One of China’s biggest lead battery manufacturers, the Chilwee Group, has said it expects to see first half-year profits “fall sharply” because of falling prices triggered by “overcapacity” in the domestic lead-acid sector.

Chilwee (also known as Chaowei) said in a Hong Kong Stock Exchange announcement estimated profits would be down in the first half of 2018 compared to the same period a year ago— but the company did not give figures.

The battery maker warned shareholders that based on its own analysis of the market, the overall price of lead-acid car batteries in the first quarter of 2018 “dropped dramatically” over the previous year.

However, Chilwee’s CEO Mingming Zhou (pictured) said the company’s performance in the second quarter of this year is likely to be similar to the first quarter.

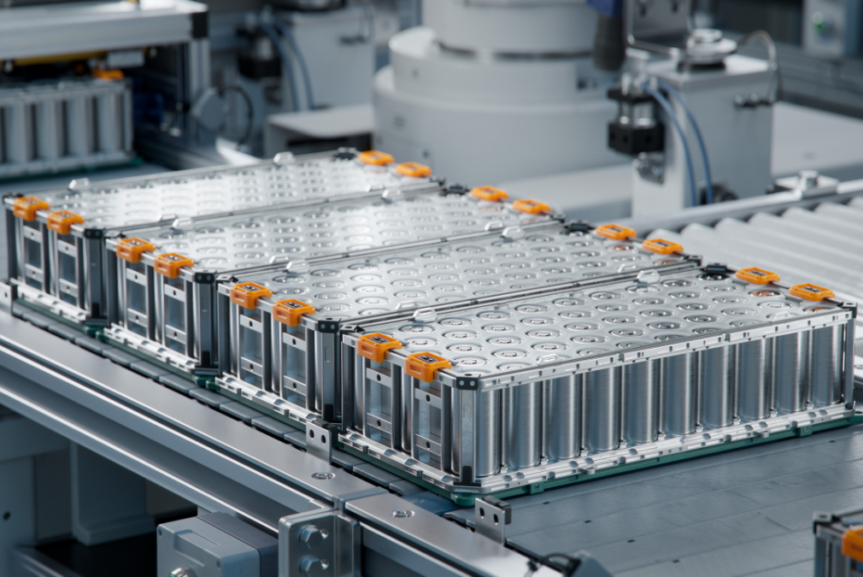

BBB reported last year that China’s lead-acid battery industry was being pressured to keep battery prices stable amid growing material cost increases— amid rumours that the country’s lithium-ion battery makers might be dropping their prices by up to 40%.

Lead industry chiefs at the recent Battery Council International convention in Arizona were warned lithium might dominate ‘transportation batteries’ by 2022.