For battery market players, understanding the intellectual property (IP) landscape can give you an insight into your competitors’ next move. Ben Lincoln, partner and energy storage specialist at European IP law firm, Potter Clarkson, considers the benefits of this foresight, looking specifically at the information available in the world of battery recycling.

The IP landscape is an assessment of the intellectual property rights in a particular area of technology. It includes the activities of your competitors in terms of their pending and granted rights, and can also reveal information about the direction of their R&D focus.

Therefore, having a good understanding of the activities of your competitors is valuable in terms of risk management because you are aware of which granted IP rights could impact your product line and you have sight of pending rights that have the potential to disrupt your future plans. The assessment of the IP landscape is also valuable for strategic reasons.

For example, it can be possible to identify trends in the filings of your competitors or the market in general; the most prolific inventors can be identified, which may inform your hiring decisions. The geographic distribution of IP rights may inform your decisions on where to place manufacturing functions, distribution facilities or research divisions.

In general, it is good practice to understand the IP landscape for risk management and strategic reasons as well as to give you an understanding of where your business stacks up against other IP rights holders.

To illustrate some of the information that can be gleaned from an IP landscape assessment, we take a look at the field of secondary cell recycling.

Patents in context

Patent applications are categorised by the technology to which they relate when they are assessed by patent offices around the world. The classification system for patents is vast and can provide insight into patent filings in precise areas of technology. To provide an understanding of the information that can be obtained, we focus on classification “H01M 10/54” which is described as “reclaiming serviceable parts of waste accumulators”.

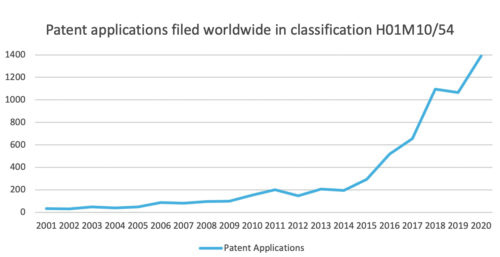

First, let us consider the number of applications filed worldwide over the last 20 years, which is shown in the graph of Fig 1.

This shows there was a moderate increase in filings around 2005 but it wasn’t until 2014 and 2015 that there was significant interest in this area of technology. Since 2008 the number of patent filings made worldwide per year has increased ten-fold. With the EU battery directives and associated legislation along with increased environmental awareness, it can be expected that this increase in the number of filings will continue.

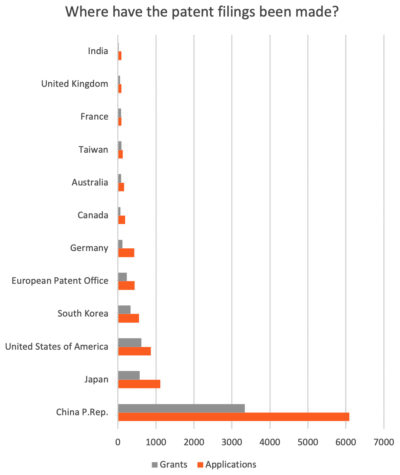

It is also important to understand what is driving this increase in patent filings. In Fig 2 we have broken down the number of patent filings in the same patent classification into the geographic areas in which the patents are filed.

We can now appreciate that a large proportion of the filings in this technological area originate from China. Thus, it may be that the significant patent filing activity occurring in China is skewing the results. Before we look at growth in filings around the world in more detail, it is worth considering that Fig 2 shows both the number of patent applications and the number that have been approved for grant.

The conditions for grant do vary slightly from patent office to patent office, but broadly the same assessment of novelty and inventive step is performed. We can see that roughly 50% of the patent filings in China are being granted, which is broadly similar to the other countries. The US appears to have a greater grant percentage. Further investigation may be required to determine whether this is because of a lower threshold for allowance or because higher quality research and development is occurring there.

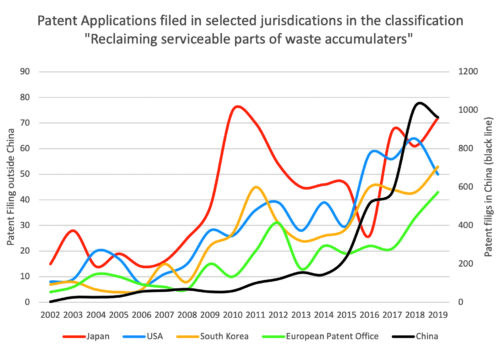

Fig 3 shows the number of patent application filings per year in Japan, the US, South Korea and at the European Patent Office. The number of patent filings is also shown for China as a black line and is plotted against a different axis to the others given the great disparity in the number of filings in the different jurisdictions.

We now see a more nuanced picture of where innovation is occurring in this area. In Japan, there was a rush of patent filings in 2010 and 2011. Looking into the figures we see that Sumitomo Metal Mining was behind a good proportion of those filings and JX Nippon Mining and Metals Corp was on the rise at the same time. In the US and South Korea, there is a steady rise in interest since 2008. In Europe however, it wasn’t until the battery Directive 2006/66/EC of 2006 that investment in patent filings increased. Nevertheless, since 2017 there appears to be a steady and continued increase in patent filings in Europe, which looks to be catching up with the levels in the US and South Korea.

Understanding the competition

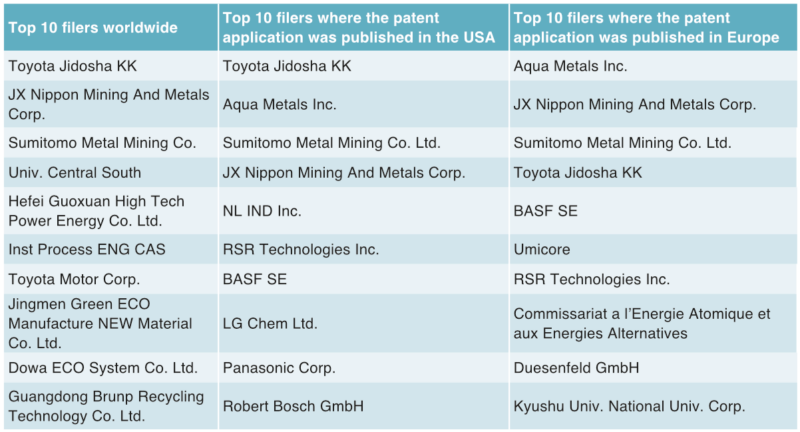

Let us now turn to who is filing the patent applications. Table 1 shows the Top 10 companies recycling filing applications worldwide in the first column. The next column shows the top 10 companies filing patent applications that are published in the US, and the final column shows the top 10 companies filing patent applications that are published in Europe.

In terms of the filings made anywhere in the world, the top 10 is filled with Japanese and Chinese companies with a Chinese University, University of Central South, at number four. However, when we consider the top filers at the US Patent and Trademark Office, the picture looks very different with US, European and Japanese companies filling the top 10. The list includes many of the big names of the battery industry as well as Aqua Metals, which specialises in closed-loop metal recycling processes and RSR Technologies, which provide chemical and metallurgical research services to battery, mining, and smelting companies. It therefore appears from this that the Chinese companies perhaps have a more domestic patent filing strategy, whereas the Japanese companies are concerned with having a patent portfolio with wider geographic scope.

Looking at the filers in Europe, we see similar names to those companies filing in the US. However, Belgium-based Umicore makes an appearance in the top 10 as well as specialist German lithium-ion recycling company Duesenfeld. Filling the number 10 spot is Kyushu University of Japan, which has a Department of Automotive Science and Advanced Materials and Chemistry specialism.

Understanding your competitor

For each filer we can look more closely at the subject matter they are filing. For example, Duesenfeld has a granted patent (EP 3 529 841 B) for a method of treating used lithium batteries featuring the steps: (a) comminuting the batteries such that comminuted material is obtained, and (b) drying the comminuted material so that electrolyte of the battery evaporates, characterised in that (c) at least 50% of the evaporation heat is introduced into the comminuted material by means of mechanical energy.

In the same patent family they have a patent (EP 3 312 922 B) for a method of treating used lithium batteries containing the steps: (a) comminuting the batteries such that comminuted material is obtained, and (b) drying at a maximum temperature of 80°C, characterised by the fact that (c) the drying occurs at a maximum pressure of 300 hectopascals (hPa) and the comminuted material is deactivated by the drying, thereby rendering an electrochemical reaction impossible, and (d) the deactivated comminuted material is not filled into a transport container after the drying process.

Understanding the claim scope of the patent rights held by your competitors is important so that you can either design solutions that circumvent the granted patents or, if that is not possible, begin a negotiation to gain appropriate licences to use the patented method or device.

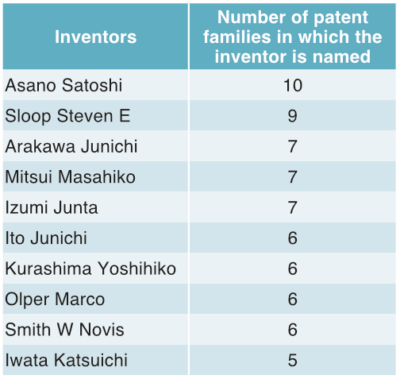

It is also possible to look at the inventors named in each of the patents. Table 2 lists the 10 most prolific inventors alongside the number of patent families with which they are listed as an inventor.

It can be seen that Satoshi Asano is an inventor for Sumitomo Metal Mining and that Junichi Arakawa is an inventor for JX Nippon Mining And Metals. Steven Sloop is president of OnTo Technology; according to their website OnTo Technology performs contract R&D to “pioneer comprehensive methods to improve safety and efficiency in recycling lithium-ion batteries and materials”.

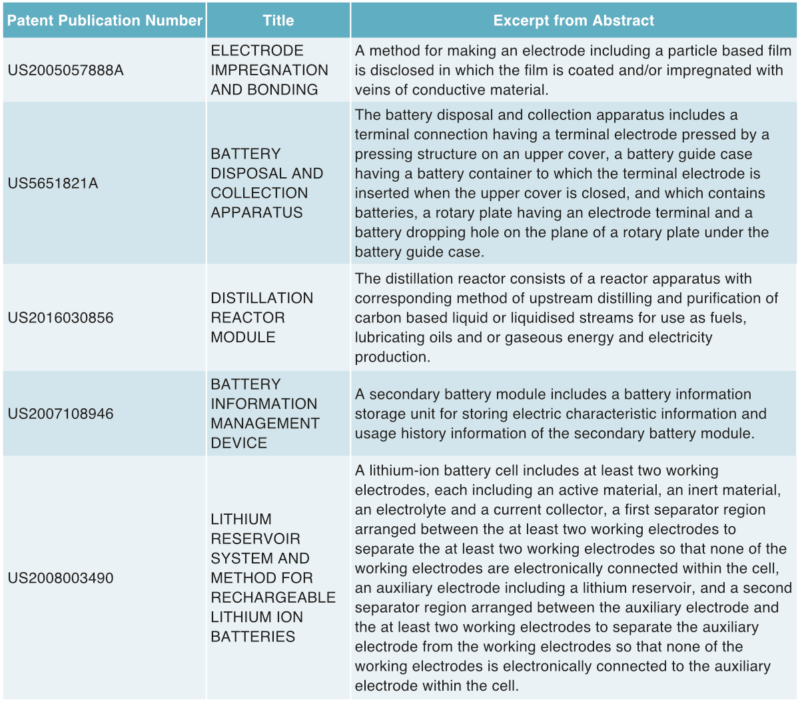

Finally, we can look at the patent applications that are classified as relating to reclaiming serviceable parts of waste accumulators and are most cited against other patent applications (shown in Table 3). Thus, when a new patent application is filed, the patent office performs a search to identify other, older, patent publications that are relevant for assessing the patentability of the new patent application. If a relevant, older, patent publication is found then it is cited against the new patent application. A patent landscape assessment can look at which patent published are cited against other patent applications most frequently.

Delivering actionable insights

In summary, an IP or Patent Landscape report provides insights into the market, your competitors and the technology. The data that can be obtained is useful for identifying trends in an area of a field of technology to inform your overall R&D and IP strategy. Once competitors and key inventors have been identified, the patents associated with them can be assessed and analysed for risk management purposes or for reasons of making a strategic acquisition. It is therefore highly advantageous for players across the energy storage market to understand the IP landscape and in doing so, become more IP aware.

Read more of Ben Lincoln’s series of patents below.

When dealing with Intellectual Property is a question of “to buy or not to buy?”