A study has identified the Democratic Republic of the Congo as a “favorable destination” for the supply of lithium-ion battery materials— despite ongoing humanitarian concerns about the mining practices in the African country.

The reason behind the conclusion is that delivering battery materials is three times cheaper there than the US, a study by BloombergNEF (BNEF) found.

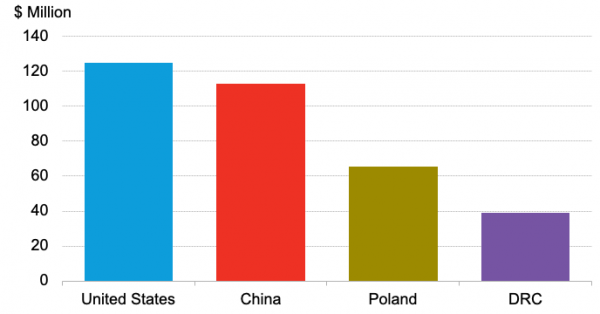

BNEF’s study on a unified African supply chain estimates it would cost $39 million to build a 10,000 metric-ton cathode precursor plant in the Democratic Republic of the Congo (DRC).

A similar plant in China and Poland would cost an estimated $112 million and $65 million, respectively.

The report notes that the DRC is well positioned to leverage its abundant cobalt resources and hydroelectric power to become a low-cost and low-emissions producer of lithium-ion battery cathode precursor materials.

The report— ‘The Cost of Producing Battery Precursors in the DRC’ — was launched at the DRC-Africa Business Forum 2021.

The study was commissioned by the UN Economic Commission for Africa (ECA), Afreximbank, the African Development Bank (AfDB), the Africa Finance Corporation (AFC), the Arab Bank for Economic Development in Africa (BADEA), the African Legal Support Facility (ALSF), and the UN Global Compact.

Reducing emissions

The report found emissions associated with battery production could be cut by 30% compared with the existing materials supply chain that runs through China.

Emissions saving would be made if cathode precursor materials from the DRC were made into cathode materials and cells in Poland, and the final pack assembly was conducted in Germany.

This is due to the DRC’s proximity to cathode raw materials and heavy reliance on hydroelectric power plants.

Kwasi Ampofo, lead author of the report and BNEF’s head of metals and mining, said: “The DRC’s cost competitiveness comes from its relatively cheap access to land and low engineering, procurement and construction, or EPC, cost compared to the US, Poland and China.

“European cell manufacturers currently rely heavily on China for battery precursors. However, the raw materials for batteries are, in most cases, imported into China from Africa and refined before being exported to Europe.

“Automakers in Europe can lower their emissions by shortening the transport distance and capitalising on the DRC’s hydroelectric powered grid and proximity to raw materials.”

James Frith, head of energy storage at BNEF said: “For regions to successfully attract battery component or cell manufacturing they need to have either a supply of key raw materials or local demand for batteries.

“If they have access to raw materials, they can use this supply to attract downstream manufacturers. If they have local demand for batteries, cell manufacturers will move to the region to be close to their customers, particularly in the automotive industry.

“Africa has a wealth of critical battery raw materials and is in a position to use these to attract more value-add in downstream processing and manufacturing.”

The full report is available here

Capturing the EV value chain

The DRC produces about 70% of global cobalt but captures just 3% of the battery and electric vehicle value chain, said Vera Songwe, un under-secretary general and executive secretary of the United Nations economic commission for Africa.

Songwe added: “The DRC can receive other upstream mineral inputs needed for lithium-ion batteries – such as manganese from, say, South Africa and Madagascar, copper from Zambia, graphite from Mozambique and Tanzania, phosphate from Morocco, and lithium from Zimbabwe, to name but a few.

“The DRC can truly become the regional and global centre of gravity for the production of precursor materials for batteries to drive the fourth industrial revolution. In so doing, the country and the rest of Africa can extend their access from the $271 billion battery precursor segment to the more lucrative $1.4 trillion combined battery cell production and cell assembly segments of the battery minerals global value chain.

This requires plenty of reliable and affordable power, which can be achieved by connecting Africa’s power systems with the Grand Inga at the core and with wind and solar power from North African countries, the Sahel and South Africa, geothermal from East Africa, hydro from Central and West Africa.”

President and CEO of Africa Finance Corporation, Samaila Zubairu, said: “Africa must benefit meaningfully from its abundance of energy transition metals by changing the extraction model. Unlike previous price booms, African countries need to move up the value chain through mineral beneficiation, smelting and refining, and move away from exporting unprocessed commodities.”

Olivier Pognon, director & CEO of ALSF, said: “The study confirms the cost competitiveness of establishing a battery precursor industry in the DRC based on local mineral resources. For the Africa Legal Support Facility (ALSF), such information is valuable for negotiating fair and equitable contracts that ensure that Africa retains maximum value from her mineral resources, while also contributing to the global energy transition.”

Image: Capital cost to build a 10,000 metric-ton battery precursor. Source BloombergNEF. Note: The cost is for a 10,000 metric tons precursor facility and does not include any government subsidy.