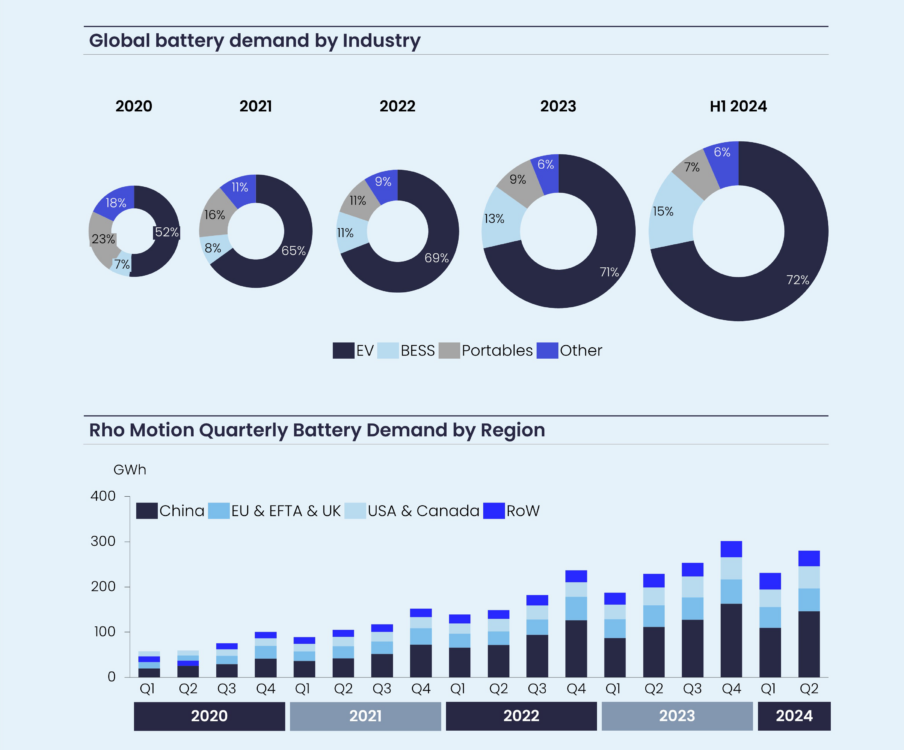

Battery demand went up 23% in the first half of 2024 to 512GWh, reported research firm Rho Motion. EV battery demand accounted for 72% of this, with EV sales topping seven million in the first half. Stationary storage had the strongest growth of almost 50%.

The data includes lead and zinc in the BESS market.

Iola Hughes, Head of Research at Rho Motion, said: “Amongst so much battery market negativity, the real upside of the year is the stationary storage market which is growing faster than the EV battery market. This is due to the frequency and size of projects entering operation increasing as more markets open themselves up to storage. The battery market is on track to surpass the 1.2TWh mark by the end of the year across all end-uses.”

As the EV market slows, cell manufacturers are being hit, though Chinese players are doing better than their Korean and Japanese counterparts, she said. LG Energy Solution, SK On and Panasonic all had falls in sales of their EV batteries in the period year-on-year.

A number of them have raised concerns, and SK On declared a ‘state of emergency management’ this week.

Demand in China rose 29% year-on-year, Rho said, to account for just under 50% of global demand. North America saw 23% growth, with stationary storage demand more than doubling. Weakest growth was in Europe at 8%. There was a notable decline in EV sales in Germany, Italy, Sweden and Switzerland.

LFP chemistry continues to dominate in China, while NCM does outside China. LMFP and sodium-ion batteries entered the mix in the final months of 2023 and there are now low, but consistent, sales of EVs with these batteries, Rho said.

In the stationary storage market, over 75GWh of new capacity entered operation, more than in the whole of 2022. Over 500 grid-scale projects came on stream in the first half of 2024, four of which were larger than 1GWh. The largest was a 1.4GWh project in California.

In 2024, 18 projects over 1GWh are due to enter operation, compared to just four in 2023.

For the full year 2024, battery demand across all end use markets is set to increase 20–25% year-on-year compared to 2023. That was the first year to pass the 1TWh battery demand mark, the report said.

In the North American lead market, Battery Council International reported 157,446,477 shipments of original equipment and replacement automotive batteries in North America in the 12 months ending April 2024. This is up from 149,097,975 in the year ending April 2023. In April 2024, there were 13 million shipments, a rise of 14.4% year-on-year.

Image: H1 2024 total battery demand 512 GWh, up 23% year-on-year. Rho Motion