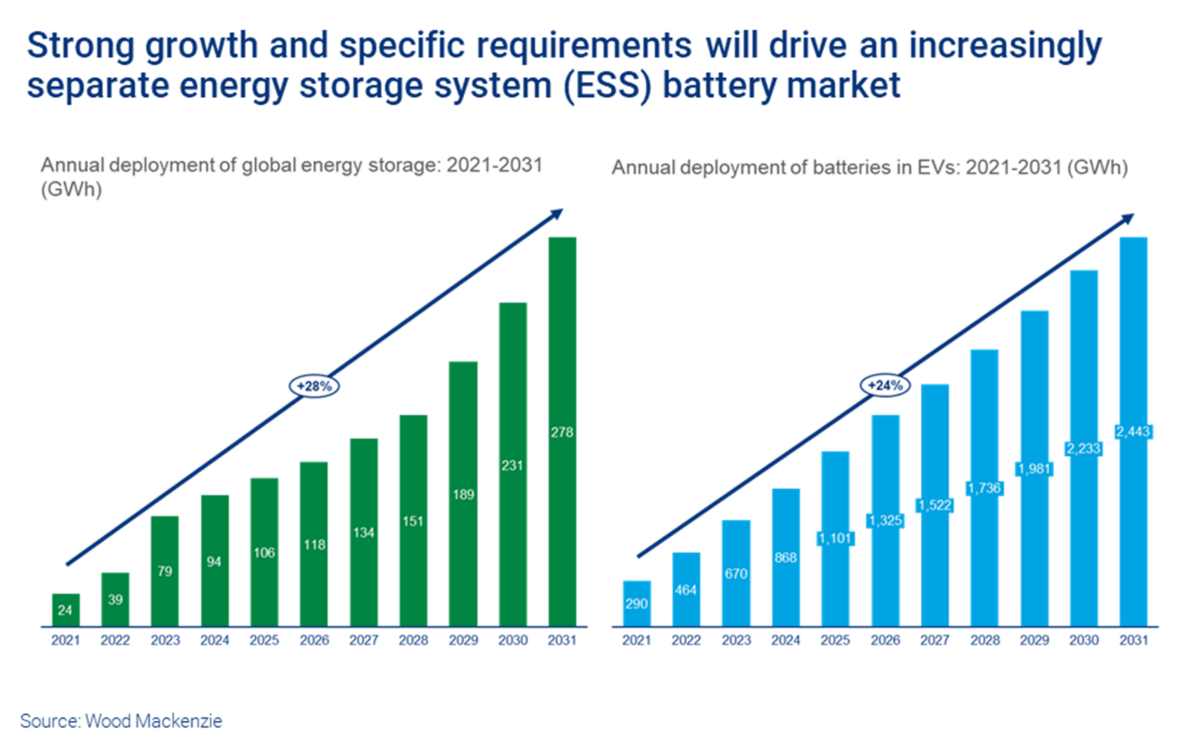

The energy storage system (ESS) sector is the new competitive battlefield for battery manufacturers, according to a report from consultants Wood Mackenzie.

There is a growing divergence between ESS and electric vehicle (EV) lithium-ion batteries, driven, it said by:

- technology

- market

- policy.

Stationary batteries need to be competitive with conventional peak and frequency modulation technology on price. They also need three times the lifespan of EV batteries, with up to 10,000 charging cycles. There is increasing demand for longer-duration ESS applications, the report said.

Policy is causing divergence too. The Inflation Reduction Act in the US allows ESS projects with 40% domestic content (55% from 2029) a 10% investment tax credit. Requirements for critical mineral sourcing for EV batteries will be much more stringent, Wood Mackenzie said.

“This will add to production costs and drive separation of battery supply for the ESS market to avoid the price of ESS batteries being needlessly increased,” it said.

Advanced silicon-based and lithium metal anode technologies, plus all-solid-state batteries, are aimed at boosting energy density. That is suitable for the EV and consumer markets.

But lithium iron phosphate (LFP) cathode technology is becoming popular in the ESS market, due to safety performance, long cycle life and the abundance (with lower cost) of iron and phosphate raw materials.

Sodium-ion batteries are commercialising quickly for stationary storage applications and are not sensitive to lithium, cobalt and nickel price fluctuations.

Battery size and format are developing rapidly in the ESS market, the report noted. The new standard for LFP batteries in grid-scale applications is 280 Ah. Up to double that capacity and a higher cycle life of up to 12,000 times are in the pipeline.

Prismatic cells – favoured by Chinese battery manufacturers – currently dominate grid-scale ESS. But cylindrical cells are relatively safe, cheap and easy to manufacture, and economical to run, it said.

The report forecast the latest generation of larger cylindrical 46xx LFP cells will be used in energy storage markets over the next decade.