The European Lead Battery Conference, held in Milan in September, heard the worldwide battery market is worth more than $250 billion and rising, and the lead battery sector is maintaining its own. Its biggest opportunity lies in new markets, especially in ESS, but technical improvements and a focus on battery systems are needed, according to the experts.

In his introduction, Glencore general manager and chair of the International Lead Association, Florian von Steinkeller said the outlook four years ago was doom and gloom amid fears that lithium-ion was going to take over and lead would end up on the European Union’s REACH list with imposed restrictions.

Neither quite happened as feared and the downturn in the EV market and battery safety concerns over lithium-ion car batteries catching fire has changed things, leaving lead in a better position.

Addressing the global rechargeable battery market, director of consulting firm Avicenne Energy Christophe Pillot told his audience his company put the total battery market worldwide at over $250 billion, with growth in the lead battery sector going from 526GWh in 2020 to 550GWh in 2023. Lead-acid retains a market share of over 30%, he said.

In the industrial battery sector, Avicenne forecasts that lead will retain its dominance in UPS batteries with a 70% market share, in telecom batteries with 73% and motive at 51%. The lowest share is in the ESS segment (grid and residential, excluding inverter market), where lead batteries make up only 1% while lithium-ion has 99%.

“Lead will stay at a high level, except for ESS,” he said. The lead-acid battery market volume is still growing, but lithium-ion will continue to take market share. The worldwide market is dominated by EV, portable, SLI and ESS batteries, but the rest of the market represented $41 billion in value at pack level in 2023, he said. Other applications include e-bikes, power tools, forklifts and automatic guided vehicles, stationary (including telecom and UPS), medical, marine, aviation, railways and low speed vehicles.

Of the over 2,000 battery manufacturing projects in Avicenne’s database, he said some will be delayed and some will not happen. “Accurate forecasting in the supply chain is needed to avoid costly timing errors,” he said. “Hundreds of billions of dollars will be invested in Europe and the US by 2030 and Europe will not be ready to meet all the demand. There is a lack of gigafactories, raw materials, equipment and skilled labour.

Dong Li of Leoch Battery provided a similar projection to Pillot. He presented an overview of world markets and concluded that in 2024, the global lead-acid battery market is expected to be worth $52.53 billion, while the lithium battery market is anticipated to be $161.72 billion. He believes lead batteries will have a very stable future, with SLI holding a leading segment position.

LFP challenging lead

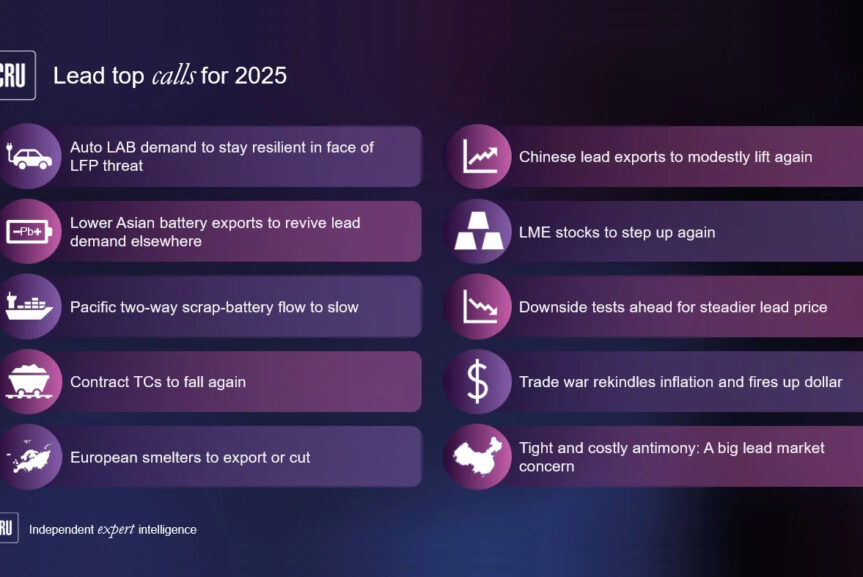

Lead analyst Neil Hawkes from CRU, celebrating 35 years in the industry, told his audience lead batteries are facing challenges from LFP batteries, as Chinese car makers such as BYD, Li Auto, NIO, Xiaomi Auto increasingly switch from 12V lead-acid batteries to 12V lithium-ion batteries.

Although lead-acid batteries seem poised to lose out to surging LFP and emerging sodium-ion batteries, they are set to remain resilient as part of a multi-battery landscape, he said.

After two years of decline, local lead production is rising again this year to close the gap on a third year of slow demand, he noted. Pricing is still hovering around $2,1000 per tonne.

The planet is not yet on a path consistent with cutting greenhouse gas emissions quickly and deeply enough to limit temperature rise to <2°C by 2050, he said. Only the light vehicle industry is on a path below 2°C. Even with bigger emission cuts after 2030, cumulative emissions are still in danger of exceeding +2.5°C by 2050, he said.

He sees this having little impact on global GDP up to 2040, then damage from physical risk to human/industrial activity will grow significantly in the 2040s up to 2050. By then, global GDP growth will slow to zero with higher inflation and a reshuffling of labour markets and resources across economies.

The sale of EVs is still growing but at a much slower rate than before. “Companies are voting with their feet and moving to a more balanced portfolio of powertrains,” he said.

Data centres

Data centres are an interesting market proposition. Nick Starita of Hollingsworth & Vose cited data from Goldman Sachs that by 2030, the power needs of Europe’s data centres will match the current total consumption of Portugal, Greece and the Netherlands combined.

This will force a rethink on back-up technologies. Alternatives such as lithium-ion and nickel–zinc are coming into the frame. China is sticking with lead for now though, he said. Low-cost LFP is “close to encroaching in lead battery territory in terms of price,” he said.

The ESS market will be “the biggest business opportunity in a lifetime” for the lead battery industry, he reckoned. Lead batteries are not the incumbent technology and improvements will be required, mostly in cycling.

However, it is a different picture in China, said Huw Roberts of CHR Metals consultancy. He noted the huge expansion in energy storage that will be required to accommodate the rapid growth in renewable energy. More than a third of the 90GW of capacity at the end of 2023 was installed in China, he reported.

He said the Chinese government had encouraged the development of several battery chemistries for energy storage. This included lithium-ion, sodium-ion and lead carbon batteries. There was subsequent optimism about a role for lead batteries, but the lack of financial support for R&D or investment means implementation of lead carbon battery installations has been slow, with few new lead battery storage projects being announced. The outlook is not positive, but there will be no shortage of lead to meet future demand should it come, he said.

He later told BEST: “The issue is that lithium is now very cheap in China and, with hundreds of projects commissioned and under construction, there is more real-time data on performance than on lead. In essence, the lead battery industry needs to dive in and get more storage facilities in use to help develop robust performance data to justify claims around cycle life and cost.”

Future lies in new markets

The Consortium for Battery Innovation (CBI) is working on a revision of its technical roadmap document. Technical Director Matt Raiford said the future of lead batteries rests in new markets. He noted the “rocky and tumultuous” EV transition has destabilised the SLI 12V automotive market.

He said the choice of auxiliary batteries is up in the air, but not for technical reasons. He noted how auto manufacturers had previously employed lead battery subject matter experts. “That’s not the case anymore. They’ve been shipped to lithium-ion or retired…We need to engage with the end user in a different way,” he said, emphasising the need to tell OEMs about lead battery solutions.

The SLI market is not going away, and remains robust in markets such as South America and India, he said. Raiford said there are several technical advancements to watch. While they are more directly applicable to micro-hybrid/start-stop, they are also useful for auxiliary/low voltage EV batteries. They include:

- carbon and other additives

- new types of lead batteries

- optimisation of current designs.

Like Pillot, Raiford said ESS represents “unprecedented opportunity” for growth (50GWh opportunity in BTM by 2030). It represents billions of dollars in market expansion, even where lead is sharing the market, he pointed out. He said CBI is doing research and supporting product development to help lead batteries into key markets.

These include commercial and industrial (EV fast charger backup), residential and LDES. It will no longer be a question of just batteries, battery systems will be needed.

Lead battery

Lead battery systems such as ESS to back up EV fast charging form part of CBI’s Blueprint project. Using batteries from C&D, Trojan, Clarios, Crown, Stryten and East Penn, and backed by a number of other companies, Raiford said he hoped to see two such systems up and running by the end of next year.

Norbert Maleschitz, chief operating officer of East Penn, said in his presentation the aim is to see 100,000 fast charging stations per year in a $50 billion investment programme. The aggressive goal from the Vehicle Technologies Office of the US Department of Energy is 200 miles charge in 10 minutes, he said.

KPMG Consulting produced a very positive report for ELBC – it was commissioned by CBI and the International Lead Association (ILA) – on the booming BESS market. Its mid-market director Martin Seban said the company identified seven battery technologies for use in applications such as EV charging, residential and grid needs. They include lithium, lead, sodium-ion, sodium-sulphur, nickel, vanadium and zinc. Sodium and flow batteries will take a big market share in the future, he added.

Quoting various sources including the International Energy Agency and the National Renewable Energy Laboratory (NREL), Seban said these drivers would propel the BESS market to some 865GWh/year in capacity additions and $165 billion in extra value by 2035. From 2025–35, it will represent an 18% and 13% annual growth respectively.

He estimates that China will be the world’s biggest BESS market, along with Europe and the US, but India is expected to make up 20% of the market by 2035. It will represent the fastest growing market.

“Lead batteries have a great position as long as they have a strategic position,” he said. This requires work to propel lead batteries in the market and R&D investment in decreasing levelised cost of storage, standardisation and advanced monitoring to boost battery life and performance.

The mood of departing conference-goers was upbeat as market opportunities were laid out. The very many deals and meetings formed an important sideline part of the event.

ILA boss Andy Bush told the conference that the traditional gala dinner was being replaced by a gala buffet reception. It was “out of necessity,” he said. “We made every effort (to have the dinner) but it wasn’t possible. We’ll return to it in 2026.”

On the sidelines, Consortium for Battery Innovation director Alastair Davidson told BEST that the decision to not hold a gala dinner was not taken lightly. It happened because ELBC was cancelled four years ago due to Covid. The organisation had committed to the Milan venue and the 2024 dates, but then found that ELBC coincided with Milan Fashion Week, which draws huge numbers to the city. Being able to get a venue and staff available for a gala dinner was impossible, he said. The only option would have been to travel an hour by bus and they did not think people would do that.

“It was absolutely not about saving costs, and a stand-up gala buffet is almost as expensive as a sit-down dinner,“ he said. He declined to say how much it costs to lay on a gala dinner or a gala buffet. He confirmed that the next ELBC in Vienna will have a sit-down gala dinner.

Over 1,000 people attended ELBC, along with 140 exhibitors and suppliers. The Chinese contingent was strong, making up some 25% of exhibitors, according to the organisers.

BEST technical editor Mike McDonagh seen with chairs of the suppliers forum technical sessions: Kevin Campbell of Digatron and battery consultant Doug Lambert. McDonagh presented a report on lead-acid battery formation on behalf of UK Powertech, Digatron, Energy Storage Publishing (publisher of BEST) and Ecotech Energy Solutions. He presented findings showing that an understanding of the chemistry can provide a more efficient process that will save lead-acid battery manufacturers hundreds of thousands of dollars per annum.

Battery regulation in the European Union still has many gaps, said ILA’s senior director of regulatory affairs, Steve Binks.

He said that much of the detail around implementing the first global policy instrument on all aspects of a battery’s life cycle has yet to be decided. It will require significant rounds of secondary legislation in the coming years. In a whistle stop tour of the EU Battery Regulation, he pointed to a few significant holes.

• Article 6 – Restrictions on substances. Its aim is to stimulate the development of environmentally sustainable batteries made without very hazardous substances. The European Commission, helped by the European Chemicals Agency, has to prepare a report by the end of 2027 on the use of substances of concern used in batteries. Lead, calcium and cobalt have already been identified as substances of concern for priority review.

“It’s likely that the European Chemicals Agency will identify certain areas,” Binks said. “That’s why it’s important to highlight the benefits of lead batteries.”

• Article 8 on recycled content of batteries is another controversial area, said Binks. This sets out the percentage share of recycled copper, nickel and lithium in active materials, or of lead in the battery.

“There’s a lot of uncertainty still about the lithium-ion recycled target,” he said. By mid-2028, there will be information requirements on recycled content for all batteries in scope (except light means of transport batteries), followed by a possible review of the target at year-end. “My view is they will be extremely challenging,” he said. “There won’t be enough information on this.”

• Articles 48, 49 and 50 require a large volume of due diligence on these raw materials: cobalt, nickel, natural graphite and lithium. The work must cover social and environmental risks as well as labour rights and human rights, including rights of indigenous people. Industrial relations must be covered by the due diligence too. It then all has to be certified by a notified body. The raw materials list does not include lead.

One thing will only become clear when the regulation is fully implemented, Binks said. That is whether the additional costs of administrative resources needed by battery producers will deliver economic and environmental benefits.

‘Zonal architecture may support transition to 48V batteries’

Moves by automakers to bring in zonal architecture may lead to the end of 12V batteries, two experts have argued. Questions remain.

Light duty vehicle architectures are evolving and a move to zonal architectures may support a transition to 48V batteries, according to Angela Johnson, vice-president of Ricardo Strategic Consulting.

In a presentation to ELBC, she said such a switch is one technology trend scenario. The advantage is reduced weight, lower power and heat loss, and lower cost for wiring harnesses. There are few 48V components on the market, however. She told BEST vehicle OEMs are not disclosing plans for any switch to 48V, despite being asked. “They want to keep any plans to themselves,” she said.

Light duty vehicle architectures are evolving and driven by increased non-powertrain system power demands, a need to reduce costs, weight, and improve efficiency to meet CO2 targets, she added. There is no clear, single industry direction yet though.

The lower complexity of zonal architecture will require new industry partnerships. Over-the-air updates will require software developments, she said.

Battery consultant Eckhard Karden also talked about a scenario where the 12V battery might no longer exist. He outlined zonal architecture, where all software runs on a few OEM-owned central controllers. Tesla has already announced this for its Cybertruck vehicle, as has EV maker Rivian.

He posed the question as to whether zonal architecture may go along with 48V-only distribution, with a zonal step-down to any voltage as needed. Might that spell the end of 12V batteries in EVs, he asked.

Such 48V architectures are an option for BEV-only platforms. Again, the question arises as to what will happen in the next 3–5 years. Will mainstream BEV manufacturers flip to 48V only?

Karden said autonomous and assisted driving technology (there is an ISO standard: Automotive Safety Integrity Level, ASIL) reliability requirements may be cascaded to 12V batteries, but alternative architectures may provide ASIL without them.

OEMs are losing their experts in lead battery technology and he expects the manufacturers will become increasingly receptive to advice and technological solutions. “Lead battery suppliers should proactively support battery application and system integration at OEMs,” he said in his presentation. “Standardisation and pre-competitive industry working groups can be instrumental.”