The European Union’s commitment to achieving what it calls ‘zero pollution’ forms part of the Green Deal. It includes a chemicals strategy for sustainability, designed to better monitor pollution and achieve a ‘toxic-free’ environment.

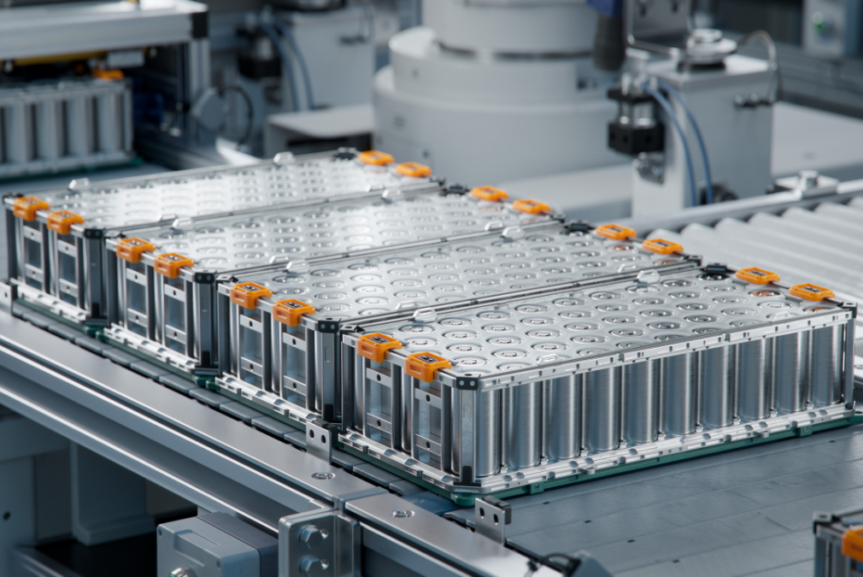

However, the aim for a toxic-free future must also address the reality that all battery chemistries, for example, rely on the use of toxic chemicals and metals, all of which need to be appropriately managed and handled.

Without them, carbon reduction will merely be a pipe dream. What is required is a responsible approach to risk management, where industry and the regulators work in partnership to find the right balance of regulation, while supporting industry’s role in delivering the products and services that will underpin a low carbon future.

What is clear is that metals such as lead are part of the solution to achieving the low carbon goals set out by policymakers. Nonetheless, the industry does face a dizzying array of legislative proposals in the pipeline, designed to improve the sustainability of industries in Europe. For example:

- Proposal to amend the Classification, Packaging Regulation to include new endpoints

- A new Battery Regulation

- Updates to the End-of-Life Vehicles Directive

- A Sustainable Products Initiative

- A REACH Regulation Review

- Waste Shipment Regulation Recast

Reviews of the following EU Directives:

- Ambient Air Quality

- Industrial Emissions

- Water Framework

- Urban Wastewater

- Marine Strategy Framework

- Energy Taxation

Ironically, given lead batteries are by far the most significant lead-based products in Europe, and a key enabler of electrification and supporting decarbonisation, they face one of the biggest challenges in the shape of potential REACH Authorisation for lead metal and several lead compounds that are the critical building blocks for EU battery manufacturing.

Should the European Chemicals Agency (ECHA) choose to include lead metal on its 11th recommendation for authorisation, the lead battery industry, and other lead-using sectors, will need to demonstrate that there are more proportionate risk management measures the EU could adopt other than REACH Authorisation.

The REACH Authorisation timetable as it stands looks like this:

- ECHA’s proposed list of substances included in their 11th Annex XIV (Authorisation list) Recommendation is expected to be published by the end of 2021

- Public consultation on ECHA’s proposal is likely to take place in Q1 2022

- Substances selected by the EU Commission for inclusion in REACH Authorisation list by 2024

- Sunset date in 2027 (all uses of selected substances must cease unless authorisation granted by EU Commission)

ILA has been working with downstream users of lead to prepare a defence and has met with senior officials at the European Commission to set out the core principles, where we argue that instead of including lead metal in the REACH Authorisation list, we propose that the EU:

- Recognises the social and economic benefits of a strategically autonomous, and key raw material that is predominantly sourced from a highly efficient recycling process that converts waste into a valuable material that supports low carbon objectives and electrification across the EU

- Identifies the most effective and proportionate measures to address any unacceptable or residual risk of lead metal use that is not already addressed through the already comprehensive framework of lead-specific EU legislation that has delivered significant reductions in exposure

- Considers targeted REACH restrictions if activities or products are identified where there is still an unacceptable risk arising from exposure to lead and which are identified as contributing most to environmental and/or human exposures

Legislation on the horizon

REACH Authorisation is not the only piece of EU legislation demanding the industry’s attention. The EU End of Life Vehicles Directive (ELV) has periodically reviewed lead substitution for over twenty years and lead batteries in passenger cars and light commercial vehicles have consistently been granted a derogation for use in new vehicles launched in the EU.

This derogation, which is reviewed every five years, is granted based on there being no mass-market alternatives to lead batteries that are technically available. A cross-industry working group that involved the participation of trade associations representing European and Japanese car industries, European manufacturers of automotive, industrial and energy storage batteries and lead producers recently provided evidence into the latest review.

The consultants working on behalf of the European Commission issued their findings in November and concluded that the exemption of 12V lead SLI and auxiliary batteries be maintained as no suitable mass-market alternatives exist. The next review starts in 2025.

However, they concluded that lead is avoidable in 48V, as well as the less prevalent 24V batteries, in mild hybrid vehicles and, as such, the exemption should be removed for these battery applications in vehicles placed on the market after January 2024. This recommendation will be considered by the Commission as they propose new legislative text for the ELV Annex V exemption in 2022.

EU Battery Regulation

A subject that has attracted widespread interest is the new EU Battery Regulation, which has generated intense focus both at Commission, member state and parliamentary level. The overall objective is to make Europe the centre for the development of “sustainable batteries” to differentiate from other markets. And while the focus is mainly on lithium-ion and beyond, there will be some implications for lead-based batteries.

These include proposals to increase the use of more recycled materials in battery manufacturing, increasing minimum recycling efficiencies, and carbon footprint declarations and targets for industrial lead batteries.

However, the most concerning aspect of the draft regulatory proposal is to restrict the use of hazardous substances where they present a risk during battery manufacturing, use and waste phase. If maintained in the final legislative text, this will duplicate existing requirements already in the ELV and REACH Regulation to demonstrate the effective management of lead in the EU battery value chain, and the importance of maintaining a strong European lead battery industry.

Blood lead levels

In Europe work is also underway to update the existing EU wide workplace occupational exposure (workplace air) and employee blood lead limits. The existing legislative limits were adopted in 1982, and are in need of revision to take into account the latest scientific evidence for health impacts from lead exposures.

In 2020 the European Chemicals Agency Risk Assessment Committee (RAC) provided an opinion that blood lead limits in male workers should be maintained below 15 µg/dL and to achieve this target, workplace air limits would need to be as low as 4 µg/m3. These values are substantively lower than existing regulatory limits and what can reasonably be expected to be achieved by the EU’s lead battery and recycling industries; even though highly successful voluntary programmes have long existed that encourage companies to continually reduce lead exposures in the workplace.

Whilst the regulator has acknowledged that there is not a good correlation between air lead levels and the amount of lead that can be measured in an employee’s blood, it is highly likely that new workplace limits for lead could be adopted as early as 2025. This will be extremely challenging for many EU lead battery manufacturers and lead producers and will necessitate capital investments in facilities. Average compliance costs are estimated to be up to €6.8 million ($7.7m) over 40 years for a lead battery manufacturing site, and nearly double this for a primary metal producer.

Helping to drive change

We must be able to demonstrate how our industries can support the political processes that drive change, and how we as key industries fit into the decision-making as individual countries and administrations as part of the green transition.

Ultimately, it is up to the industries to demonstrate their continued value to the green transition, and their ongoing contribution to economic value and products that support growth, creating jobs and prosperity. Critical to this will be the continued investment in improving the performance of lead batteries— so that they remain the product of choice for OEMs that seek energy storage applications that meet their customers’ ever-evolving demands.

Coupled with this is the need to ensure that lead exposures during battery manufacturing and recycling are managed using the best available techniques, and that company’s source raw materials responsibly.

Lead batteries will remain one of the key enabling technologies necessary to allow society to meet the ever-growing demand for truly sustainable mobility and energy storage solutions. However, industries must continue to invest and adapt to meet future challenges; and regulators need to adopt legislation that is proportionate, and does not impact opportunities for the long-term investment required to deliver the transition to a low carbon future.

A companion piece to this article whereby battery association EUROBAT answers key questions on the importance of the forthcoming Battery Regulation can be read below.

Levelling the playing field: modernising Europe’s battery legislation