Industry experts are currently testing a proprietary technology that could make the production of graphite for lithium-ion anodes cheaper and easier.

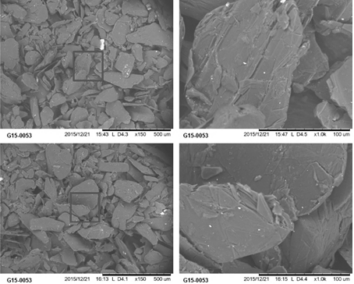

Canadian minerals firm Elcora Advanced Materials claims to have developed a method of graphite manufacturing that reduces or eliminates the need for spheronisation, purification and coatings.

The Elcora processes are designed to reduce the carbon and energy footprint of the anodes and to reduce costs, said the company.

The company is sourcing from a number of different mines to minimise supply risks and ensure sufficient volume to supply the lithium-ion battery anode market and worldwide ‘Gigafactories’.

Tests are currently underway with industry experts to prove the technology and to design a production facility.

Troy Grant, President and CEO of Elcora, said: “With the significant increases in the electric car market over the next ten years this is an exciting focus on downstream technologies to maximise value.

Graphite demand set to double

Graphite demand is set to rise by 200% in the next four years while battery makers shift from MW to GW scale production as electric vehicle and energy storage system markets mature.

A graphite mine currently has an average output of around 11.600 tonnes-per-annum (tpa), but forecasters believe by 2019 a ‘Gigafactory’ will need six mines worth of graphite to keep up with production.

For example, if Elon Musk’s boast that the Tesla ‘Gigafactory’ will be 150GW (three times original plans) it will need 110,000 tpa of coated spherical graphite, 75,000 tonnes of lithium hydroxide, and 21,000 tonnes of cobalt.

Around 65% of all battery anode material is sourced from natural spherical graphite, with 30% coming from synthetic graphite material and 5% from other alternatives including lithium titante, silicon and tin.

China currently produces 780,000 metric tonnes of graphite a year, around 66% of global output, according to the US Geological Society— more than the next nine graphite producing countries combined.

It also produces 100% of the world’s spherical graphite, which serves the lithium-ion battery anode market.

Industry adviser Benchmark Mineral Intelligence forecasts 70% of demand for raw materials will come from China as the country’s cell manufactures, such as ATL and Lishen, expand operations and a planned seven ‘Gigafactories’ come online.