive auctions will be held between technologies such as batteries and gas-fired generators. It will incentivise “greener, flexible technologies” to compete in CM auctions by offering multi-year contracts for low-carbon flexible capacity, such as smart demand-side response technologies and smaller-scale electricity storage.

The government will also evaluate the role government energy policy has in supporting projects with long build times and the relationship between the CM and wider government support for large-scale long duration electricity storage.

Wrong financial incentives

Anthony Price, Managing Director of Swanbarton, a UK-based energy storage consulting company, said Britain led the way in terms of LDES because its ancillary market was relatively open, and the system was small. But the market is being held back by inappropriate financial incentives because of privatisation of the energy market.

He said: “There were high investment rewards to be made from building renewables when renewables had fixed contracts. There were then high rewards to be made when batteries could provide short-term reserve frequency services and the like and get paid large sums of money from providing these ancillary services. So, if you’ve got an attractive income stream why would you want to go after a less attractive income stream?”

The more you separate generation, transmission, and supply of electricity – as happened in the UK during privatisation – the less you get system benefits, he said. When storage was used by the whole electricity enterprise it could be used for the whole system. If you lowered generation costs, you would get lower costs to the consumer. The more it is carved up, the more profits generated for some means costs for someone else, he said. “We have rewarded power, but we haven’t yet begun to reward energy. As we know both are important in running a system.”

While LDES is lagging in many countries, California and Japan are standing out for their efforts, said Price. “You can’t just move large blocks of energy from one time of day to another without having LDES. California is beginning to do that quite well though.” In June 2021, the California Public Utilities Commission issued its Mid-Term Reliability Procurement Decision, which required energy retailers in the state to procure 11.5GW of capacity between 2023 and 2026. “More than 90% of that is storage,” said Shinjini Menon from electricity supply company Southern California Edison.

Price said 4-hour storage for PV and batteries is fairly common in California, and thoughts are turning to 6-8 hours’ duration. The wildfires seen in California meant high temperatures and peak demand for air conditioning. The system coped because several batteries could come on for 2-3 hours as long duration energy storage was in place.

In Japan, NGK and Sumitomo have been quietly and efficiently developing LDES for many years, with 6-8 hours’ battery life, said Price.

Europe paying power premium

He said Europe is paying a premium for providing power – frequency response – but not a premium for providing 4-8 hours’ energy. “We’re beginning to draw back on that with the capacity market,” he said, with power being delivered in the afternoons.

In Europe, he said the European Commission recognised the market is broken with prices of gas and renewables seemingly getting out of control. “The way to do that is you have to have sufficient diversity of supply, both short-term and long-term, to meet both economic targets and sustainability targets. If you want to get rid of high carbon-emitting fossil fuel peaking generation that may run for two, three or four hours on a winter’s day, you’re going to need efficient long-duration storage.”

Price said the reason why it’s not being done enough is it costs too much money, and the returns aren’t attractive enough. He gives the analogy of the rate of return on a fire engine to protect against a house burning down: “All the time it sits there doing nothing it’s not earning you any money. When you need it, it’s worth a fortune. And energy storage is the physical embodiment of an electrical insurance policy…There’s an inherent value in it that’s not rewarded by the present market structure.”

Cost of LDES must come down

Attitudes are beginning to change, he said, with a recognition that batteries are already making reasonable money and why not make more by putting in LDES. But the cost of LDES must start coming down. Sales of LDES have not been as high as short-duration batteries and so the economies of scale have not been realised.

There is no agreed definition of LDES, said Price, who believes it should be 8+ hours’ energy.

Change comes quickly

“Often when change happens in the energy industry, it happens very quickly,” he said. “If you look at the cataclysmic changes we’ve had since 2020, when we got used to having suddenly almost no demand on the system, and how were we going to accommodate having too much renewable and nothing else, through to having too much demand because we didn’t have enough generation because we didn’t have enough gas to produce it.”

He said energy security means having a diversity of energy supply sources and not relying on a low availability feedstock, such as gas from Russia. “Energy security means having diversity of energy supply. That means energy storage, and for energy storage you need energy storage security with a diversity of energy storage types. And while there will always be a demand for short, medium, and long duration energy storage, he envisages battery power lasting 8-12, possibly up to 24 hours’ duration.

Uncertainty over responsibility

Steve Saunders, renewable energy business leader for the UK, Middle East, and Africa at engineering company Arup, said energy storage is “vital” for maximising the generation of renewable energy and meeting global carbon commitments. “Yet although viable technology exists, the uncertainty over who is responsible for energy storage threatens to seriously limit the UK’s use of renewables,” he said.

“I think having a single body for energy distribution, infrastructure and storage could resolve this issue. Because demand and supply are more easily identified and anticipated at a local level, National Grid or the local distribution operators would be strong candidates to take sole responsibility for energy storage in the UK,” he added.

Without storage of electricity (levelling out the intermittency in supply from technologies such as wind or solar), a grid is limited to around 18% renewables, he said.

Doubling of storage projects

RenewableUK, the body representing renewable energy companies, said in April that a change in planning law in December 2020 allowing local planning authorities to determine projects with a capacity of over 50MW in England and 350MW in Wales had already led to a doubling of energy storage projects over 12 months. Plans were previously determined by central government, making the process longer and more complex.

As a result, it said, there had been a shift towards larger projects, with the average size increasing to 54MW. Total pipeline of battery projects last spring doubled from 16.1GW a year before to 32.1GW. Operational battery storage project capacity grew by 45%, from 1.1GW to 1.6GW, and the capacity of projects under construction more than doubled to 1.4GW. More was in the planning system.

RenewableUK’s Director of Future Electricity Systems, Barnaby Wharton said: “The fact that the battery storage pipeline has doubled within the space of 12 months shows that the enormous appetite among investors for this technology is continuing to grow fast. But developers still need access to cheaper capital.”

LDES draws $58 billion

Analyst body Wood Mackenzie’s Long duration energy storage report 2022, published in December, said LDES projects around the world attracted more than $58 billion in commitments from governments and companies since 2019. If all these projects were realised, it would lead to the installation of 57GW of LDES – the equivalent of three times the global energy-storage capacity deployed in 2022, it said.

Projects representing $30 billion are either under construction or in operation, it noted. But it added that most LDES technologies are still nascent, and technology developers will struggle to scale cost-effectively before 2030.

Kevin Shang, Senior Research Analyst at Wood Mackenzie, and lead author of the report, said: “To accelerate the energy transition, more renewable energy sources will be used for generating power, but this in turn presents challenges for the reliability and stability of the power system. Some technology solutions exist today, but they are far from meeting society’s power needs.

“Long duration energy storage technology, with longer durations of eight to approximately 100 hours, holds great promise as a low-cost solution to enable a grid with more renewable sources,” he said. “This is why companies and governments have significantly increased their commitment to the LDES market.”

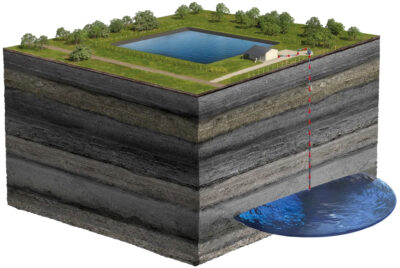

It said pumped hydro storage is the only LDES technology deployed on a large-scale and believes it will continue to dominate the market until 2030.

VRFBs in China

Wood Mackenzie’s analysis shows geographical disparities in the development of the LDES market. The deployment of vanadium redox flow batteries and compressed air energy storage has accelerated rapidly in China, largely driven by strong policy support. Last year saw the world’s largest redox flow battery energy storage system, 100MW/400MWh connected to the grid in Dalian, China. The city of Zhangjiakou also saw the world’s largest compressed air energy storage project, 100MW/400MWh, start operations.

Shang said the US continues to invest in and build its LDES industry, with companies actively pushing for innovation, and promoting pilot and demonstration projects. But most European countries (except the UK) have been less enthusiastic.

Grid-scale energy storage capacity is expected to surpass 30GW/111GWh of installed capacity by the end of 2025, according to a report in December by the US Energy Information Administration. Over 75% of 20.8GW utility-scale battery capacity planned for installation from 2022 to 2025 will be in Texas and California.

Global energy storage market

Bloomberg New Energy Finance (BNEF) forecast in its 2H 2022 Energy Storage Market Outlook that the global energy storage market would grow 15 to 30-fold by 2030 and reach a cumulative 411GW/1194GWh. That is 15 times the 27GW/56GWh of storage online at the end of 2021.

It upped previous forecasts for capacity by 13%. This is due to the US Inflation Reduction Act, “a landmark piece of legislation” providing more than $369 billion in funding for clean technologies, and the European Union’s REPowerEU plan, which sets ambitious targets to reduce reliance on gas from Russia.

The energy crisis caused by the war in Ukraine has spurred Europe into ramping up energy storage capacity, it said. BNEF has noted more than double the energy storage deployments from 2025 to 2030 across Europe from previous forecasts. However, supply chain constraints could slow additions, it said.

Growing pains

Helen Kou, an energy storage associate at BNEF and lead author of the report, said: “The energy storage industry is facing growing pains. Yet, despite higher battery system prices, demand is clear. There will be more than 1TWh of energy capacity by 2030. The largest power markets in the world, like China, the US, India, and the EU, have all passed legislation that incentivises energy storage deployments.”

BNEF’s forecast suggests that the majority of energy storage build by 2030, equivalent to 61% of megawatts, will be to provide energy shifting – i.e. advancing or delaying the time of electricity dispatch. Co-located renewables-plus-storage projects, in particular solar-plus-storage, are becoming commonplace globally, it said. It believes customer-sited batteries – residential, commercial, and industrial – are also expected to grow to make up about 25% of global storage installations by 2030.

Batteries to dominate to 2030s

Rapidly evolving battery technology is driving the energy storage market, it said. Lithium-ion batteries account for the majority of installations at present, but many non-battery technologies are under development, such as compressed air and thermal energy storage.

BNEF said it expects batteries to dominate the market at least until the 2030s – largely due to their price competitiveness, established supply chain and significant track record. But if new technologies can successfully outcompete lithium-ion, then total energy storage uptake may well be larger, it added.

Although developers are rushing to bring more battery projects online, and demand remains strong, high battery pack prices, global shipping bottlenecks and other supply chain constraints are dampening near-term deployments, said BNEF last summer.

An analysis from consulting firm McKinsey in 2021 and authored by the LDES Council, a CEO-led organisation, argued that timely development of a long duration energy storage market with government support would enable the energy system to function smoothly with a large share of power coming from renewables.

Store 10% of electricity by 2040

McKinsey modelling for the study suggests that by 2040, LDES has the potential to deploy 1.5-2.5TW of power capacity globally (85-140TWh) and store up to 10% of all electricity consumed. This corresponds to a cumulative investment of $1.5-3 trillion.

Its report said a key milestone for LDES will be reached when renewable energy reaches 60-70% market share in bulk power systems, which many countries with high climate ambitions aim to reach between 2025 and 2035.

Reductions in the cost of LDES technologies will be needed and will depend on improvements in R&D, volumes deployed and scale efficiencies in manufacturing, it said. Similarly, total LDES deployment is closely tied to the rate of decarbonisation of the power sector and the deployment of variable renewable energy generation.

It believes in the short to medium term, government action will be required to kick-start an LDES market by lowering costs, mobilising the necessary investment capital, and creating a market ecosystem enabling investors to make an attractive return on LDES.

The images show a random selection of storage technologies with grid-scale potential.