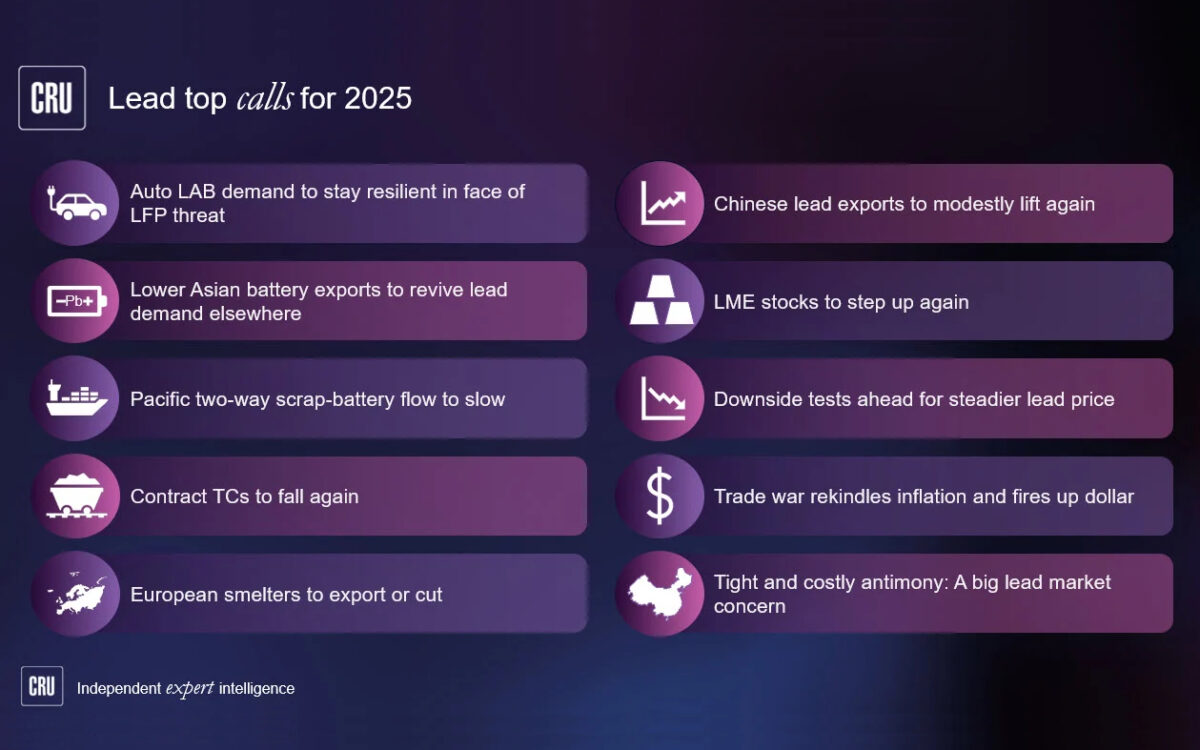

Analyst house CRU has put out its top calls for the lead battery market this year. BEST spoke with CRU’s principal analyst Neil Hawkes to better understand some of his predictions.

- Auto lead-acid battery (LAB) demand to stay resilient in the face of lithium-ferro-phosphate (LFP) threat

The sale of replacement LABs is due to keep this demand up, as part of the regular running costs of cars. But not the sale of new vehicles, for which there is no indication of any improvements from last year, he said.

“To be honest, that’s been the case for many years. Replacement battery demand is about 50–55% of global lead demand in any one year”

- Contract treatment charges to fall again

Treatment charges, the colloquial term for the process of converting concentrate from the mines into lead metal, are due to fall for a fifth year. This is because there is less available concentrate now, he said.

- European smelters to export or cut lead

There could be higher exports to Asia and the US, as there is weak demand, lower metal premium, lower TCs, and an easier European market for lead, he said.

Hawkes – who ceclebrates his 58th birthday today – said to watch out for smelters in the UK and Germany exporting to the US. It is a repeat of the spikes of exports to the US in 2020/21, particularly as European lead premiums have fallen and the US ones have gone up a little, he said. Other places which could see exports are Turkey and Singapore, he said.

- London Metal Exchange stocks to step up again

This could happen in relation to exports, particularly to Singapore, he said. “Singapore has been the focal point for LME stocks and surging to their 11-year highs last year.”

Hawkes has found that more than half of the inflow of lead into Singapore has been from India, while there has been a lot from Europe too. There is an underestimation on the amount of surplus Indian lead, he said.

“There’s this view that some of the informal lead recycling is being clamped down on, but I guess that makes me suspect it is not happening as much as everyone thinks,” he said.

LME stocks are already high, and Hawkes thinks they will go even higher.

“It is looking like a generally weak lead market globally this year,” he said and expects demand to be soft.

- Downside tests ahead for steadier lead price

There will be some downward pressure on prices, he said. “But are we going to go down another $500? No, we’re just going to see a few dips by below $100/ton and maybe get into the 1800s a few times before this year is out.”

- Trade war rekindles inflation and fires up dollar

One of the big uncertainties of this year is the incoming presidency of Donald Trump and what that will mean because of his proposed tariffs, Hawkes said.

He added: “There is a lot of talk and speculation about what he is going to do but I think now we will have to wait and see what he actually does. I think all around there’s going to be a lot of volatility with one claim and counterclaim, and revision and counter revision.”

This is not specific to just lead, but given Trump’s proposed tariffs alongside tax cuts and tighter labour, inflation will be rekindled and interest rates lifted. These factors will influence lead, he said.