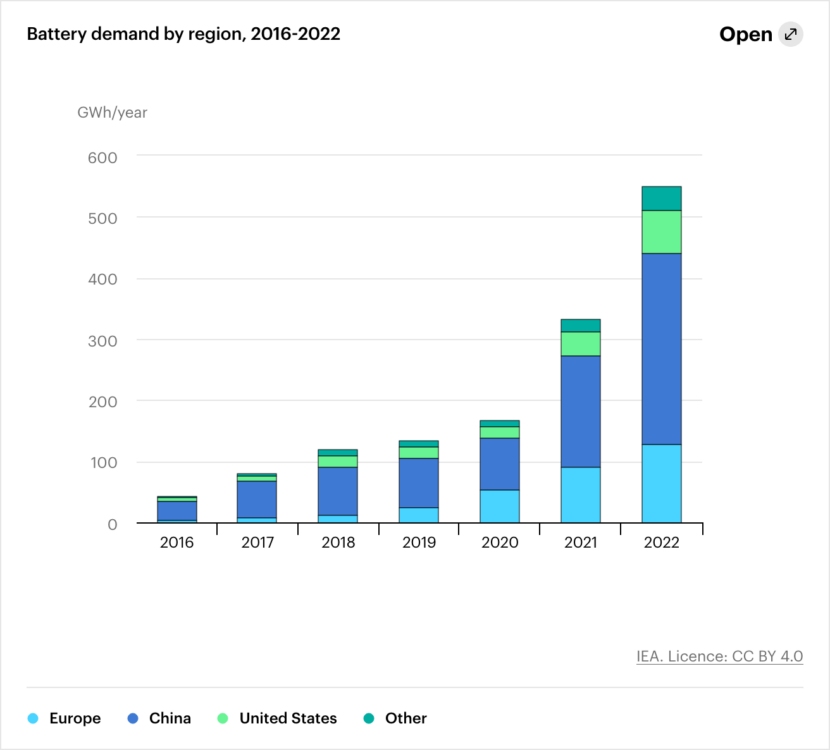

Demand for automotive lithium-ion batteries surged 65% to 550GWh in 2022, reported the International Energy Agency (IEA) in its annual Global Electric Vehicle Outlook.

It said more than 10 million electric cars were sold worldwide in 2022 and sales are expected to grow another 35% this year to reach 14 million.

In China, battery demand for vehicles increased over 70%, it said. Electric car sales went up by 80% in 2022 compared to 2021, though growth in battery demand was slightly tempered by an increasing share of PHEVs.

Battery demand for vehicles in the US was up around 80%, despite EV sales only increasing by around 55% in 2022. The average battery size for battery electric cars in the US grew about 7% in 2022.

The average US electric car battery size remains about 40% higher than the global average. This is partly due to a greater proportion of SUVs sold in the US than elsewhere. Manufacturers also aim to offer longer all-electric driving ranges.

Demand for critical minerals

More battery sales are driving the demand for critical minerals, said the IEA. In 2022, lithium demand exceeded supply (as in 2021) despite the 180% increase in production since 2017.

In 2022, about 60% of lithium, 30% of cobalt and 10% of nickel demand was for EV batteries. In 2017, these shares were around 15%, 10% and 2%, respectively.

Mining and processing of these critical minerals will need to increase rapidly to support the energy transition, it said.

Advanced battery technologies that require smaller quantities of critical minerals will help this, as will measures to support sales of vehicle models with optimised battery size and the development of battery recycling.

Lithium iron phosphate (LFP) cathode chemistries reached their highest share in the past decade, the report said. This trend is driven mainly by Chinese OEM preferences. Around 95% of the LFP batteries for electric LDVs went into vehicles made in China. BYD took half, Tesla 15%. Tesla is increasingly using LFP batteries (20% in 2021 and 30% in 2022), but only 3% of electric cars with LFP batteries were made in the US in 2022.

Alternatives to lithium-ion batteries have been emerging in recent years, said the IEA. This includes sodium-ion, which is cheaper to produce and avoids the need for critical minerals. It said it is the only viable chemistry not containing lithium.

The sodium-ion battery developed by China’s CATL is estimated to cost 30% less than an LFP battery, but does not have the same energy density as lithium-ion.

“This could make sodium-ion relevant for urban vehicles with lower range, or for stationary storage, but could be more challenging to deploy in locations where consumers prioritise maximum range autonomy, or where charging is less accessible,” the report said.

Almost 30 sodium-ion battery plants, representing more than 100GWh, are either operating or planned, almost all in China, the report stated. It means EVs running on sodium-ion batteries will be on the roads in 2023-24.

The price of batteries varies across different regions. China has the lowest prices on average, said the IEA, while the rest of Asia Pacific has the highest. This is due to the fact that around 65% of battery cells and almost 80% of cathodes are manufactured in China.

The average battery price was about $150 per kWh in 2022, it said.