Korean battery chemicals company Posco is looking to expand its battery materials business and catch up with local and Chinese rivals despite a slowdown in sales of EVs.

A report in Nikkei Asia said the company is looking to diversify its raw materials supply chains by buying quality assets such as lithium salt-lake brines and rocks at low prices. It will exploit the EV market’s temporary downturn and low mineral prices, it said.

Posco told the news site its battery materials strategy is paying off. Its Posco Future M unit signed a $10.8 billion three-year deal in 2022 to supply advanced cathode materials to auto maker General Motors. It then agreed a six-year contract worth $688.6 million to supply anode materials to GM battery unit Ultium Cells.

Shares in Posco Future M have fallen 26% this year, after a 99% rise in 2023, as investors worry about slowing EV sales. The report quoted Chang Jeong-hoon, senior analyst at Samsung Securities, saying has it cut the target share price by 7%, adjusting for poorer cathode materials performance.

There are geopolitical risks, as Posco has joint ventures with Chinese companies CNGR Advanced Material and HY, Nikkei said. They could be subject to the US Foreign Entity of Concern (FEOC) restrictions. Posco is unclear if Chinese companies are being classed as FEOCs, but it will lower stakes in JVs if needed to avoid sanctions, it said.

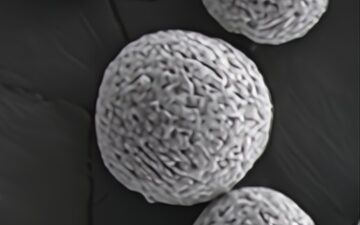

Image: High-nickel cathodes. Posco Future M