Fraunhofer, the German science research institute, said all international battery strategies refer to solid-state batteries as the technology of the future. Lithium-ion batteries are regarded as the benchmark.

Alternative technologies such as sodium-ion have the potential to increase technology sovereignty and improve sustainability, it said.

In a new report, Benchmarking International Battery Policies, it said the scope is on a cross-analysis of strategies developed and adapted in Germany, other EU countries, the US, China, Japan and South Korea.

Batteries will play a major role in the decarbonisation of society, it said. Targets for climate neutrality vary from 2045 in Germany to 2060 in China.

It added the focus is on EV battery technology, recycling and reuse of materials. Reuse is typical for Europe, while improvement of efficiency rates (e.g. energy density) is the norm for Chinese suppliers.

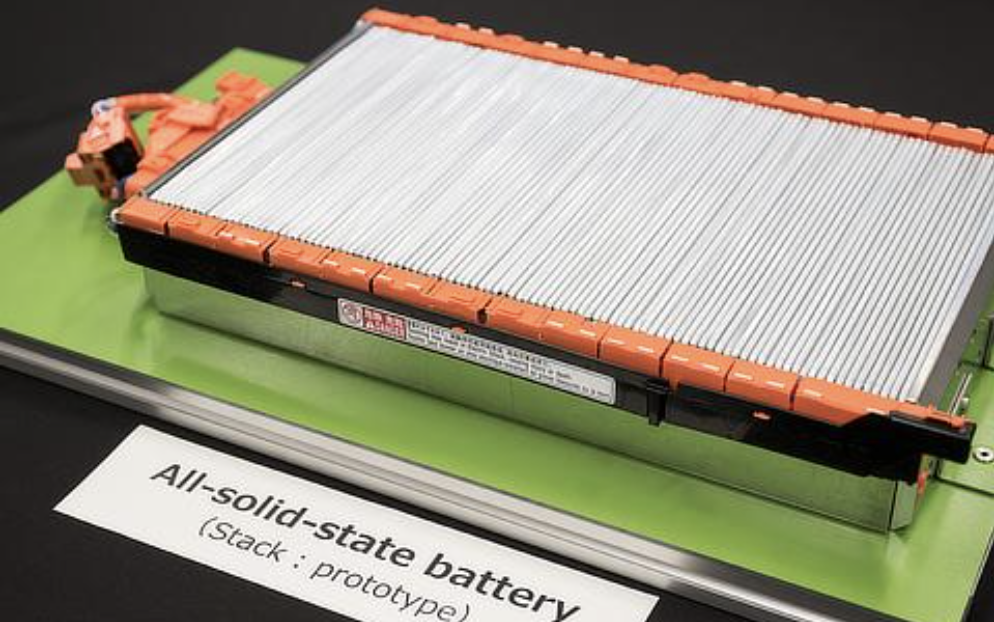

China is focusing on LIBs, SSBs, metal-sulfur, and especially lithium-sulfur batteries, it said. South Korea’s focus is on LIBs, SSBs and other next-generation batteries. Japan is concentrating on LIBs, SSBs and alternative battery types (fluoride shuttle and zinc-anode batteries).

The US follows a technology-open approach, it said, with a focus on SSBs and alternative battery types. The EU and Germany have set their focus on lithium-ion (Gen.3a +Gen.3b), solid-state and alternative battery types such as redox-flow, metal-air and sodium-ion batteries.

Regarding public funding of the research, the US is investing more than €220 million ($238 million) per year, followed by Japan with €130 million ($140 million). China has chosen a different approach, where R&D is funded by battery suppliers in clusters with raw material producers.

The report also contains regional and national analyses of political drivers and incentives for future battery technologies. China has the largest number of publications, more than 30% of the total, while Japan has the greatest number of patents – except for lithium-air, sodium-sulfur and lithium-sulfur batteries, where the US dominates. Europe ranks well beyond the three major players in the battery industry, Japan, China and South Korea.

The EU and Japan concentrate on new battery technologies which are expected to replace the most common types (lithium-ion, solid state) after 2030, the report said.