Global EV sales saw 1.1 million units sold in January 2024, up 69% year-on-year but down by 26% from the month before, reported Rho Motion.

It said the European market grew 29% year-on-year while the US and Canadian market was ahead by 41%. In China sales almost doubled.

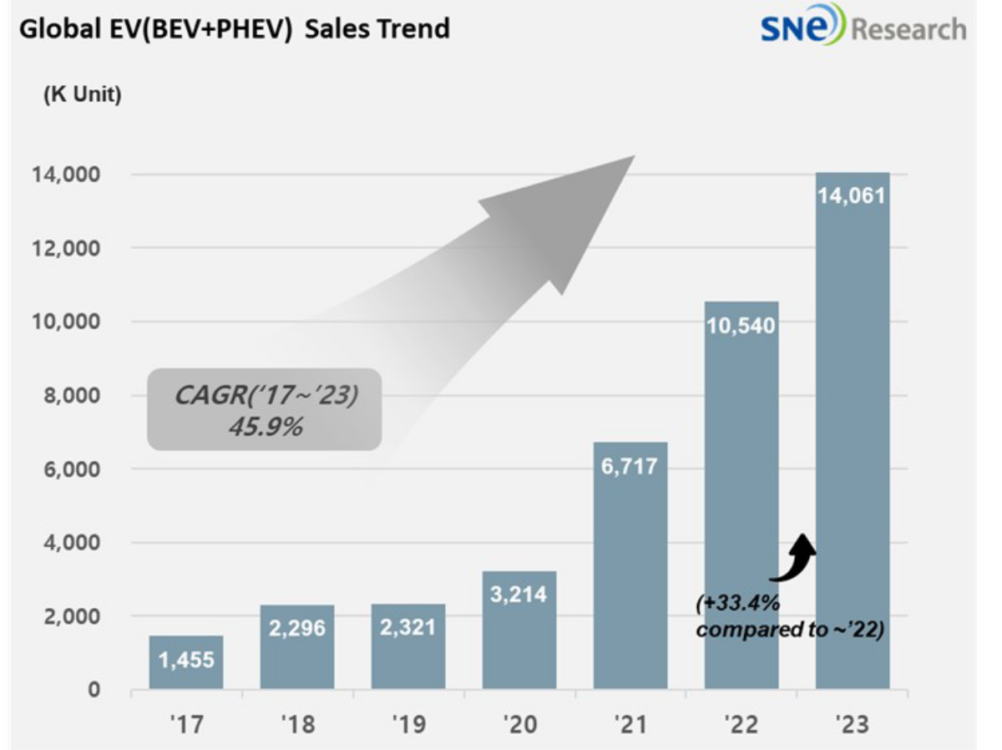

And Korean research body SNE Research said worldwide EV deliveries in 2023 totalled 14.06 million units, up 33.4% year-on-year. China remains the biggest market, with 60% of the world market.

It said even after major countries, including China, decided to terminate or reduce EV subsidies at the end of 2022 and the effect of high interest rates, the global EV market in 2023 still saw a solid demand.

However, in 2024 uncertainties related to a possible slowdown in EV demand are expected to continue, it said. Early adopters have already purchased EVs, and the target now should be people seeking EVs at lower prices with similar or better performance.

In Korea, a customer buying a new EV has to wait only a month, while for hybrid vehicles, the wait is up to 20 months. It said it shows that “demand for electric vehicles has been slowed down at a faster pace than before”.

Subsidy policies and fuel efficiency regulations are getting tougher and charging infrastructure remains insufficient, it said.

The answer seems to be to expand the EV line-up at affordable prices. The trend in the EV market has shifted from vehicle performance to price, it said.

UK car maker Jaguar Land Rover said it is switching focus from EVs to plug-in hybrids (PHEVs). Development timelines for electric models are being extended.

In an earnings conference call, CEO Adrian Mardell told reporters: “We are a little bit slower than we said three years ago.” In 2021, it announced plans to launch six electric Land Rover models by 2026. Now, it is only four. The race to BEVs has begun to stutter a little, he said.

Last year, its sale of PHEVs was the biggest increase of any European carmaker, up 68%, according to Dataforce data.

The European Automobile Manufacturers’ Association said PHEVs accounted for 7.7% of European vehicle sales in 2023. EVs made up nearly double the market share at 14.6%, while hybrids made up 25.8%.

“PHEV acceptance has been quite a surprise,” Mardell said.

US EV maker Tesla said in January it was looking to renegotiate contract pricing with its suppliers to cut costs. Weaker EV demand pushed Q4 earnings to below market expectations. Chinese battery maker CATL has reportedly slashed LFP battery prices by half.

Chart: Global EV and Battery Monthly Tracker, SNE Research