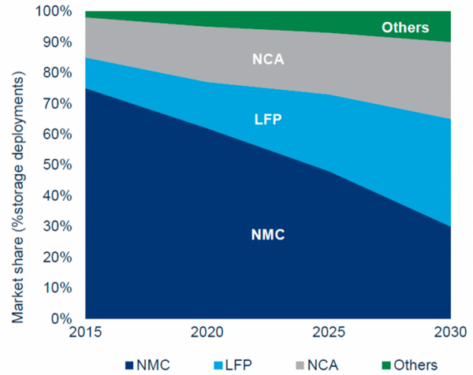

Lithium-iron-phosphate (LFP) is poised to triple its market share to become the leading lithium-ion battery chemistry within the decade as demands change, especially in the energy storage system (ESS) markets.

LFP will overtake lithium-manganese-cobalt-oxide (NMC) to claim a 30% market share of the stationary storage chemistry by 2030 compared to 2015, according to new analysis from Wood Mackenzie.

While LFP will steal the show for ESS applications, the analysts believe LFP will remain popular within the Chinese EV market before breaking into the global passenger EV sector.

The chemistry is expected to retain more than 20% of EV battery installations through 2025.

The change will come as demand from electric vehicles (EV) and ESSs create the need to develop advanced lithium-ion batteries through improvements in battery cathodes, anodes and electrolytes, say the analysts.

Milan Thakore, Wood Mackenzie senior research analyst, said: “Improvements in gravimetric energy density combined with cell-to-pack technology is the key to LFP now becoming a more attractive proposition in the passenger EV space. Not only will cost and safety be a benefit, but OEMs won’t have to worry about issues surrounding the supply of cobalt and nickel.”

Changing requirements such as high recycling capabilities and high frequency will take precedence over energy density and reliability for ESS project developers— while cost and safety will continue to be important, said Mitalee Gupta, Wood Mackenzie Senior Analyst.

Gupta said: “The ESS market has heavily relied on EV batteries in the past but changing performance requirements will lead to an evolution of separate markets.

“Since 2010, the rapid rise in demand for EVs has driven down the cost of lithium-ion batteries by more than 85%. Historically, the ESS market has mostly deployed NMC batteries. In late 2018 and early 2019, demand for NMC batteries for the energy storage industry grew swiftly, outstripping the available supply.

“While there was a shortage of NMC batteries in the storage market, there were plenty of LFP batteries available – with capacity mostly in China.

“As lead times for NMC availability grew and prices remained flat, LFP vendors began tapping into NMC constrained markets at competitive prices, thus making LFP an attractive option for both power and energy applications.”

Wood MacKenzie states EVs will continue to make the lion’s share of global lithium-ion battery demand over the next decade, while demand from portable electronics will see a significant drop from 26% in 2020 to 6% in 2030, as both EVs and ESS markets begin to take off.