China’s largest lithium compounds producer Ganfeng Lithium is reportedly looking to raise $1 billion from an initial public offering (IPO) in Hong Kong to expand its battery-related businesses.

According to the Financial Times, the IPO would fund new Ganfeng acquisitions and further exploration of lithium resources to secure future supply for the growing electric vehicle market in China.

Ganfeng has hired US investment banking group Citi for the IPO process and could raise up to $1.5bn, the FT quoted sources as saying.

Ganfeng is the world’s third largest lithium producer after US chemical company Albemarle and Chile’s Sociedad Química y Minera. Ganfeng’s operations include lithium extraction, lithium compounds and metals processing as well as lithium battery production and recycling.

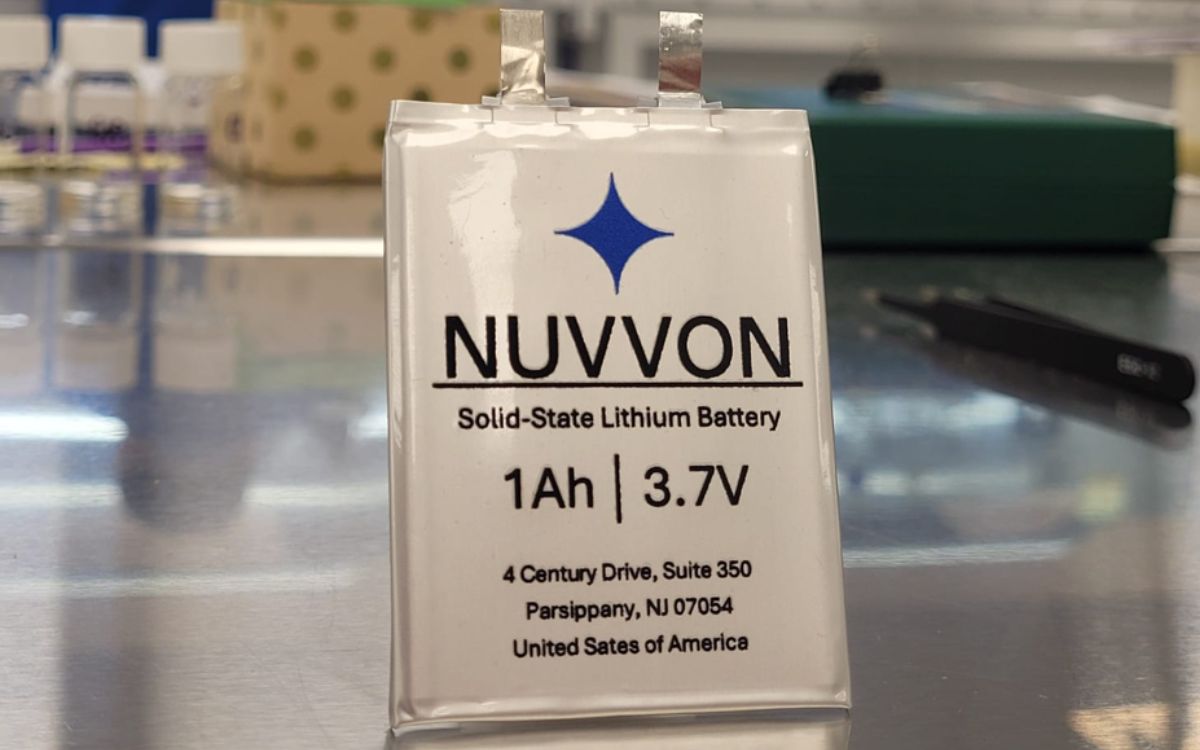

BBB could not contact Ganfeng for comment, but the company is increasingly interested in solid-state lithium batteries development. In a recent HKEX announcement, Ganfeng said it had a solid-state-battery-specialised R&D centre in Ningbo, Zhejiang Province and is building a pilot production line to commercialise the technology in 2019.

Ganfeng first entered the lithium battery production market in 2015. Last month, the company said its wholly-owned battery subsidiary would invest CNY42.6 million and hold a 71% stake in a new venture named Jiangxi Ganfeng New Energy Battery. The venture will focus on developing lithium, nickel-metal hydride, and sodium-sulfur batteries.

Ganfeng said it is also building a production facility for battery-grade lithium carbonate with a designed production capacity of 17,500 tons per annum in Ningdu, Jiangxi Province, which is expected to be commissioned this year. The company also said it is on track to produce an additional 20,000 tons a year of battery-grade lithium hydroxide production in the country.

BBB reported in August 2016 that a top Ganfeng official had expressed concern that lithium carbonate supply could outstrip demand in China as bottlenecks in charging facilities and developing technology slowed the EV market.