Demand for electric vehicles has prompted Chinese lead-acid battery producers to embrace lithium— including two of the country’s biggest firms.

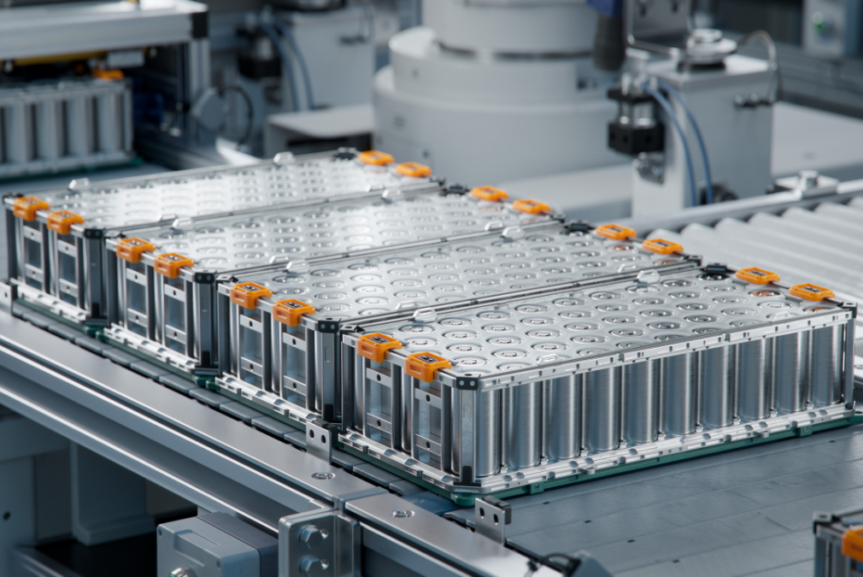

A plethora of lead-acid firms are adjusting their business model to include lithium-ion, with firms doubling lithium-ion output or building lithium battery plants in China, the Shanghai Metal Markets reports.

Tianneng Group is set to almost double its lithium battery capacity year-on-year to 2.25 GWh in 2016. It follows a 209% rise in sales volumes for its lithium products totalling 556 million yuan ($85.16 million) in 2015.

The firm is now concentrating more on lithium, with 40% of it’s $125.8million expenditure on the chemistry.

Last year BBB reported how the company opened a new battery manufacturing plant for the 4th generation e-bike market.

Fellow Chinese big player Chaowei Power is investing more than 800 million yuan ($123.7million) on constructing lithium battery projects which have an annual capacity target of 3GWh.

Last year, both Chaowei Power and Tianneng Group— which own around 75% of the motive EV batteries market share, including bikes— were accused of deliberately keeping EV battery prices low to keep out competition.

Elsewhere, Camel Group plans to complete construction of its 0.6GW lithium battery plant by the first half of this year.

Shenzhen Center Power Tech has plans for a 1GW lithium battery production line; this will include 0.7GW of motive capacity, 0.2GW of telecoms capacity and 0.1GW of storage capacity.

Guangdong Dynavolt Power Technology is proposing to raise funds of around 935 million yuan ($144.6million) for construction of an R&D centre and motive lithium battery project.

Last year, Fujian Dynavolt New Energy Technology Co broke ground on a lithium plant. Once completed the factory will have an annual production capacity of 6GW lithium battery cell and packs.