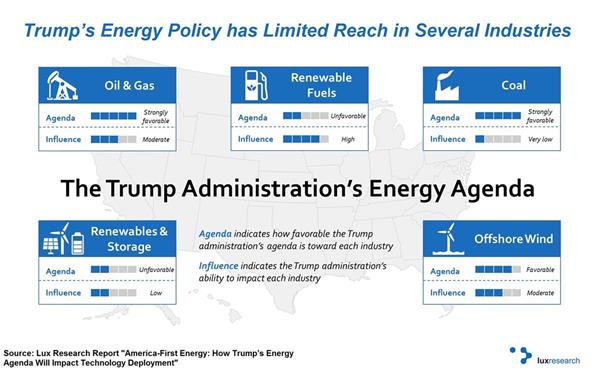

Despite President Trump’s coal, oil and gas-friendly agenda, his impact in the US energy landscape is likely to be “minimal”, according to a new study.

A report (pictured) released last week by US-based Lux Research says: “Renewables and energy storage will continue to see strong growth. Although renewables and energy storage have been largely ignored in Trump’s energy vision, the president’s ability to impact their deployment is minimal, as deployment has been driven primarily by state-level policies.

“Thus, even Trump’s recent decision to withdraw from the Paris Agreement and the abolishment of the federally imposed Clean Power Plan will have a negligible impact on renewables deployment; funding for early-stage research will be Trump’s primary area of influence.”

The report goes on to say that offshore wind may, in fact, “emerge as a rare renewables winner”. The report, titled ‘America-First Energy: How Trump’s Energy Agenda Will Impact Technology Deployment, states: “The president’s planned relaxation of environmental regulations could accelerate the deployment of large-scale offshore wind projects in the US.”

Yuan-Sheng Yu, lead author of the report, commented: “Clearly Trump’s policies follow the overarching theme of fossil fuels, but these policies do not mean an end to quickly-emerging renewables.”

• Meanwhile, the US energy storage market has experienced its largest quarter.

According to GTM Research and the Energy Storage Association’s latest US Energy Storage Monitor, 234MWh of energy storage were deployed in the first three months of the year – a 944% increase compared with Q1 2016.

In terms of power rating, 71MW of storage projects were used in the period, a 276% increase over 2016 and the third highest quarter since GTM and the ESA began tracking energy storage in 2013.

Front-of-meter deployments grew 591% year-on-year, boosted by a few large projects in Arizona, California and Hawaii.

“Much of this growth can be attributed to a shift from short-duration projects to medium- and long-duration projects in the utility-scale market, along with a surge of deployments geared to offset the Aliso Canyon natural gas leak,” said Ravi Manghani, GTM Research’s director of energy storage. “Although, the industry shouldn’t get too comfortable, as with fulfilment of Aliso Canyon deployments, there aren’t that many 10+ MWh projects in the 2017 pipeline, indicating that the first quarter may be the largest quarter this year.”

Overall, front-of-meter energy storage represented 91% of deployments for the quarter.

The behind-the-meter market segment, which is made up of residential and commercial energy storage deployments, declined 27% year-on-year in megawatt-hour terms. The report attributes the slowdown to a pause in California’s Self-Generation Incentive Program, which re-opened in May after a hiatus during which the program rules were revised.

California will remain the undisputed king of the US storage market over the next five years, according to the US Energy Storage Monitor. Arizona, Hawaii, Massachusetts, New York and Texas will battle for second place, with each market forming a significant chunk of deployments through to 2022, at which point GTM Research forecasts the US annual market to reach 2.6GW and 7.2GWh.

To put this in perspective, the Center for Sustainable Systems at the University of Michigan says the US had more than 21.6GW of rated power in energy storage in June 2016 and 1,068GW of total in service installed generation capacity. 95% of US energy storage (20.4GW) comes from Pumped Hydroelectric Storage (PHS).