As uncertainty rises in consumer adoption of EVs and global market forces cause disruption to existing electrification plans, energy-efficiency rises as the imperative to the future of energy storage. Sara Siddeeq reports for BEST on German plans for continuing battery innovation development across the energy sector.

Similarly, BMW has been investing heavily in electric vehicle technology, with a focus on developing next-generation batteries for its “Neue Klasse” platform. The company is establishing high-voltage battery assembly facilities globally – including at its plants in Debrecen (Hungary), San Luis Potosi (Mexico), Spartanburg (USA), and in Germany – to support its expanding EV lineup. These facilities are designed for scalability and will support cylindrical cell formats to increase energy density and performance.

Despite these advancements, the industry has faced notable setbacks. In late 2024, Swedish battery manufacturer Northvolt filed for bankruptcy. Once touted as Europe’s flagship response to Asian battery dominance, Northvolt’s collapse highlighted the intense financial pressures and technological challenges faced by local players. Analysts noted that despite receiving substantial funding and securing supply agreements with several automakers, Northvolt struggled with high operational costs and delays in scaling production.

Energy storage solutions

Germany has made remarkable strides in energy storage, a critical component for balancing the intermittency of renewable energy sources like wind and solar. By the end of 2024, the country had installed approximately 19GWh of battery storage capacity, marking a 50% increase from the previous year. This surge was driven primarily by residential installations, which accounted for around 15.4GWh. In fact, 2024 saw the addition of more than 600,000 new stationary battery storage systems, bringing the total to over 1.8 million in operation – underscoring growing consumer demand for self-sufficiency and grid independence.

In the commercial and utility-scale segments, there was also substantial growth. Approximately 100 new large-scale storage facilities with a combined capacity of around 0.8GWh were commissioned in 2024, effectively doubling the expansion seen in 2023. Additionally, companies like TotalEnergies are accelerating deployment. In March 2025, TotalEnergies announced €160 million in new investments to develop six battery storage sites in Germany, totalling 221MW of capacity. These installations are designed to support renewable integration and improve grid flexibility.

Friedrich Grupe, CEO of Digatron, told BEST the importance of adaptable testing systems in this evolving landscape: “Digatron’s software platform is designed to stay ahead of technological progress. With open interfaces, modular test protocols, and an intuitive user experience, our systems adapt seamlessly to new cell chemistries, evolving test strategies, and emerging standards.”

TWAICE’s software offers a complementary approach – focusing on real-time system monitoring and performance modelling. Its analytics suite enables BESS (battery energy storage system) operators to increase availability, reduce degradation, and optimise usage. “For example, one customer operating a 300MWh system was losing 18MWh per day due to six defective modules. With our analytics, they pinpointed the issue, replaced the modules, and restored efficiency – saving over $1 million annually,” Dr Stephan Rohr, Founder and co-CEO, said to BEST.

Electric vehicle manufacturing

Germany continues to lead Europe in electric vehicle production. In November 2024, the country produced a record 143,200 electric cars, marking a 38% increase compared to the same month in the previous year. This figure included 110,100 battery electric vehicles (BEVs) and 33,100 plug-in hybrid electric vehicles (PHEVs), reflecting the strength of the country’s EV supply chain and manufacturing capabilities. Cumulatively, nearly 1.3 million electric cars were manufactured in Germany during the first eleven months of 2024, surpassing the total production for the entire previous year.

However, domestic EV demand did not keep pace with production. BEV registrations in Germany for the full year 2024 totalled 380,609 – a 27.4% decline from 2023 – accounting for just 13.5% of total new car registrations. This slump has been attributed to the expiration of EV subsidies, economic uncertainty, and intensified price competition. Tesla led the BEV market in Germany, registering 37,574 vehicles, followed by Volkswagen, Mercedes-Benz, and BMW. The trend highlights a widening gap between EV production capacity and consumer uptake.

Supply chain challenges and opportunities

Germany’s battery supply chain faces a complex array of challenges and opportunities. A central concern remains Europe’s dependence on imported raw materials – particularly lithium, nickel, cobalt, and rare earth elements – most of which are currently processed outside the continent. Recognising this, the European Union has stepped up efforts to fortify domestic supply chains.

In March 2025, the European Commission unveiled a list of 47 strategic projects under the Critical Raw Materials Act (CRMA). These projects aim to strengthen the EU’s capacity to mine, refine, and recycle 14 critical materials. The CRMA sets ambitious targets: by 2030, at least 10% of the EU’s consumption of strategic raw materials should be extracted domestically, 40% processed in the EU, and 15% derived from recycling.

Germany is also pursuing bilateral collaborations. In July 2024, the EU and Serbia signed a landmark agreement to improve access to Serbia’s raw materials. The deal, part of the EU’s Global Gateway initiative, ensures the EU benefits from Serbia’s lithium and copper reserves while supporting Serbia’s sustainability standards and infrastructure development.

Despite these positive steps, the bankruptcy of Northvolt in late 2024 raised fresh doubts about Europe’s ability to scale battery manufacturing without Asian input. Northvolt’s collapse served as a cautionary tale: high CapEx, supply chain bottlenecks, and intense competition from Chinese and South Korean producers – which still control around 70% of the global EV battery market – continue to challenge Europe’s ambitions.

When speaking to BEST, Kevin Campbell, global head of strategy at Digatron, underscored the importance of comprehensive testing solutions in navigating these complexities: “Digatron is at the forefront of every new cell chemistry variant through our design and supply of cell assembly equipment and formation/aging solutions as offered via Digatron Systems in Verona, Italy. The broad coverage of experience and technical know-how from cell assembly equipment through cell testing solutions makes Digatron a one-stop shop, a valuable partner of choice.”

Digatron’s integrated solutions allow battery manufacturers to maintain quality and reliability despite an increasingly fragmented and fast-evolving supply chain.

Government initiatives and investments

Germany has been actively promoting the battery industry through a range of strategic initiatives and public-private partnerships. The government’s push is tightly aligned with its Energiewende transition plan, aiming to decarbonise the power and transport sectors by 2045.

One standout project is the Forschungsfabrik Batterie (Battery Research Factory), a nationwide network of universities, Fraunhofer Institutes, and industrial partners. The goal: to develop scalable, cost-effective, and sustainable battery technologies in Germany. The platform enables pilot production lines and supports rapid industrial translation of R&D innovations.

More recently, in response to budget constraints affecting climate funding, Germany’s Federal Ministry of Education and Research (BMBF) announced interim funding of €25 million in January 2025 to keep critical battery R&D projects afloat. This ensures continuity in innovation across areas such as next-generation cell chemistries and recycling solutions.

On the regulatory side, Germany is also working to streamline project approvals for energy storage systems. A pipeline of 3.7GWh in new projects is projected by September 2027, as reported by Reuters, and the government is taking steps to reduce bureaucratic friction, particularly for large-scale installations.

Public investment is being complemented by private capital. Companies like BASF, Varta, and Mercedes-Benz are partnering with government bodies to advance battery materials, cell production, and recycling in line with EU climate targets.

Meeting new technological demands

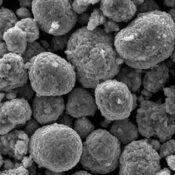

As the battery industry pivots toward next-generation chemistries – such as solid-state, sodium-ion, and lithium-sulphur – Germany’s manufacturing and testing infrastructure is evolving to keep pace. Each new chemistry introduces unique production and safety challenges, demanding corresponding advancements in both hardware and software.

A notable initiative is the launch of SIB:DE FORSCHUNG (Sodium-Ion-Battery Deutschland Forschung) in late 2024. Backed by the German government, the project brings together leading research institutions and companies to accelerate the industrialisation of sodium-ion batteries. These batteries offer lower costs and improved thermal stability compared to lithium-ion counterparts, making them a promising solution for stationary storage and affordable EV segments.

“The industry’s demand for higher measurement accuracy is increasing – often down to the microampere and microvolt level,” noted Grupe. “We’re addressing this with state-of-the-art measurement tech and evolving calibration standards.”

Rohr echoed the growing complexity facing operators: “The increasing scale and duration of battery systems, coupled with market volatility and performance-based business models, means analytics is no longer a nice-to-have – it’s essential.”

Battery analytics is now central not only to operational monitoring but also to strategic planning, warranty compliance, and regulatory alignment. With the upcoming EU Battery Regulation and the introduction of a digital battery passport (mandated from 2027 for industrial and EV batteries), transparency, traceability, and lifecycle data are becoming mandatory features – not optional upgrades.

“Germany is setting the standard in battery intelligence and software-driven optimisation,” said Rohr. “With the EU Battery Regulation and digital battery passport on the horizon, the need for traceability, data transparency, and lifecycle insight is only going to grow.”

Breakthrough innovation: 1500V pack tester with SiC

Among Digatron’s most advanced offerings is its high-voltage pack tester built using silicon carbide (SiC) semiconductor technology – a major leap forward for battery validation in electric mobility and high-performance energy storage systems. SiC enables greater efficiency, faster switching speeds, and higher thermal conductivity compared to traditional silicon-based systems.

“This solution offers ultra-fast response times, more than 95% energy efficiency, and unmatched power density,” said Grupe. “It’s adaptable for both low-voltage (up to 750V at 1000A) and high-voltage (up to 1500V at 500A) applications – ideal for automotive R&D and production validation.”

SiC-based systems are becoming increasingly relevant as EV architectures shift toward 800V and 1500V platforms, allowing for faster charging and lighter components. Digatron’s system supports these voltages while offering bidirectional regenerative capabilities, feeding recovered energy back to the grid – improving both sustainability and cost-efficiency.

With a flexible architecture and built-in safety systems, the tester supports rapid transitions from prototype to series production while meeting IEC 61010 and UL safety standards. This innovation supports a growing market need: McKinsey & Co estimates the global battery testing market will more than double by 2030, driven by more stringent safety and reliability requirements.

Meanwhile, on the software side, TWAICE plays a pivotal role in ensuring that high-voltage battery systems remain reliable and economically viable. Through accurate state-of-charge (SoC) tracking, fault detection, and performance forecasting, TWAICE’s analytics help operators mitigate financial risks associated with system underperformance.

One example comes from a major ERCOT (Electric Reliability Council of Texas) operator, which used TWAICE’s platform to identify and correct state-of-charge errors caused by faulty sensors. The result: restored output, avoidance of penalties, and enhanced system trustworthiness.

Energy efficiency as a success factor

With Germany targeting carbon neutrality by 2045, energy efficiency has become a strategic imperative. Battery manufacturers and energy operators are under mounting pressure to optimise resource use – not only to meet regulatory thresholds, but to boost ESG performance and remain cost-competitive.

“Digatron’s regenerative test systems recover up to 95% of discharged energy and feed it back into the grid,” said Grupe. “This dramatically lowers electricity costs and improves the environmental footprint of battery manufacturing.”

This energy recovery feature is particularly important in a landscape where electricity prices remain volatile and margins tight. Germany’s battery testing ecosystem is increasingly defined by such energy-smart design principles, helping manufacturers align with national decarbonisation goals and reduce lifecycle emissions.

TWAICE complements these hardware gains with a software layer that surfaces hidden inefficiencies. Its digital twin models continuously simulate real-world operating conditions, flagging anomalies such as idle string imbalances, excessive cycling, or thermal inconsistencies.

In one recent case, a full battery energy storage system (BESS) string went offline without alerting the operator – leading to 1.4MWh of lost capacity daily. TWAICE flagged the anomaly, allowing the team to restore full functionality and avoid further revenue losses.

These combined innovations – real-time monitoring, predictive modelling, and energy recovery – are redefining what battery efficiency means. It’s not just about lower electricity usage; it’s about maintaining optimal performance, reducing wear and tear, and protecting the bottom line.

Challenges for manufacturers: speed and scalability

Germany’s competitive advantage lies in its ability to industrialise complex technologies at scale. But in the battery sector, speed and scalability must go hand-in-hand with quality, traceability, and safety.

“Bringing new battery technologies to market requires rapid, scalable testing – from early-stage samples to full production,” said Kevin Campbell. “Consistency, automation, and seamless integration are essential – and this is where Digatron’s decades of expertise makes a difference.”

Digatron’s modular, automated test systems allow manufacturers to validate new chemistries and cell formats with precision, ensuring consistent quality across development stages. These systems integrate directly with production lines, supporting agile manufacturing strategies and minimising human error.

A strong example of Germany’s commitment to innovation at scale is the EXINOS² project, launched in February 2025. Backed by €3.64 million in federal funding, the initiative brings together research partners to create a highly flexible stacking process for battery cells. This aims to significantly reduce production time and costs while increasing configuration options – critical as new battery formats proliferate.

Meanwhile, on the data front, TWAICE’s analytics are enabling battery owners and integrators to make faster, more informed decisions. Insights from operational data allow teams to:

- validate warranties more accurately

- optimise charge-discharge cycles

- minimise downtime

- predict and prevent degradation before it impacts performance

“Flexible, usage-based warranties and value-stacking business models are becoming more common,” said Rohr. “Battery analytics plays a crucial role in managing risk, validating conditions, and ensuring long-term system performance.”

Germany as a global pacemaker

Germany’s leadership in the global battery industry extends far beyond production volume. It stems from a foundation of rigorous regulatory frameworks, engineering excellence, and a tightly knit ecosystem that fosters innovation across the battery lifecycle – from cell design to predictive analytics.

“Germany upholds some of the most stringent battery testing standards globally,” said Campbell. “Many international protocols are developed or heavily influenced here. That leadership comes with responsibility, and at Digatron, we embrace it.”

Indeed, German testing protocols have influenced standards adopted by ISO, IEC, and UN ECE, setting benchmarks for global safety, durability, and transport compliance. These standards are increasingly shaping how batteries are tested for aviation, grid storage, and automotive use worldwide.

The country’s robust academic and industrial R&D infrastructure also plays a crucial role. Institutions like Fraunhofer IKTS, KIT, and TU Munich are globally recognised for their contributions to electrochemistry, materials science, and battery simulation. Germany’s Battery Pass Consortium, for instance, is leading efforts to design the framework for the EU’s upcoming Digital Battery Passport, which will be mandatory by 2027 under the EU Battery Regulation.

“Germany is uniquely positioned to lead the global battery software market,” said Rohr. “With its engineering heritage and commitment to sustainability, the country is shaping the next frontier in battery lifecycle management.”

This frontier includes a shift from hardware-defined systems to software-defined batteries – where optimisation, predictive maintenance, and risk management are powered by data. TWAICE, with its advanced lifecycle analytics, is emblematic of this shift.

Germany is also playing a central role in shaping the European battery alliance. In late 2024, France, Germany, and Sweden jointly urged the European Commission to accelerate support for homegrown battery companies and reduce reliance on China. The move reflects growing consensus that Europe’s strategic autonomy hinges on its ability to control key technologies such as batteries, semiconductors, and hydrogen.

From cell formation to digital twin modelling, from SiC-based test systems to predictive maintenance platforms, Germany is not just following the global battery transition – it is driving it. As nations race to decarbonise mobility and energy, Germany’s industrial and regulatory influence ensures that the solutions tested and proven here will define global best practices for years to come.