There appears to be a conflict of interests as to where lithium batteries need to be utilised to attain net-zero. Is it in energy storage or electric vehicles? And what is the best chemistry? Can you reduce demand for EV batteries when there is a 28% CAGR forecast for EVs? Or should other chemistries fill the gap in the supply/demand equation? BEST listened in to the International Battery Seminar in Florida to find out more.

In 1966, 25-year-old Irv Gordon, bought a red Volvo P1800S— and in 2018, shortly before he passed away, it clocked up 3.25 million miles (5.23 million km). The car is now owned and still being driven by Volvo. The average car spends about 4% of its life being driven, 73% of its life parked at home and 23% of its life parked elsewhere.

The million-mile battery

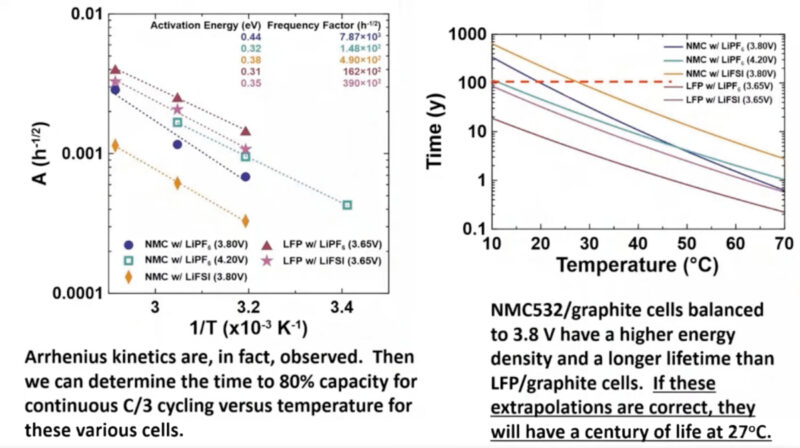

‘More than a million miles and a century of life’ was the title of the keynote talk by Jeff Dahn at the International Battery Seminar in Florida in March. Pie-in-the-sky? Apparently not. In a study published in the Journal of the Electrochemical Society in 2019, the authors concluded that one million miles and at least two decades in energy storage were possible— and the so-called ‘million-mile battery’ was born.

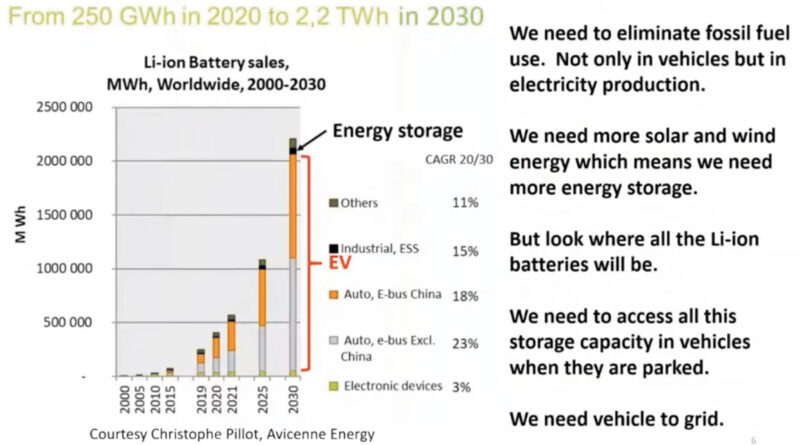

Avicenne Energy has forecast lithium-ion battery sales of 2.2TWh in 2030. Dahn said: “90% will go in vehicles… We need vehicle-to-grid. Simple as that.”

Dahn said: “In 2016, lithium batteries reached 2,500 cycles before degrading to 80% capacity. By moving to single-crystal NMC532, with good artificial graphite and appropriate additives, cells can attain 12,000 cycles over three years with minimal capacity loss at room temperature. 12,000, 400km cycles equates to five million km.”

While there are not many who drive these distances, there is no reason for cars today not to last for at least this amount of mileage. EVs, with their vastly simpler drivetrain, should be capable of far more. So, it now, largely, comes down to the battery.

Dahn said: “Eight hundred, 100% DoD cycles are enough for an EV battery— at 500km per cycle this is 400,000km. However, in vehicle-to-grid (V2G) operation, vehicles will be charged and discharged when parked— maybe one or two partial cycles per day. For this scenario 800 cycles will not be enough, more than 10,000 cycles will be required to operate V2G in a serious way.”

To develop a long lifetime cell Dahn identified five key points:

- Avoid large volume changes in positive electrode materials

- Use good artificial graphites

- Use appropriate electrolytes— LiFSI

- Keep the upper cut-off voltage down— which will also improve safety

- Be lucky

Dahn explained that when NMC 811 cells are charged to only 4.06V, large changes in the volume of the cell are avoided, the capacity retention is improved, and direct current resistance growth is reduced— when compared to charging to 4.2V. Capacity retention is greatly improved by using the best artificial graphites. Using LiFSI as the electrolyte does not exhibit aluminium corrosion when charged below 4.0V. Electrolyte oxidation significantly increases above 4.1V. Parasitic heat flow increases above 4.0V— above this voltage, there are increased reactions between the charged electrode materials and the electrolyte on the positive side.

Dahn said: “NMC/graphite cells can outperform the lifetime of LFP/graphite cells— which flies against the conventional wisdom. Initial $/kWh is not a meaningful metric when incredibly long lifetime cells are in discussion.

“I sincerely hope that some cell makers and OEMs take up this opportunity for the good of society.”

Greater sustainability

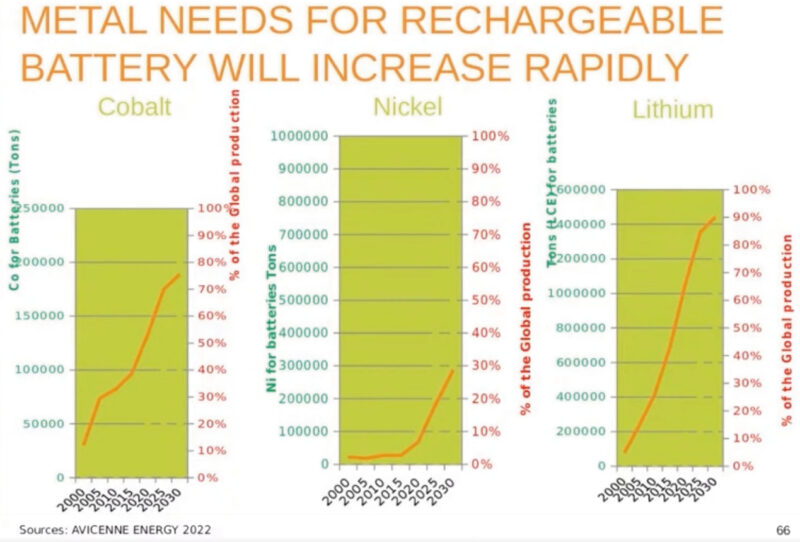

Why do we need cells that last 100 years? Michael Sanders of Avicenne said: “EVs are the primary driver of the overall battery market. We must accept that Moore’s Law does not work in electrochemistry and safety issues could kill the market.” The latest forecasts show the demand for battery minerals is increasing and battery costs are increasing, due to the rising cost of materials, particularly nickel, lithium and aluminium. However, cell and pack manufacturing costs continue to decrease so some of this additional cost is offset. But there is forecast to be a 28% CAGR in the xEV market between 2021 and 2030, according to Avicenne.

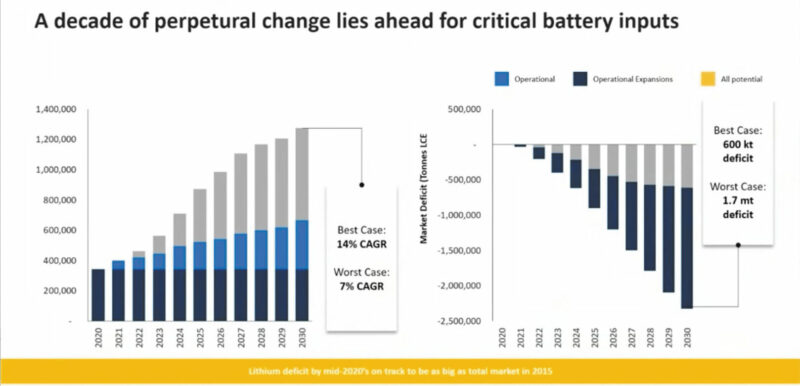

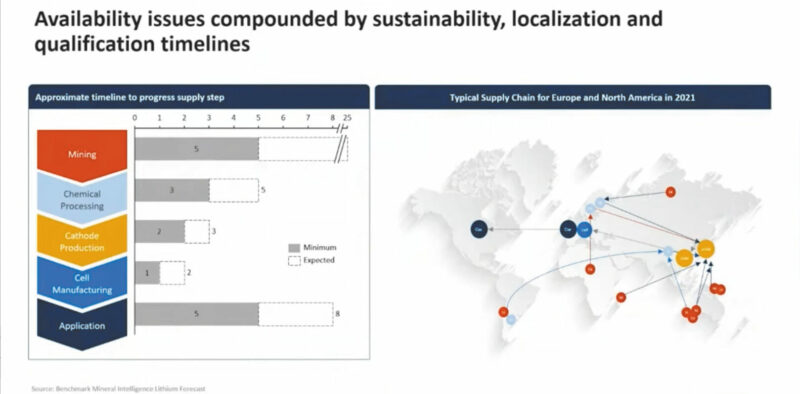

Andrew Miller of Benchmark Mineral Intelligence said that there is a disconnect between the upstream and downstream supply of materials for the lithium battery industry. It takes 1-5 years for chemical processing, cathode/anode production and cell manufacturing to be built, but it can take 5-10 years for a materials extraction plant to come online.

For a 30GWh NCM lithium-ion Gigafactory, 33,000 tonnes of graphite anode are required, 6,000 tonnes of cobalt, 19,000 tonnes of nickel, and 25,000 tonnes of lithium— each will require its own mine for supply. And there are 285 Gigafactories in the world, with more planned. Multiple mines will be required every year to meet the demand for EV raw materials.

Miller said that in the worst-case scenario lithium demand will increase by 7% CAGR and in the best-case scenario by 14%. However, EV demand at more than 20% CAGR creates a best-case deficit of materials by 2030 of 600,000 tonnes and a worst-case deficit of 1.7 million tonnes. And this pattern is repeated across the key materials— nickel, cobalt, and graphite— each of which faces its own unique set of challenges.

And it’s not just availability— sustainability, localisation and material qualification are all factors that affect the markets.

Ken Hoffman of McKinsey & Co started by saying: “If I was a doctor and my patient was the internal combustion engine: you are terminal. There is no way around it, there is no fix. You are dead. It’s just a matter of how long it takes before you die but there is no way you are coming back.” He was a bit more optimistic when talking about advanced battery materials supply, saying there was an amount of short-selling in the nickel market and that lithium may well have reached its peak price. The demand from industries, such as stainless steel, would shift to different types of nickel, which would free up nickel for batteries. And with other supplies coming online from around the world there should be no shortage.

Hoffman said: “With the range and recharge time being the number one issues EV customers around the world look for, nickel chemistries are going to be in demand. LMNO could be the chemistry that delivers low cost, high density and high cycle life, with the latest developments in niobium as a dopant. As new chemistries are developed the rate of change increases to keep up— so expect to see new products coming to market in shorter times. Also, you cannot have large deficits for long; price will correct all, and high prices will incentivise new supply to the market.”

Walter van Schalkwijk of Battery Sciences Inc asked: “Are batteries in EVs a panacea for some of our climate woes?” He said: “Batteries are a very dirty business. What most of us observe is that making batteries at the battery factory is a clean process but the full energy picture is quite different.” It is the mining and refining of materials for the supply chain where the significant problems were identified a few years ago by Amnesty International. Schalkwijk said: “Each stage has its own demand on resources and creates its own waste stream before being fit for use in batteries— the auto OEMs were only seeing partway down the supply chain. Add in the human cost of air and water pollution from mining and mine tailings and it doesn’t seem sustainable.”

Many major automakers signed up for the “Drive Sustainability” partnership with a pledge to uphold ethically and socially responsible standards in purchases of materials. Critical materials have essential functionality and are difficult to substitute— they are not necessarily scarce, but the fewer we use the better.