In the first of a three part series, Dr Peter Harrop takes a wry look at where money can be made in supercapacitors and who is making it.

IDTechEx

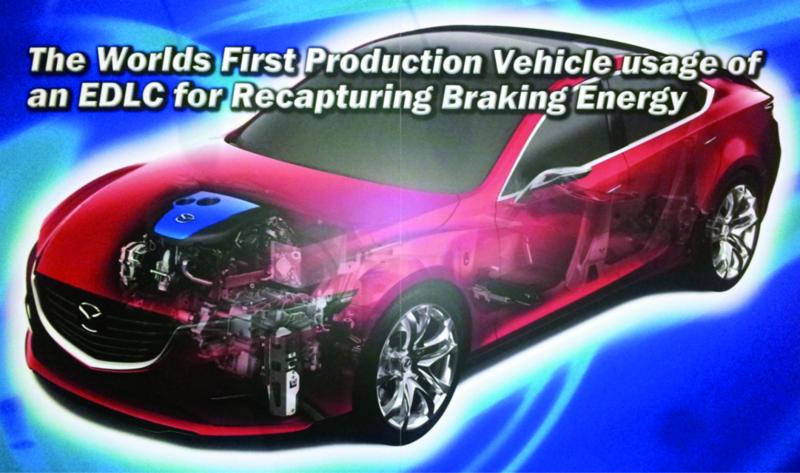

There are many ways of deciding who is winning in supercapacitors otherwise known as Electrochemical Double Layer Capacitors EDLC, ultracapacitors and by a host of other names. We can even include the sister product the Asymmetric Electrochemical Double Layer Capacitor AEDLC better known as the supercabattery on the web and about ten more names for that.

Supercapacitors have just become one of the . . .

to continue reading this article...

Sign up to any Premium subscription to continue reading

To read this article, and get access to all the Premium content on bestmag.co.uk, sign up for a Premium subscription.

view subscription optionsAlready Subscribed? Log In