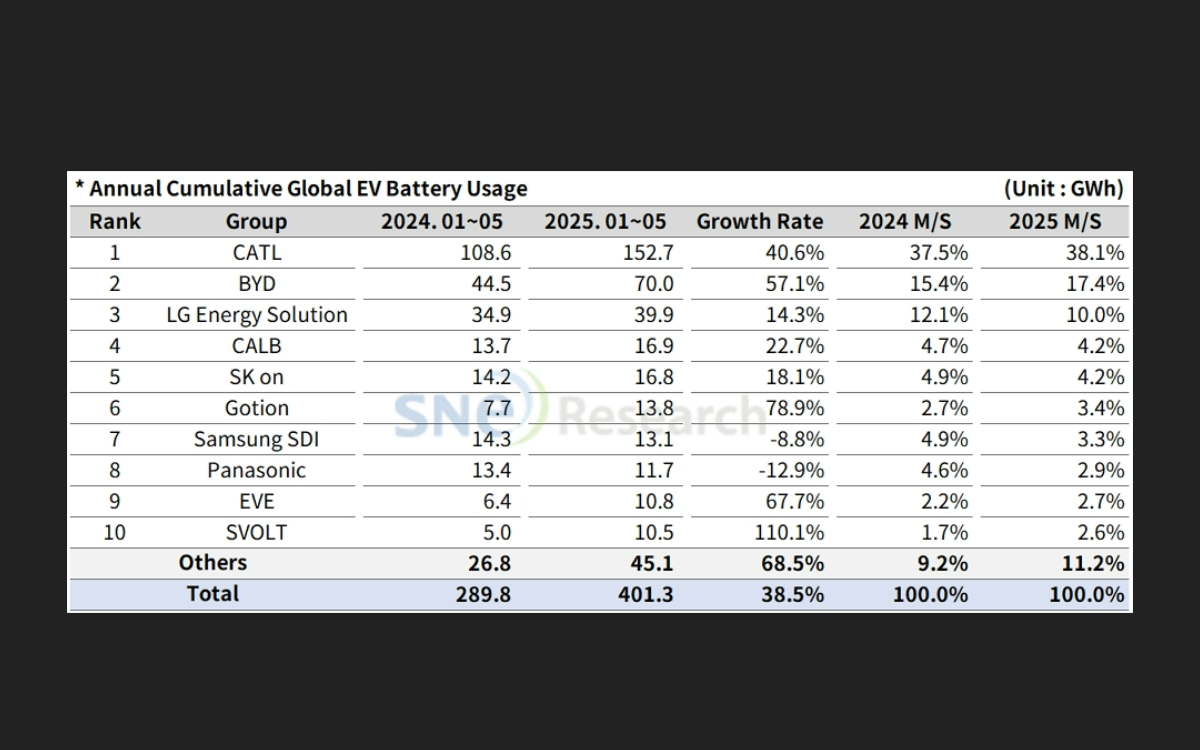

SNE Research, the Korea-based battery industry research and consulting firm, has found that the amount of energy held globally by batteries for electric vehicles (EV) has increased by 38.5% year-on-year to approximately 401.3GWh from January to May 2025.

The firm is has collated annual global EV battery use data including the 10 largest companies for this period.

Chinese owned CATL has the highest share of global EV battery usage, with 152.7GWh of use reported, which had a growth rate of 40.6% from the same period last year.

Its batteries were said to be used by OEMs in China such as Zeekr and Xiaomi as well as international OEMs such as Tesla, BMW, Mercedes-Benz

The second highest EV battery use was from BYD batteries, which makes its own batteries and EVs in-house, with 70GWh reported and a 57.2% growth rate than the same period last year.

The firm collated market share data from Korean battery makers including LG Energy Solution, SK On and Samsung SDI.

All together, the three firms’ combined market share in global EV battery use was 17.4%, meaning a 4.5% decline from the same period last year.

The report looks at sales data for the three Korean companies, showing that Samsung SDI’s batteries were supplied to BMW, Audi and Rivian. It said that there were favourable sales of the BMW i4 and i5.

But it was reportedly negatively affected by decline in sales of the Audi Q8 e-tron and other cell makers’ LFP batteries being used on the standard trim of Rivian.

SK On’s batteries were said to be mainly used in Hyundai Motor Group’s EVs, but also in Ford, Mercedes-Benz and Volkswagen.

Overall, the report states that the global EV market has seen a marked recovery from January to May 2025, mainly in Europe.

It states that there have been double-digit growth rates in countries such as Germany and UK that have fortified regulations on carbon dioxide emission.

The US has seen a slowdown in pre-emptive demand with the possibility of the EV tax credit being reduced, and the early termination of the Inflation Reduction Act.

China is said to have seen an upward trend in use due to an old-for-new replacement policy but has an overstock which is said to potentially cause a risk of intensified price competition.

Image: 2025 June Global Monthly EV and Battery Monthly Tracker, SNE Research. Credit: SNE Research.