Confidence in the battery/storage sector more than doubled in the second quarter of the year with venture capitalists plowing $125million into ten deals.

Twenty investors put cash into companies focused on lithium-ion, sodium, energy storage systems, lead-based technology, energy storage management software and thermal energy storage.

Lithium-ion continues to generate the most interest, with companies involved in the chemistry raising $51.3 million in three deals, announced in a report by research and consulting firm Mercom Capital Group.

Funding rose from eight VCs investing $54 million in 10 deals in the previous quarter.

However, year-over-year funding in Q2 2016 was slightly down from Q2 2015, which had $126 million in 13 deals.

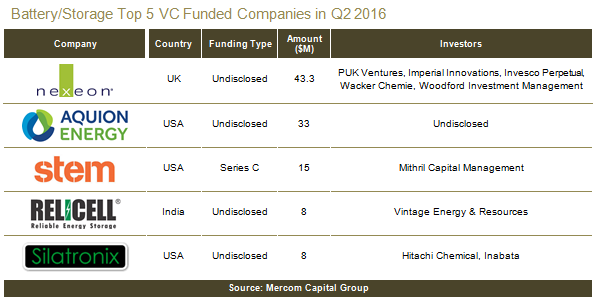

The biggest winners were: Nexeon with $43.3 million from PUK Ventures, Imperial Innovations, Invesco Perpetual, Wacker Chemie and Woodford Investment Management; Aquion Energy with $33 million; Stem with $15 million from Mithril Capital Management, Greenvision Technologies (brand name Relicell) with $8 million from Vintage Energy & Resources; and Silatronix with $8 million from Hitachi Chemical and Inabata.

This quarter also saw four Mergers & Acquisition transactions in the sector, , compared to two in the previous quarter.

The largest M&A deal in the second quarter of 2016 was the $1.1 billion acquisition of Saft by Total.