Jochen Di Vincenzo, project manager and next-generation battery cell industrialisation expert at German consultancy P3, considers whether lithium-ion batteries will continue to dominate the electric passenger car market, examining the current state of battery chemistry, emerging trends, and the challenges of industrialisation. He argues promising cost advantages for new battery technologies are unproven and uncertain.

Despite a recent growth slowdown in certain markets, the electric vehicle (EV) revolution is steadily gaining momentum, propelled by the imperative to reduce greenhouse gas emissions and the transition towards sustainable energy solutions. At the core of this transformation lies battery technology. Among the various battery types, lithium-ion technology currently dominates the market.

Cathode and anode chemistries

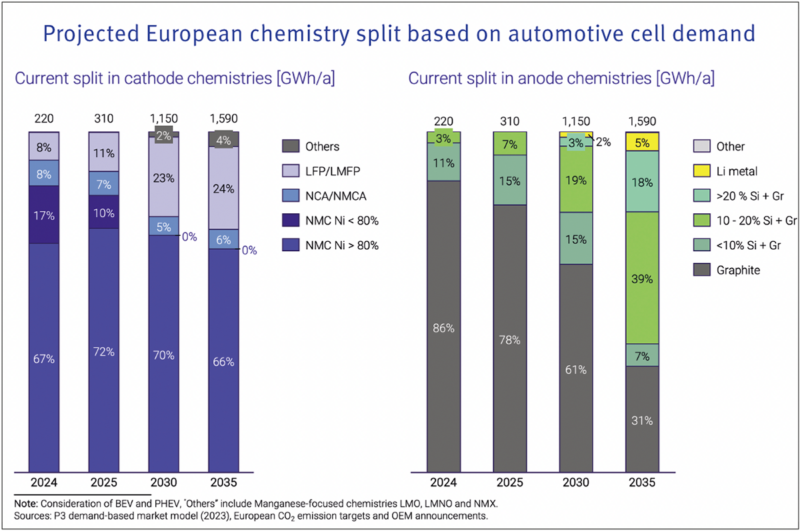

The current EV market is dominated by cell chemistries featuring graphite anodes and lithium nickel manganese cobalt oxide (NMC) cathodes. In 2024, high-nickel (>80%) cathode materials are expected to capture the largest market share, driven by the superior performance of layered oxides such as NMC and lithium nickel cobalt aluminium (NCA). However, alternatives like lithium iron phosphate (LFP) are gaining attention due to cost advantages and the use of less critical raw materials.

On the anode side, silicon-enriched products are starting to capture market share, offering benefits such as faster charging times and enhanced capacity.

Key drivers

The primary trends in cell and material roadmaps are driven by the imperative to reduce costs and enhance performance. Given the current lack of commoditisation, the ability to innovate is crucial for survival in the battery industry.

Material properties must be carefully balanced against costs. In some cases, synergies can be harnessed – for example, increasing energy density can reduce costs at the cell level. This balancing act will lead to the development of distinct solutions for specific use cases, as evidenced by the trend towards LFP and other low-cost options in entry-level segments. However, the need to bridge the gap between costs and performance also results in hesitations to industrialise novel materials due to the high risk of stranded assets.

Ensuring that lab-scale successes can eventually be transferred to mass-scale production set-ups at competitive cost positions is vital. With the ongoing development and evolution of ‘classical’ lithium-ion batteries, this factor becomes increasingly important – as target production costs for any kind of battery are now significantly lower compared to a few years ago.

Market penetration questionable

In the late 2010s and early 2020s, solid-state batteries were heralded as the potential ‘holy grail’ of the battery industry due to their promise of significant advantages over traditional lithium-ion batteries, including higher energy density, improved safety, longer lifespan, and faster charging times. A wave of technological progress, major industry investments, and partnerships (such as Volkswagen/QuantumScape, Mercedes/Factorial, and BMW/SolidPower) led to highly enthusiastic initial sentiments within the industry.

However, with increasing transfer from lab-scale research to pilot-scale manufacturing (and key players like Tesla not following solid-state technology at all), the initial hype slowed down significantly. This shift was especially driven by rapid development steps in key performance parameters of conventional lithium-ion batteries.

Currently, there is a certain ambivalence in the market. While OEM-backed solid-state players continue to release optimistic statements about their progress, these advancements are still in early qualification stages. Concerns about scalability and industrialisation persist, underscored by remarks from industry leaders like the CATL CEO, who has stated that solid-state EV batteries remain impractical, unsafe, and years away from commercialisation.

Despite this, Reuters reported in May that China plans to invest over $800 million in a government-led feasibility project, including major players like CATL and BYD. The outcomes of this project could either significantly boost the global solid-state industry or set it back considerably.

Sodium-ion

Sodium-ion technology has gained attention following announcements from CATL and BYD about integrating sodium-ion batteries into mass production by the middle of the decade. With layered-oxide technology similar to NMC, the drop-in potential of sodium-ion batteries is notably higher compared to solid-state solutions, despite the need for hard carbon on the anode side.

Beyond the Chinese market, Northvolt announced in 2023 their pursuit of a different sodium-ion technology based on Prussian Blue Analogues (PBAs), which do not require nickel, manganese, or cobalt. While PBAs offer significant cost reduction potential compared to layered oxides, the lack of established supply chain structures and upstream infrastructures presents substantial challenges.

On the anode side, an evolution rather than a revolution is anticipated, particularly for conventional lithium-ion batteries. There is a clear trend towards increased silicon content, as various players are increasingly managing challenges such as volume expansion during intercalation. Additionally, artificial graphite manufacturers like Vianode are aiming to reduce value-chain dependencies from China. Next-generation technologies necessitate lithium-metal or hard-carbon anodes. But it remains uncertain when these materials will reach mass-market readiness.

Major challenges

While solid-state batteries promise high energy densities and enhanced safety, they face significant challenges in fast-charging, lifespan, and industrialisation compared to conventional lithium-ion batteries. Ion movement through solid electrolytes is slower than in liquid ones, and interface resistance further slows charging in combination with complicated heat management.

Lithium-metal anodes in solid-state batteries can form dendrites, compromising electrolyte stability, while mechanical stress and chemical reactions at interfaces degrade performance. Mass production faces hurdles due to the complexity of manufacturing solid electrolytes and ensuring consistent, defect-free interfaces.

As mentioned, sodium-sulphur batteries come in two main variations: layered oxides and PBAs. While safety and cost improvements are key focuses, challenges remain in energy density and industrialisation. PBAs have lower drop-in compatibility into existing supply chains compared to layered oxides.

Sodium-sulphur batteries (both kinds) typically use hard carbon anodes due to the larger size of sodium ions compared to lithium ions. The interplay between porosity, layer thickness, and electrolyte requires further research and it is not yet clear to what extent mass-market penetration will eventually occur. Generally, sodium-ion technology aims to compete with LFP as a hedge against rising lithium prices – and critical raw material availabilities in the PBA case.

Silicon anodes offer much higher theoretical capacity for lithium-ion storage compared to graphite, enabling higher energy density and faster charging rates. However, silicon’s volume can expand up to 300% during ion intercalation, causing mechanical stress, loss of electrical contact, and electrode degradation. To address these issues, composite materials with silicon embedded in a flexible carbon matrix have been developed to harness silicon’s advantages while maintaining anode integrity.

Pricing advantage

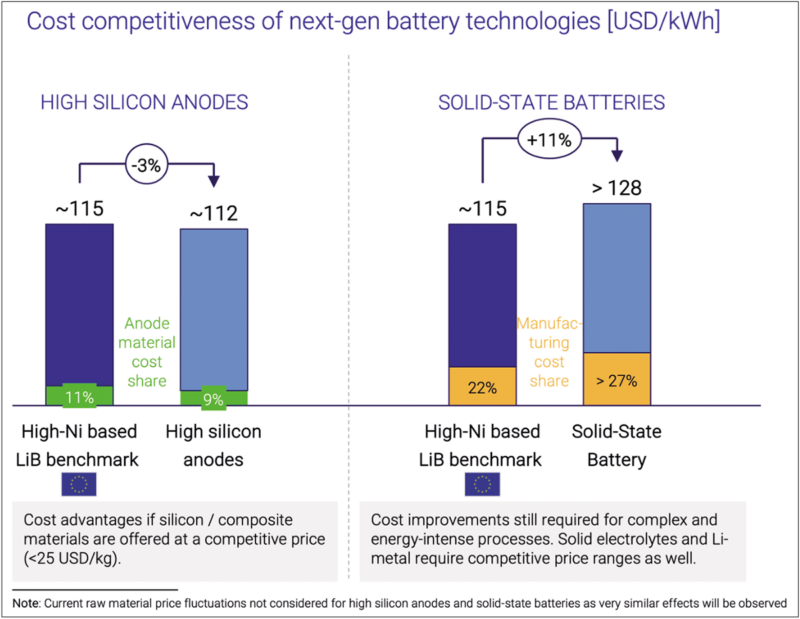

Current high nickel benchmark costs for lithium-ion batteries from European production, with 100% graphite anodes, are approximately $115/kWh, with manufacturing costs accounting for around 22%, depending on cell format and installed production technologies.

The use of high-silicon anodes can offer a slight cost advantage. In contrast, solid-state battery production costs vary significantly based on technological solutions and production processes. Due to higher manufacturing costs from complex and energy-intensive processes, solid-state cell costs are expected to start at around $128/kWh.

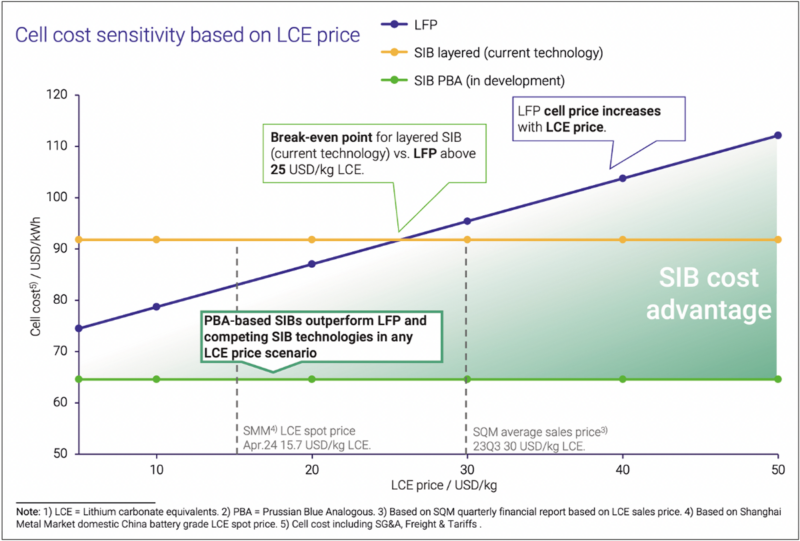

Sodium-ion batteries must be benchmarked against China-originating LFP cells, currently priced at around $85/kWh (including SG&A, freight, and tariffs). Compared to layered oxides, PBAs have significantly lower costs due to reduced material expenses. In a simplified cost sensitivity scenario, the price of sodium-ion batteries remains unaffected by lithium prices.

Excluding other material cost fluctuations (e.g., nickel for layered oxides), the break-even cost for layered sodium-ion batteries to compete with LFP opens at around $25/kWh. PBAs have a clear cost advantage over LFP due to the significantly lower material cost of the PBA cathode.

Long-term lithium price forecasts, with prices above $20/kg lithium carbonate equivalent (LCE), make sodium-ion technology a feasible alternative to LFP. However, vertically integrated cell producers with direct access to LCE at significantly lower prices than the LCE spot market may have a competitive advantage for LFP.

Market outlook

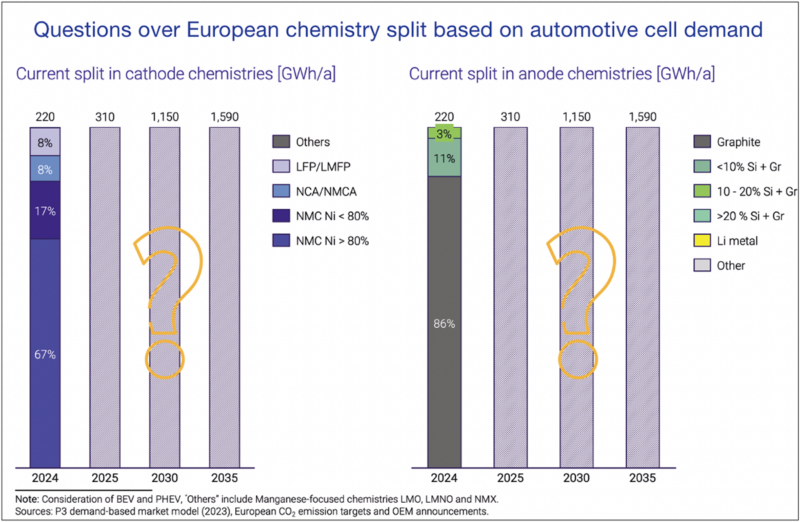

Based on market demands of vehicle manufacturers and the announced technology roadmaps of cell suppliers, high-nickel chemistries will dominate as cathode active material (CAM). This trend aligns with announcements from cell manufacturers.

However, LFP chemistry will gain importance, particularly for low-cost and entry-level automotive applications in the EU, with approximately 25% of production volume dedicated to LFP-based cells by 2035.

The market penetration of sodium-ion chemistries in the mass-market automotive sector remains to be seen but offers promising advantages. Initially, the graphite-dominated market will partially shift to graphite/silicon blends, with lower silicon shares that will gradually increase until 2030 (exceeding 20% silicon share).

A stronger market segmentation into high-performance and low-cost vehicle classes is expected to become more prominent by 2030. Recent technology developments show promising opportunities. It remains questionable though, especially for solid-state and sodium-ion, to what extent both technologies will eventually meet automotive requirements.

In all cases, achieving technological maturity, efficient industrialised production and cost competitiveness remains a significant challenge for players aiming to lead in the EV market. Promising cost advantages for new battery technologies have not yet been proven and remain uncertain, especially as several new and not yet industrialised materials (e.g. solid electrolytes) are involved.

Since both silicon-rich anodes and solid-state batteries fall within the lithium-ion battery category, and the mass-market application of sodium-ion technology in passenger cars remains uncertain, lithium-ion battery technology is likely to continue dominating the market in the long term.