The 2023 International Congress for Battery Recycling (ICBR) was told there is a finite supply of raw materials and limited availability. Demand will outstrip supply, so recycling, innovation and efficiency are more important than ever. Chris Hale attended the two-day event in Valencia and shares his reflections.

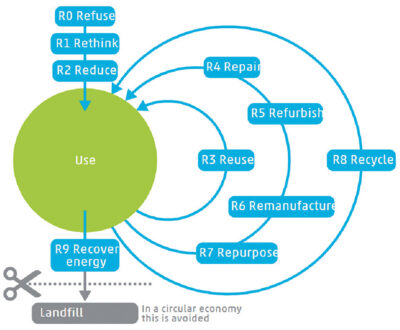

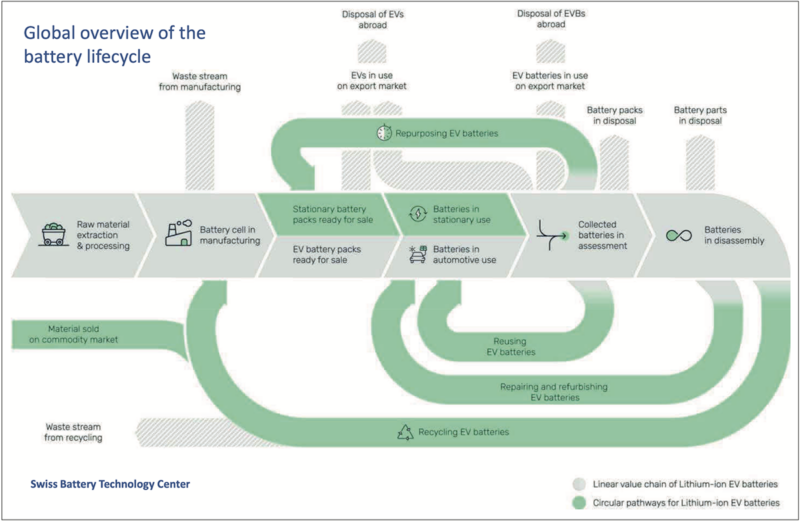

We may be familiar with the current concept of the Four R’s for Green Living: Reduce, Reuse, Repurpose, Recycle. The concept, of course, is applied to a battery circular economy, although these days it can now be widened in scope to more like that of an ‘R’ Ladder (Fig 1): Refuse, Reduce, Reuse, Repair, Refurbish, Remanufacture, Repurpose, Recycle. All aspects essential to tackle the challenge of material supply and wastage.

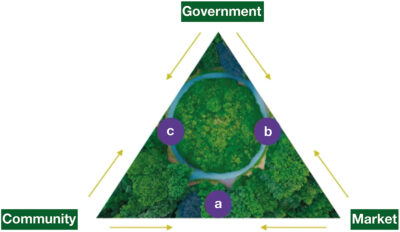

That being said, there are still fundamental challenges in adopting these approaches. The push-and-pull of public demand vs concerns; market-drive vs wariness; and government support vs popularity.

As Fig 2 demonstrates, although consumer behaviour plays a role in shifting mindsets it may not believe there is enough support from businesses or government. Businesses are concerned that what they produce will not be bought and governments are concerned with public support and re-election. Ultimately, what results is a roadmap that is slow to ensure change.

Regulatory guidelines

What can be highlighted though is that, even though regulation is being put in place, individual countries or states are seeing holes that still need to be addressed, even if change is slow to implement.

The marked divide, as it were, between EU and US legislation, for example, shows the mounting problems being faced where recycling is slow to take off. Not all states in the US are aligned on the same policies and some states are slower or faster to adopt change.

The problem areas are not just with concerns about large automotive battery systems, however, as it is with the smaller, more portable batteries. The US, where regulations are state-by-state and vary across the board, are slowly expanding coverage of the North American ‘Extended Producer Responsibility’ (EPR) battery laws, addressing; safety, recycling, transportation, and storage/fire codes. Interestingly though, these laws are relatively new and only cover a few states, the ones as mentioned above, more aligned to the needs of better battery legislation. The coverage, it should be noted though, is mainly for portable battery types typically under 2kWh.

So where does this leave the issue of material supply and recycling in countries such as the US? Well, put simply, it leaves it in the hands of unregulated or illegal disposal. Undeclared waste shipped to Asia. Instances of containers with used/waste batteries of all types bound for Asia, are not all being declared as dangerous goods. Instead, containers may be marked as “synthetic resins” or “computer parts” as an example from one documented instance following a container fire. Container fires of undeclared batteries are, and will continue to be, a problem, until legislation rules are tightened.

The upside, however, is that there are more not-for-profit and industry-funded organisations, focused on providing collection centres to handle issues of improper disposal. Safety and transportation costs are still big issues though, hampering roll-out, which also lends to a rise in counterfeit and improper re-use. Economies-of-scale are important and adoption will only increase if costs and safety can be better addressed.

Size matters

We consider EV’s as being the major concern for battery recycling. But EV’s can be more easily covered within end-of-life (EoL) recovery after the vehicles are scrapped.

What should be considered as a wider problem, and hence the initial regulation aims on portable batteries, is the disposal of items such as power tool, vape, and e-bike batteries. These smaller batteries are tending to present the bigger challenge. ‘Disposable’ vapes – thrown away in bins or littering the street, still contain rechargeable lithium-ion cells. E‑bikes and e‑scooters – in the US alone, the NBDA reported that 2022 saw e-bike sales surpass $1.3 billion a 33% increase from 2021.

But there can also be argued that motivation is shifting from environmental to safety concerns. If we consider that, as published by The Guardian, e‑bike and e-scooter fires have injured at least 190 people and killed eight in the UK up to the middle of 2023, although predominantly through charging within the home, it is still eight deaths too many and rising. Volatile batteries present an ever-present threat, especially at EoL or when damaged.

Collected batteries, therefore, also present a necessity for protecting people and property, and cost-effective containment is more likely achievable for battery packs less than 1kWh. The size, ferocity, and temperature attained by these smaller packs does at least enable the use of fire-proof sleeves or drums.

EU Battery Regulation

So, what about in the EU? If we can consider that the 2006/66/EC Battery Directive including recycling was a total of 18 pages, and in force up to July of this year, the new Battery Regulation 2023, which has recently come in to force, now contains 117 pages. With an additional 30 pieces of secondary legislation to be adopted (each of which between 5–50 pages) the total document is more likely to be around 700 pages of new legislation.

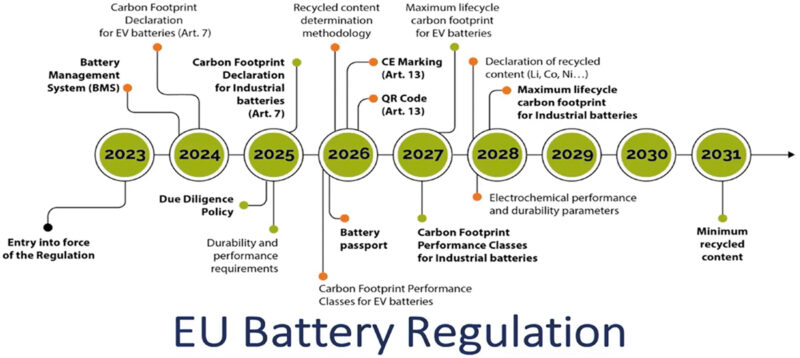

This new document does provide an adoption roadmap (Fig 3), which shows the stages and targets for implementation of enforced policies from 2023 up to 2031. Not least of which will be obligation on manufacturers to conduct due diligence on their supply chain, carbon footprint declarations by 2025, and battery passports by 2026 – covering cradle to grave.

Ownership is highlighted for manufacturers to take responsibility for collection and take-back targets. Disposal and targets for the levels of recycled materials to be used in new batteries have also been laid out. Of course, take-back targets for 2023, which are currently set at 45% of portable batteries placed on the market, rise to 73% by 2030. There is then a need to align the take-back with the material recycling capability and refining processes.

Of course, to complete the picture, there needs to be a structure for feeding back recovered materials into the supply chain. Recovery-of-material targets are in the order of 90% for cobalt and nickel and 50% for lithium by 2027. Although some recovered materials can find life in alternative products, there is still the expectation, as defined in the new regulations, for 10–20% make up of new batteries to be from recycled materials rising to 20–30% by 2035.

Recycled materials

We know that a percentage of recycled materials will be purified and re-introduced to manufacture new cells, but how suitable is the material for re-use? Once the batteries have been collected and shipped to respective recycling plants, shredded, and reduced to a black mass that can be sorted, separated, and purified; if you compared the recovered material with freshly mined you would unlikely get an even match.

There are currently three generally accepted recycling approaches; hydrometallurgical, pyrometallurgical and direct recycling. The direct recycling route entails rejuvenating the electrolyte and active materials, an approach that is still a way off from mainstream adoption.

Pyrometallurgical approaches, which are far more common, will generally involve temperatures of around 1600°C and potentially alter the crystalline structure of the materials and, therefore, their chemical properties. The impact of high temperature when recycling materials is still the subject of much research.

Hydrometallurgical processes, on the other hand, are seen as being more economical and ecological but, all-in-all, the purity of recycled materials vs freshly mined will not be the same for either approach. The question then remains, what impact will a lower purity have when re-introducing recycled materials into new cells?

If we consider all the materials within a battery pack that are shredded and reduced to a black mass for sorting and refining, these will range from; plastics, steel, copper, aluminium, as well as the nickel, cobalt, manganese and lithium, to name just a few.

So, naturally, the challenge is removal of impurities from the recycled materials. However, how pure is pure enough?

Rates claimed of >98% purity seem good, but even the smallest contamination may have an undesirably detrimental effect. Referring to an article in issue 78 of BEST – The A-B-C of cell grading and testing, some of the fundamental challenges of quality from introduction of foreign particles or impurities has highlighted uncertainties on reliability and service life of cells.

With manufacturing or material defects that occur within the manufacturing process, the challenge of how these can be tested or vetted at the production stage and the level of scrap from manufacture that results, is yet to be met with using recycled materials. Or perhaps there may just be an acceptance of higher quantities of ‘B’ grade cells.

Evaluating impure active materials

Certainly, work carried out by academic institutions can help evaluate the impact. Such studies carried out by the Fraunhofer institute, for example, elaborated on a (re)-synthesis approach, adding impurity concentrations to evaluate the negative influence on particle morphology, electrode preparation and electrochemistry.

In essence, there are two schools; the first driving research into the impacts of material changes and introduction of impurities, and the second developing the recycling processes involved to significantly reduce the levels of introduced impurities or altered material and chemical characteristics. Naturally, if the latter is entirely successful, the former is not required. However, the market for black mass and material recovery will always generate sales of materials with a greater or lesser purification success rate. Cost, of course, also plays a part and there will always be the cheaper, but less effective, recyclers introducing sub-standard materials back into the value chain.

Don’t drink the water

Without a doubt, recycling is the way to go for a sustainable future. Recovery of raw materials and prevention of improperly-disposed-of batteries ending up in landfill, where toxic chemicals can leach out, is a must. Especially if there is a risk of buried batteries leaking toxic chemicals that may eventually end up entering the water table and ultimately into drinking water.

But what about the less obvious routes of contamination through the processes of recycling, or in containing lithium-ion battery fires? Surely the potential for water used in these instances, especially with run-off, will increase risk of contamination.

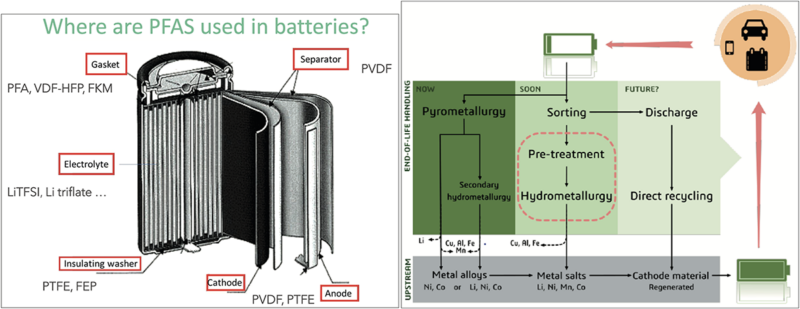

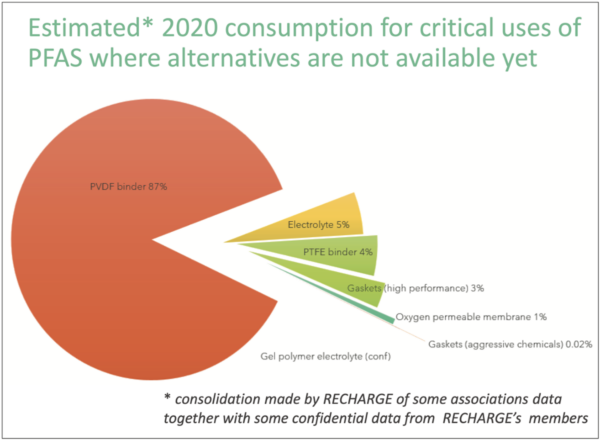

It is not just the toxic metals that may present a risk to the environment or public health, but the use of what are termed ‘forever chemicals’. More technically, PFAS – Per and Pol-fluoroalkyl substances used in many products or manufacturing processes, including lithium-ion cells.

These chemicals are given the nickname ‘forever chemicals’, simply because they do not break down in the environment and are used in a huge range of everyday consumer products and industrial processes – from non-stick pans to waterproof materials and fire-fighting foams. Teflon, which used PFOA, was notorious for the impact it had in the US when it poisoned local drinking water. Another – PFOS, used in firefighting foam, made it into water used by a number of towns in Australia.

PFAS risks are currently not adequately controlled and the question of whether emissions should be minimised due to their accumulation over time, is still being raised. Studies on the impact, and risk of reaching levels likely to cause effects on humans and the environment, are also still being carried out.

But what about the PFAS in batteries? Fig 4 clearly shows where some of these chemicals are used, and indeed can be claimed are necessary to use. If the battery burns though, the process of dousing with large quantities of water can carry away those forever chemicals. If the battery is buried in landfill, it will eventually leach out and, if recycled (Fig 5), the process of hydrometallurgy and levels of water used may also present a risk of contaminated waste water.

At present, the most common lithium-ion battery recycling process involves pyrometallurgy, which operates at high temperatures (up to 1600°C), sufficient for PFAS mineralisation. That being said, voluntary PFAS measurement after battery recycling has been highly recommended – to confirm that there are no unintended or uncontrolled PFAS emissions during the battery recycling process (Ref: Recharge batteries).

The question now is, ‘what is the way forward?’ If the EU plans to restrict the use of PFAS chemicals, what impact will this have on the European battery industry? Not all uses of PFAS within lithium-ion batteries have currently available alternatives (Fig 6).

And second life?

Recycling is one thing, but what about the option of extending a battery’s use before the need to recycle? If we consider the battery lifecycle (Fig 7), there is the inevitable drive for repurposing, reusing and refurbishing battery packs before they ever get to the recycling facility at EoL.

The advantages and disadvantages for each case are still being worked out and the debates are ongoing. Regulation is still in the grey over the best ways to control what is or isn’t EoL.

To put this into perspective, the term ‘second life’ has only been mentioned five times in the new Batteries Regulation (EU)2023/1542 document – in the Preambles and Article 77 Battery Passport.

However, there is no specific definition of second life. Interpretation is open, but do we take it as only for a repurposing operation, and if so, what about reuse or remanufacturing?

In Brief:

- Preparation for repurposing: any operation by which a ‘waste’ battery or part thereof is prepared for a different purpose or application from which it was originally designed

- Repurposing: an operation resulting in a battery that ‘is not waste’ or parts thereof being used for a purpose or application ‘other than’ that for which it was originally designed – “second life”

- Remanufacturing: any technical operation on a ‘used’ battery including disassembly of cells and modules to restore capacity to at least 90% of the original rated capacity, resulting in a battery being used for the same purpose or application as originally designed.

And then there raises the question on producer or waste management? Which, to clarify, considers the terms;

- A producer: any manufacturer or distributor that designs, sells, or supplies batteries for the first time under their own name or trademark

- Treatment: any operation carried out on ‘waste’ batteries handed over to a facility for preparation of re‑use, or preparation for repurposing

- Waste management: a legal entity with the separation, collection, or ‘treatment’ of waste batteries.

This implies that a battery is considered waste or, if you wish, EoL, prior to re-use or repurposing. But then, any economic operator carrying out preparation for re-use, preparation for repurposing, repurposing, or manufacturing, and puts on the market a battery that has undergone any of those operations, they are then considered a ‘manufacturer’ for the purpose of regulations. That is, they are potentially considered as a ‘new’ battery, or if you prefer – beginning of life (or rather – new life). The debate is ongoing…

So, to summarise, the EU Commission wants:

- Capabilities for sustainable high-quality batteries

- To reduce environmental and social impact through all stages of battery life-cycle

- To reduce waste

But for a regulatory second-life battery framework:

- Further regulatory clarification is required, as there are currently very few already in place

- There is no legal advantage for second-life

- Classification for ‘waste’ or ‘new’ when considering processes for second life need to be properly considered.

The take-outs from the ICBR event are not just in opportunities to understand the extent of the challenges and opportunities faced by the battery industry in attaining a level of sustainability. But also, in the awareness and inevitability of the impacts on the industry, what the need for sustainability brings. The event sessions mobilised great insight into the impact of the required legislation.

Panel discussions from distinguished experts focused on the challenges and opportunities, taking views and opinions from the audience in the debate.

Workshops on black mass recycling and the second-life industry made clear that the whole industry needs to rise to address what battery recycling will bring and the roadmap of legislation.