US car maker Ford announced plans on Monday to invest $3.5 billion to build an LFP battery plant in Marshall, Michigan. It claimed it will be the first LFP plant in the US backed by a car maker. The 35GWh factory will build both nickel cobalt manganese (NCM) and lithium iron phosphate (LFP) batteries.

Ford said it reached a new agreement with Contemporary Amperex Technology (CATL). Under the arrangement, Ford’s subsidiary would manufacture the battery cells using LFP battery cell knowledge and services provided by CATL.

Ford engineers will integrate these LFP battery cells into its vehicles. This new agreement with CATL adds to Ford’s existing battery capacity and available battery technology. This includes collaboration with battery makers SK On and LG Energy Solution (LGES).

Battery analyst Christopher Chico said on LinkedIn that Ford and CATL are going to work together through a license partnership. “Nevertheless, Ford is still committed to purchase LFP batteries from CATL from 2024,” he said.

He added it means that Ford vehicles will not qualify for the entire $7500 tax credit but only $3750, as the battery will be sourced from China.

“In my opinion, Ford has the best approach with the future use of both LFP and NMC chemistries. They will be able to be more flexible,” he said. One unknown is whether Ford will be able to use CATL cell-to-pack technology, he added.

Ford said LFP batteries are very durable and tolerate more frequent and faster charging while using fewer high-demand, high-cost materials. That makes them cheaper and helps reduce reliance on critical minerals such as nickel and cobalt, it said.

Production of LFP batteries at the BlueOval Battery Park Michigan will begin in 2026, it said. The plant will be part of a wholly-owned Ford subsidiary. Diversifying and localising the battery supply chain in the countries where Ford builds EVs is designed to improve availability and affordability, according to the company.

Today, Ford separately outlined plans to cut one in nine jobs in product development and administration across Europe. This is part of a global drive to cut costs and be competitive in the EV market, it said.

Around 3,800 jobs will go in all. This includes 2,300 at the car maker’s Cologne and Aachen sites in Germany, 1,300 in the UK and 200 in the rest of Europe. It intends to achieve the reductions through voluntary programmes.

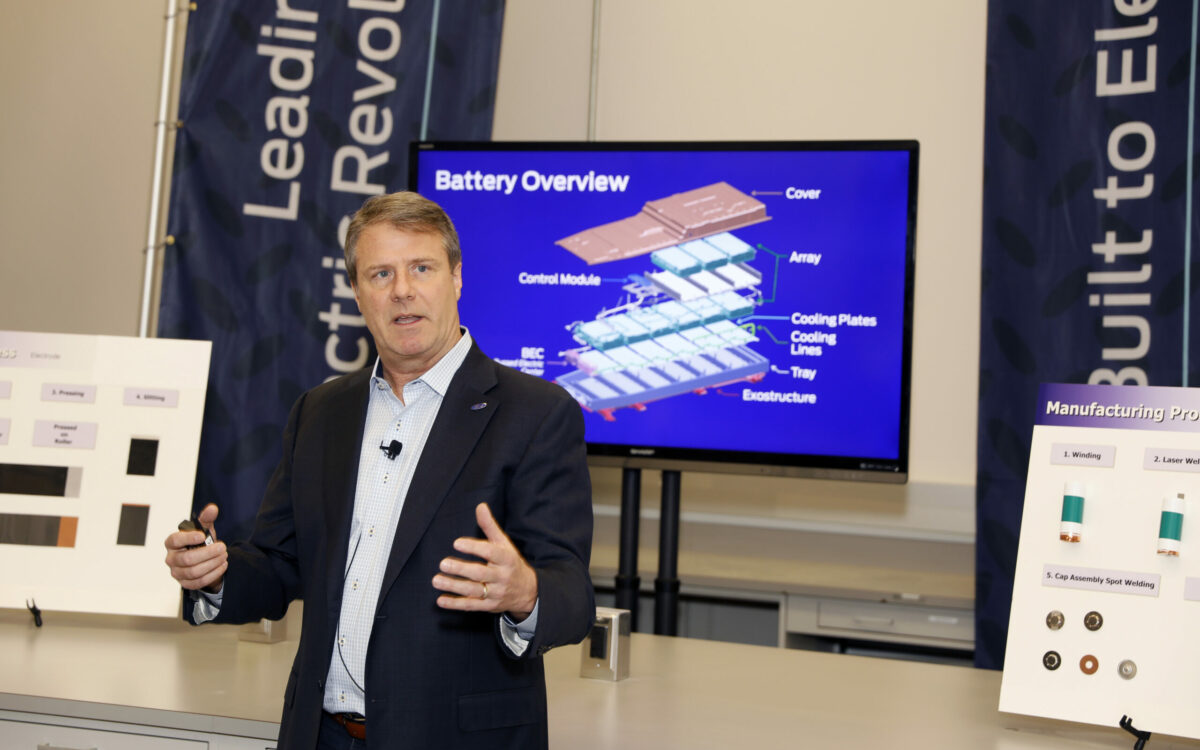

Photo: Ted Miller, Manager, Ford Battery Cell Research and Advanced Engineering