Annual global lithium-ion battery consumption in registered electric vehicles jumped nearly 17% last year with 117GWh of installed capacity.

No surprises that Asia dominated the supply chain with the top 10 manufacturers all based in China, Japan and Korea, according to market research firm SNE Research.

At the top of the charts is CATL with a manufacturing supply of 32.5GWh (a 30% market share). CATL and Panasonic (24% market share with 32GWh production capacity) accounted for half of production of the top ten manufacturers, and continued to grow above the market average.

However, Chinese and Japanese battery makers saw their consumption decline or grow below the market average, according to SNE Research.

The data is based on sales of electric cars in 76 countries.

SK Innovations was tenth in the list, the highest position in the firm’s history. It was also the biggest mover with 132% growth year-on-year to 1.9GWh, or around a 1.7% market share.

SNE Research noted that: “The growth of the three companies was driven by increased sales of models with their own batteries.

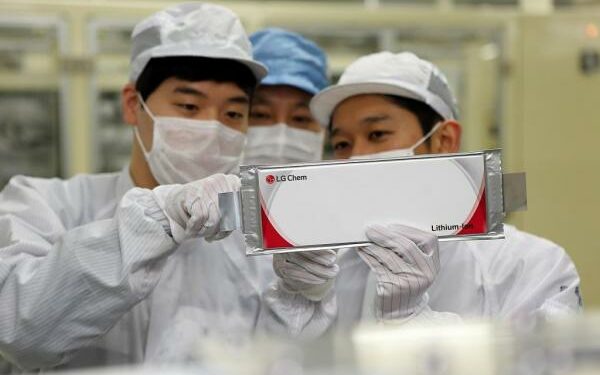

“2019 is a year when Korean companies are on the rise. LG Chem, Samsung SDI, and SK Innovation are expected to expand their market share further.

“However, as CATL and Panasonic occupy more than half of the global EV battery market, it is urgently needed to cultivate competitiveness and establish market strategies to overcome the offensive of both companies.”

LG Chem’s usage was pinpointed as the increased sales of Audi E-Tron EV, Hyundai Kona EV and Jaguar I-Pace surged.

Samsung SDI’s growth was fuelled by strong sales of Volkswagen e-Golf and BMW i3.

SK Innovation posted rapid growth thanks to strong sales of Niro EV and Soul Boosters.