Key lithium-ion, lead-acid and vanadium redox flow battery materials have been placed on the 2020 Battery Critical Raw Materials list by the European Commission.

Lithium, antimony, cobalt, natural graphite, and vanadium have all been placed on the list, which is composed every three years following a review of raw materials for their economic importance and concerns over supply risk.

The Commission will also continue to monitor nickel closely, in view of developments relating to growth in demand for battery raw materials.

The Commission takes the list into consideration when negotiating trade agreements or seeking to eliminate trade distortions.

Economic importance looks in detail at the allocation of raw materials to end-uses based on industrial applications.

Supply risk looks at the country-level concentration of global production of primary raw materials and sourcing to the EU, the governance of supplier countries, including environmental aspects, the contribution of recycling (i.e. secondary raw materials), substitution, EU import reliance and trade restrictions in third countries.

A report by the Commission stated: “Gaps in EU capacity for extraction, processing, recycling, refining and separation capacities (e.g. for lithium or rare earths) reflect a lack of resilience and a high dependency on supply from other parts of the world.

“Certain materials mined in Europe (like lithium) have to leave Europe for processing. The technologies, capabilities and skills in refining and metallurgy are a crucial link in the value chain.

“These gaps, and vulnerabilities in existing raw materials’ supply chains, affect all industrial ecosystems and therefore require a more strategic approach: adequate inventories to prevent unexpected disruption to manufacturing processes; alternative sources of supply in case of disruption, closer partnerships between critical raw material actors and downstream user sectors, attracting investment to strategic developments.

“Through the European Battery Alliance, public and private investment has been mobilised at scale and should, for example, lead to 80% of Europe’s lithium demand being supplied from European sources by 2025.”

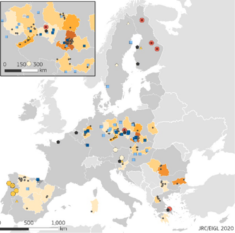

The report noted the development of battery raw materials in Europe such as lithium, nickel, cobalt, graphite and manganese provided interesting opportunities to companies in the region.

Companies in several Member States are already participating in the European Batteries Alliance, benefiting from private sector, EU and national funding, both for the exploitation of the raw materials and for their processing in Europe.

A forthcoming proposal for a Batteries Regulation aims to address the responsible sourcing of battery raw materials and the Commission is considering making a “possible horizontal regulatory proposal” on due diligence.

Industry insight

Gavin Montgomery, Wood Mackenzie Research Director – Battery Raw Materials

“We are already seeing increasing focus of ‘regionalisation’ or restoring of production since the pandemic exposed some stress points in globalised supply chains. And some voices have been calling on Europe to develop its own battery raw materials supply chain for some time now. With adding new metals to the list, the EU is acknowledging that while there are now a lot of battery manufacturing plants moving forward, there are not many projects to produce the chemicals, precursors and cathodes/anodes to supply these.

“It’s hard to say if it will be successful right now, as there are still many challenges to bringing on new mining and refining projects in Europe, but it is a sign politicians are seeing how important security of supply is for decarbonisation. And how they don’t want a repeat of the geopolitics of oil and gas as we move towards lithium-ion value chains.”

Chris Berry, president of House Mountain partners

“This move by the EU Commission is an admission that decarbonisation and electrification are set to put significant stresses on a host of small and opaque metals markets. The irony here is that it will take more, not less, of these metals to achieve decarbonisation goals and supply chain self sufficiency.

“It’s only a matter of time before nickel is added to the list. Though it’s a much larger market than other metals referenced here, there is set to be enormous nickel demand based on EV uptake in the future and nickel projects are capital intensive and slow to come to market with a chequered history.

“The announcement by the EU Commission doesn’t mean anything specific in the immediate-term for these metals markets, but is a sign that the supply chains of the future will come under increasing stress unless secure supplies of critical materials are obtained.

“The Geopolitics of Critical Materials is a major investment theme for the next decade.”

Caspar Rawles, head of Price Assessments at Benchmark Mineral Intelligence.

“The move by the EU to include lithium, cobalt and graphite on the bloc’s critical minerals list is an obvious and necessary inclusion considering Europes minimal production of these minerals, but heavy reliance as part of its goal to reduce emissions and the energy storage revolution. For example, Benchmark forecast data shows that currently Europe’s domestic production of lithium currently represents less than 1% of global supply – this is far from enough to fuel the growing number of lithium ion battery megafactories that are being developed on the continent.

“According to Benchmark data, Europe housed 26.9 GWh of lithium-ion battery production capacity at the end of 2019, this is expected to increase 256.3GWh by 2024— the volume of the raw materials needed to feed these plants will not be produced domestically and therefore protecting supplies of these critical minerals is of upmost importance to protect European interests.

“We are starting to see some funding flow into the upstream European battery supply chain, but to date the vast majority of investment has been focussed on the downstream battery cell and EV production. The move by the EU to include battery minerals on the critical minerals list appears to be a signal of greater political commitment to securing upstream supply also.”